Rising Instances of Online Payment Frauds

28-11-2023

11:45 AM

1 min read

What’s in Today’s Article?

- Why in News?

- Different Types of Digital Payments

- Rising Instances of Online Payment Frauds

- What Government is Planning to Curb Online Payment Frauds?

Why in News?

- To curb rising instances of online payment frauds, the government is planning to introduce a minimum time for a transaction beyond a particular amount happening for the first time between two persons.

- If finalised, the measure could cover a wide range of digital payments through Immediate Payment Service (IMPS), Real Time Gross Settlement (RTGS) and even the Unified Payments Interface (UPI).

Different Types of Digital Payments

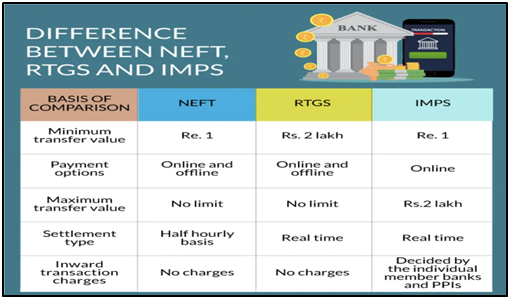

- NEFT (National Electronic Funds Transfer):

- It is an electronic payment system used for transferring funds from one bank account to another.

- It operates on a deferred net settlement basis, which means transactions are processed in batches throughout the day.

- RTGS (Real-Time Gross Settlement): It is a payment system that enables large-value transactions to be processed in real-time.

- IMPS (Immediate Payment Service): It is an instant payment system that enables customers to transfer funds in real-time, 24/7.

- Unified Payments Interface (UPI):

- UPI is an instant payment system developed in India, by the National Payments Corporation of India (NPCI).

- The interface facilitates inter-bank peer-to-peer and person-to-merchant transactions. It is used on mobile devices to instantly transfer funds between two bank accounts.

- UPI transactions rose 427% in volume during 2020 and 2022. In May 2023, a total of 9.41 billion UPI transactions amounting to Rs 14.89 trillion were recorded by the NPCI.

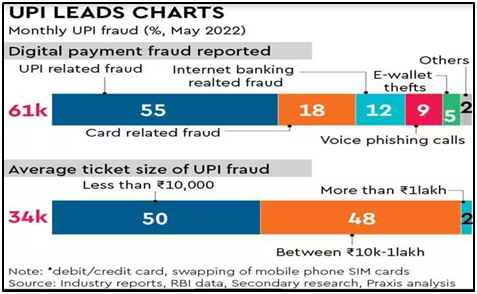

Rising Instances of Online Payment Frauds

- According to the RBI’s FY23 annual report, the value and volume of digital frauds committed using cards and internet-based payment methods nearly doubled (to 6,659 digital frauds amounting to 276 crore) in the previous financial year.

- The trigger to formally discuss the issue came after the recent case faced by the Kolkata-based public sector lender UCO Bank when it reported credit of Rs 820 crore to account holders of the bank via IMPS.

- The case has now been referred to the Central Bureau of Investigation (CBI).

What Government is Planning to Curb Online Payment Frauds?

- The plan likely includes a possible 4-hour window for the first transaction (to users they have never transacted with before) between two users for digital payments above Rs 2,000.

- It will be along the lines of NEFT where the transaction happens within a few hours.

- The users will have four hours after making a payment to someone for the first time to reverse or modify the payment.

- While the process is expected to add some friction to digital payments, it is necessary to mitigate cybersecurity concerns.

- The plan is not to just delay or limit the first transaction (which already happens in some shape or form) but to regulate every first transaction between two users, irrespective of their independent past transaction history.

Q1) What is the National Payments Corporation of India (NPCI)?

NPCI is an umbrella organisation for all retail payment systems in India. It was set up with the support and guidance from RBI and Indian Banks Association (IBA) as a registered company under the Companies Act, 2013.

Q2) What is the Project Financial Literacy?

The RBI has undertaken a project titled "Project Financial Literacy". The objective of the project is to disseminate information regarding the central bank and general banking concepts to various target groups.

Source: To curb fraud, 4-hour delay likely in first UPI transfer over Rs 2,000 | FE