National Urban Cooperative Finance and Development Corporation Limited (NUCFDC)

04-03-2024

06:40 AM

1 min read

What’s in Today’s Article?

- Why in News?

- What is Cooperative Banking?

- The Urban Cooperative Banks in India

- About the NUCFDC

- Significance of the NUCFDC

Why in News?

- The Union Cooperation Minister inaugurated an umbrella organisation for urban cooperative banks (UCB) - the National Urban Cooperative Finance and Development Corporation Limited (NUCFDC).

What is Cooperative Banking?

- Meaning: In order to support the financial needs of a community such as a village or a specific community, people come together to pool resources and provide banking services such as loans, savings accounts, etc.

- Working:

- Membership: Individuals or businesses who meet specific eligibility criteria can become members by purchasing shares or making an initial deposit

- Democratic Governance: Every member has equal voting rights regardless of the number of shares they hold.

- Members elect a board of directors among themselves to oversee the bank’s operations and make key decisions.

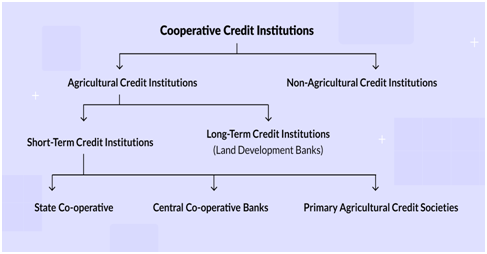

- Structure:

- They are regulated by both the Reserve Bank of India (RBI) and the respective state governments. They (like the PACS) registered under the Co-operative Societies Act.

The Urban Cooperative Banks in India

- At present, there are over 1,500 scheduled and non-scheduled Urban Cooperative Banks in India with a total number of branches exceeding 11,000.

- The banks have a deposit size of over Rs 5.33 lakh crore, and total lending of more than Rs 3.33 lakh crore.

- The Urban Cooperative Banks in the country have reduced their Net NPA rate to 2.10% and there is a need for further improvement.

- Many of these banks have constraints related to technology platforms, and difficulties in offering modern banking services.

About the NUCFDC

- The NUCFDC has received Certificate of Registration (CoR) from the RBI to operate as a Non-Banking Finance Company (NBFC) and serve as the umbrella organisation for the urban cooperative banking sector.

- In addition to this, it will be allowed to operate as a Self-Regulatory Organisation (SRO) for the sector.

- The NUCFDC aims to raise capital, with plans to reach a capital base of Rs.300 crores.

- It intends to utilise this capital to support Urban Cooperative Banks and develop a shared technology platform to improve service offerings and reduce costs.

- Besides offering liquidity and capital support, the umbrella organisation would set up a technology platform that can be shared by all UCBs, enabling them to widen their range of services at a relatively lower cost.

- It can also offer fund management and other consultancy services.

- The umbrella organisation will provide various facilities to small banks, facilitate dialogue between banks and regulators, and work on improving communication.

Significance of the NUCFDC

- If India wants to become the world's third-largest economy, economic development should be inclusive and comprehensive.

- If India wants to move forward with this concept, the goal should be to establish Urban Cooperative Banks in every city.

- The NUCFDC is another milestone in achieving the goal of ‘Sahakar se Samriddhi’ to make ‘Aatma Nirbhar’ Bharat, as it aims to modernise and strengthen the UCBs in India.

- This umbrella organisation is a security shield for small banks, which will increase the confidence of depositors.

Q1) What are Primary Agricultural Credit Societies (PACS)?

PACS are financial cooperatives, which are typically organised by farmers and other agricultural professionals to provide credit and other services to farmers. They are regulated by the RBI and registered under the Co-operative Societies Act.

Q2) What are the limitations of Cooperative Banks?

Despite the various advantages of these banks, there are certain limitations such as inadequate coverage, inefficient societies, problem of overdues, regional Disparities, etc.

Source: Amit Shah launches umbrella organisation for urban cooperative banks | PIB | RazorPay