Chartered Accountants Now Under Ambit of Money Laundering Law

26-08-2023

12:29 PM

1 min read

What’s in today’s article?

- Why in News?

- About Prevention of Money Laundering Act, 2002

- Major Provisions of the PMLA

- Criticism of PMLA

- News Summary

Why in News?

- The Union Finance Ministry has notified changes to the Prevention of Money Laundering Act (PMLA).

About Prevention of Money Laundering Act, 2002

- The Prevention of Money Laundering Act (PMLA), 2002 was enacted in January, 2003.

- The Act seeks to combat money laundering in India and has three main objectives –

- To prevent and control money laundering

- To confiscate and seize the property obtained from the laundered money; and

- To deal with any other issue connected with money laundering in India.

- Sec. 3 of the Act defines offence of money laundering as –

- whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.

- The Act was amended by the Prevention of Money Laundering (Amendment) Act, 2009 and by the Prevention of Money Laundering (Amendment) Act, 2012.

- Most recently, the PMLA was amended through the -

- Finance Act, 2015 ('2015 Amendment')

- Finance Act, 2018 ('2018 Amendment')

- Finance Act, 2019 ('2019 Amendment')

Major Provisions of the PMLA

- The Act prescribes obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions.

- PMLA empowers the Directorate of Enforcement (ED) to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

- ED is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India.

- It was formed as an Enforcement Unit, in the Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- PMLA envisages setting up of an Adjudicating Authority to exercise jurisdiction, power and authority conferred by it essentially to confirm attachment or order confiscation of attached properties.

- It also envisages setting up of an Appellate Tribunal to hear appeals against the order of the Adjudicating Authority

- PMLA envisages designation of one or more courts of sessions as Special Court or Special Courts to try the offences punishable under the Act.

- PMLA also allows Central Government to enter into an agreement with Government of any country outside India for enforcing the provisions of the PMLA.

Criticism of PMLA

- Certain provisions of the PMLA have received criticism on the grounds of legal and constitutional principles.

- These provisions include –

- Stringent bail conditions,

- Arrest of persons without supply of Enforcement Case Information Report (similar to FIR),

- Non-communication of grounds of arrest to the accused,

- Statement given by accused during investigation made admissible as evidence during trial, and

- Broad definitions of money laundering and proceeds of crime under the Act.

- Critics argue that the amendments to the Act have not yielded the desired results of improved convictions but has only resulted in a procedure that takes away an individual’s liberty depriving them of all constitutional guarantees and procedure laid down under the Code of Criminal Procedure (CrPC).

News Summary

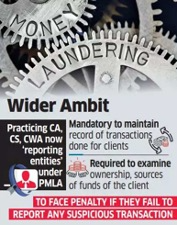

Image Caption: Changes to PMLA

- The Union Finance Ministry has notified changes to the Prevention of Money Laundering Act, 2002, widening its ambit to include transactions facilitated by chartered accountants, company secretaries, etc.

- Going forward, setting up a company, buying property and financial transactions executed by these professionals on behalf of their clients will now be covered under the PMLA.

- They will be liable under the PMLA if they facilitate a transaction that violates the law.

- They will need to comply with verification of identity rules, maintain records and furnish information when asked.

- The Act also stipulates confidentiality on information sought from the reporting entity, thereby, requiring adherence to the strictest of professional standards.

- In case a transaction undertaken by a client appears to be suspicious or possibly involves proceeds of crime, the reporting entity shall step up monitoring of the business relationship.

- The amendments are expected to aid investigative agencies further in their probe against dubious transactions involving shell companies and money laundering.

- Over a month ago, in March, the government had widened the ambit of reporting entities under money laundering provisions to incorporate more disclosures for non-governmental organisations and defined politically exposed persons (PEPs) under the PMLA.

Q1) What is Hawala?

Hawala is an informal funds transfer system that allows for the shifting of money from one person to another without the actual movement of money. It is a simple process that requires no documentation and, therefore, is an anonymous system of moving money.

Q2) What is the meaning of black marketing?

A black market is any market where the exchange of goods and services takes place in order to facilitate the transaction of illegal goods or to avoid government oversight and taxes, or both.

Source: Chartered accountants, company secretaries now under ambit of money laundering law | ET