Credit card spend in forex to come under LRS, and taxed 20%

26-08-2023

12:31 PM

What’s in today’s article?

- Why in news?

- What is Liberalised Remittance Scheme (LRS)?

- Background of LRS:

- Which transactions are allowed under the LRS?

- What are the Restrictions under LRS?

- News Summary: Credit card spend in forex to come under LRS, and taxed 20%

- Key highlights of the notification

- Possible Impacts of bringing Credit card spend in forex under LRS

Why in news?

- The Government has amended rules under the Foreign Exchange Management Act to bring in international credit card spends outside India under the Liberalised Remittance Scheme (LRS).

- As a result, the spending by international credit cards will also attract a higher rate of Tax Collected at Source at 20 per cent effective July 1.

What is Liberalised Remittance Scheme (LRS)?

- Liberalised Remittance Scheme (LRS) was brought out by the RBI in 2004.

- It allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

- According to the prevailing regulations, resident individuals may remit up to $250,000 per financial year.

Background of LRS:

- Resident Indians or people resident in India are allowed to transfer foreign currency under the foreign exchange regulations.

- The transfer of foreign currency outside India is governed by the Foreign Exchange Management Act, 1999 (FEMA).

- Hence, to regulate transferring of funds within a specified limit, RBI brought the LRS.

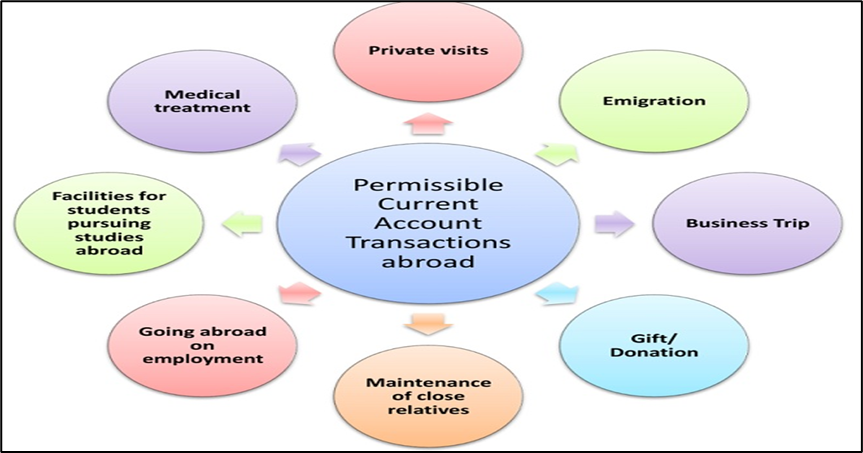

Which transactions are allowed under the LRS?

·

- Apart from the areas highlighted in the above diagram, the remitted amount can also be invested in shares, debt instruments, and be used to buy immovable properties in overseas market.

- Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme.

What are the Restrictions under LRS?

- LRS restricts

- buying and selling of foreign exchange abroad, or purchase of lottery tickets or sweep stakes, proscribed magazines and so on,

- or any items that are restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Also, one cannot make remittances directly or indirectly to countries identified by the Financial Action Task Force as non co-operative countries and territories.

News Summary: Credit card spend in forex to come under LRS, and taxed 20%

- Central government has brought transactions through credit cards outside India under the ambit of the LRS with immediate effect.

- This will enable the higher levy of Tax (collected at Source), as announced in the Budget for 2022-23, from July 1.

Key highlights of the notification

- Existing mechanism

- The usage of an international credit card to make payments towards meeting expenses during a trip abroad was not covered under the LRS.

- These spendings were excluded by way of Rule 7 of the Foreign Exchange Management (Current Account Transaction) Rules, 2000.

- Changes made

- Rule 7 has now been omitted, paving way for the inclusion of such spendings under LRS.

- Not only foreign tour packages but 20 per cent TCS rule also applies on credit cards on international transactions.

- This means even direct booking would come under the ambit of 20 per cent TCS.

- It will not apply on the payments for purchase of foreign goods/services from India.

- Budget 2023-24 and provisions related to Tax Collected at Source (TCS)

- The government had changed the limits for TCS for foreign remittances in the Budget for 2023-24.

- TCS is a direct tax levy, which is collected by the seller of specified goods from the buyer and deposited to the government.

- Taxpayers can then claim refunds on the TCS levy at the time of filing tax returns

- The Budget had stated that on foreign outward remittance under LRS, other than for education and medical purposes, a TCS of 20 per cent will be applicable from July 1, 2023.

- Before this proposal, the TCS of 5 per cent was applicable on foreign outward remittances above Rs 7 lakh and 5 per cent without any threshold for overseas tour package.

- The government had changed the limits for TCS for foreign remittances in the Budget for 2023-24.

Possible Impacts of bringing Credit card spend in forex under LRS

- Tedious task for banks

- Many transactions for purposes like education and medical expenses remain outside the purview of this higher 20% TCS

- It will be a herculean task for banks to keep track of each and every transaction and for every card user to maintain their accounts.

- More expansive foreign travel

- Taxpayers would be able to claim the “20% TCS” back at the time of Income Tax Return (ITR filing).

- However, the current move will straightaway make foreign travel 20% more expensive as this amount will be blocked till it is refunded in the income tax.

- Widen the pricing gap

- TCS at 5 per cent on LRS remittances was first introduced in October 2020.

- This already led to a significant loss of business for domestic travel and tour agents (DTAs).

- This was because customers started booking overseas travel services with Global Travel Agents (GTAs).

- GTAs have been escaping TCS compliance and hence can offer better pricing on their platforms.

- Now that tax rate has increased four-fold, it will further widen the pricing gap as the upfront cost for travellers will increase further on DTAs.

Q1) What is Tax Collected at Source (TCS)?

Tax Collected at Source (TCS) is a tax levied by the government of India on certain specified transactions. It is a mechanism for collecting tax at the source from the buyer or licensee, rather than from the income earner or seller. The person collecting TCS is required to collect a prescribed percentage of the transaction value as tax and deposit it with the government.

Q2) What is Foreign Exchange Management Act, 1999 (FEMA)?

The Foreign Exchange Management Act, 1999 (FEMA) is a legislation enacted by the Parliament of India to consolidate and amend the laws relating to foreign exchange transactions, external trade, and payments. FEMA replaced the previous foreign exchange law, the Foreign Exchange Regulation Act (FERA) of 1973. FEMA provides a legal framework for the regulation, control, and management of foreign exchange transactions in India. It aims to facilitate external trade and payments, promote orderly development and maintenance of the foreign exchange market, and preserve the stability of the country's foreign exchange reserves.

Source: Credit card spend in forex to come under LRS, and taxed 20% | Economic times | Business Today