Imapct of Carbon Border Adjustment Mechanism (CBAM) on India

26-08-2023

12:28 PM

What’s in today’s article?

- Why in news?

- What is Carbon Border Adjustment Mechanism (CBAM)?

- Impact of CBAM on India

Why in news?

- The Commerce Ministry is exploring various options to cope with the European Union’s decision to introduce a Carbon Tax.

- The EU is planning to introduce a Carbon Border Adjustment Mechanism (CBAM).

- CBAM will entail a monitoring mechanism for imports from producers deploying non-green technologies starting this October and a tax levy from January 2026.

What is Carbon Border Adjustment Mechanism (CBAM)?

- Background:

- In 2021, the European Union (EU) proposed the Carbon Border Adjustment Mechanism (CBAM), which would tax very carbon-intensive items such as cement and steel beginning in 2026.

- CBAM is part of the “Fit for 55 in 2030 package”, the EU’s plan to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

- About:

- A carbon border adjustment tax is a duty on imports based on the amount of carbon emissions resulting from the production of the product in question.

- As a price on carbon, it discourages emissions and as a trade-related measure, it affects production and exports.

- The CBAM will enter into force in its transitional phase as of 1 October 2023 and the permanent system will enter into force on 1 January 2026

- How does it work?

○

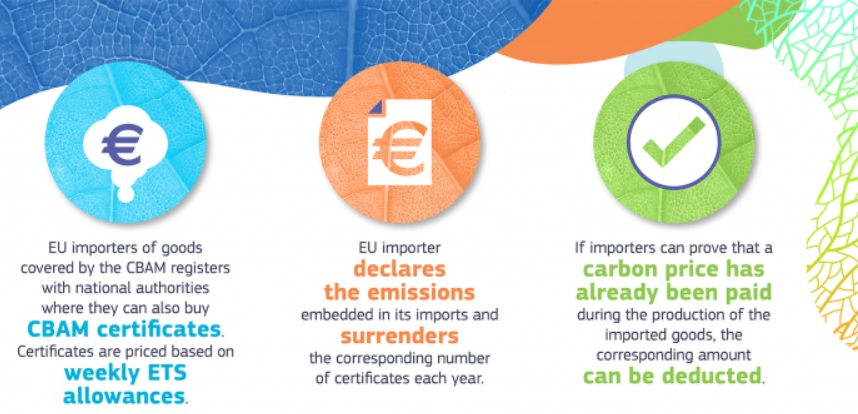

- Image caption: Working of CBAM

- If implemented as intended, EU importers will be required to purchase carbon certificates equal to the carbon price paid in the EU if the items had been manufactured locally.

- The certificates' price would be determined by the auction prices in the EU carbon credit market.

- The number of certificates required would be determined yearly by the quantity of commodities imported into the EU and the embedded emissions in those goods.

- The CBAM would first apply to cement, iron and steel, aluminum, fertilizers and electricity imports.

- Concerns:

- The US, China, India, Brazil, South Africa and several others, including least-developed countries, have expressed concern over -

- How to fairly account for emissions related to the production of imported goods?

- How to duly consider the costs that companies already face in complying with climate regulations in exporting countries?

- It places a carbon charge on companies from countries that did not primarily cause climate change.

- Mozambique’s GDP, for example, would drop by about 1.5% due to the tariffs on aluminium exports alone.

- According to the EU, CBAM is designed to be in full compliance with WTO rules and international climate law.

- However, questions have been raised over the consistency of CBAM with international trade law and environmental principles.

- It is likely to be viewed as unfair by trading partners since it runs the possibility of unfairly protecting local industries from foreign competition in so-called 'green protectionism.'

- The US, China, India, Brazil, South Africa and several others, including least-developed countries, have expressed concern over -

Impact of CBAM on India

- Adverse impact on India's exports of metals

- CBAM will have an adverse impact on India's exports of metals such as iron, steel and aluminium products to the EU.

- In 2022, India's 27 per cent exports of iron, steel, and aluminium products of value USD 8.2 billion went to the EU.

- From January 2026, when CBAM will be fully enforced, more than 50 percent of Indian exports come under the CBAM proposal.

- This will leave a dent on India’s European exports.

- CBAM will have an adverse impact on India's exports of metals such as iron, steel and aluminium products to the EU.

- Increased compliance costs

- CBAM is bound to pose challenges to those industries which are exporting to European markets in terms of increased compliance costs.

- This is due to the requirement to monitor, calculate, report, and verify emissions.

- CBAM is bound to pose challenges to those industries which are exporting to European markets in terms of increased compliance costs.

- India at a disadvantageous position

- In terms of carbon intensity, the carbon intensity of Indian products is significantly higher than that of the EU and many other countries.

- This is because coal dominates the overall energy consumption. Hence, higher emissions would translate to higher carbon tariffs to be paid to the EU.

- The proportion of coal-fired power in India is close to 75%, which is much higher than the EU (15%) and the global average (36%).

- Moreover, India has no domestic carbon pricing scheme in place which poses a greater risk to export competitiveness.

- Other countries with such a system in place might have to pay less carbon tax or get exemptions.

- Goal of 5 trillion economy

- A prerequisite for India to become a 5 trillion economy is to expand its exports and the EU is India’s third largest trading partner.

- EU accounted for €88 billion in goods trade in 2021, or 10.8% of total Indian trade.

- A prerequisite for India to become a 5 trillion economy is to expand its exports and the EU is India’s third largest trading partner.

Q1) What is green protectionism?

Green protectionism refers to the use of trade barriers or other protectionist measures to promote domestic industries that produce environmentally friendly products or to discourage imports from countries that do not meet certain environmental standards. By creating barriers to trade with these countries, green protectionism aims to encourage greater adoption of environmentally friendly technologies and practices.

Q2) What is Fit for 55 package?

The "Fit for 55" package is a series of legislative proposals and policy initiatives put forward by the European Union (EU) in July 2021. The package is aimed at achieving the EU's target of reducing greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

Source: Centre looks into options to counter EU’s carbon tax plan | European Commission | Times of India