RBI Tightens Norms for Lenders Investing in AIFs

20-12-2023

10:09 AM

1 min read

What’s in Today’s Article?

- Why in the News?

- What are Alternative Investment Funds (AIFs)?

- Types of AIFs

- Benefits of Investing in AIFs

- News Summary

Why in News?

- The Reserve Bank of India (RBI has directed banks, non-banking financial companies (NBFCs) and other lenders not to invest in any scheme of Alternative Investment Funds (AIFs).

What are Alternative Investment Funds (AIFs)?

- Alternative Investment Fund is a special investment category that differs from conventional investment instruments. It is a privately pooled fund.

- Generally, institutions and High Net worth Individuals (HNIs) invest in AIFs as substantial investments are required.

- These investment vehicles adhere to the SEBI (Alternative Investment Funds) Regulations, 2012.

- As of December 19, there were 1,220 AIFs registered with the SEBI.

- Total investment commitment raised by AIFs stood at Rs 8.44 lakh crore as of June 30, 2023.

- AIFs can be formed as a company, Limited Liability Partnership (LLP), trust, etc.

Types of AIFs

- SEBI has categorised Alternative Investment Funds into 3 categories:

- Category 1: These funds invest in SMEs, start-ups, and new economically viable businesses with high growth potential.

- Venture Capital Fund:

- New-age entrepreneurial firms that require large financing during their initial days can approach VCF.

- VCF can help them in overcoming the financial crunch. These funds invest in start-ups with high growth prospects.

- HNIs investing in VCFs adopt a high-risk, high-return strategy while allocating their resources.

- Angel Funds:

- These invest in budding start-ups and are called angel investors.

- They bring early business management experience with them.

- These funds invest in those start-ups that do not receive funding from VCF.

- The minimum investment by each angel investor is Rs 25 lakh.

- Infrastructure Funds:

- This fund invests in infrastructure companies, i.e., those involved in railway construction, port construction, etc.

- Investors who are bullish on infrastructure development invest their money in these funds.

- Social Venture Funds:

- Funds investing in a socially responsible business are social venture funds.

- They are a kind of philanthropic investment but have a scope of generating decent returns for investors.

- Venture Capital Fund:

- Category-2:

- Private Equity Funds:

- A private equity fund invests in unlisted private companies.

- It is difficult for unlisted companies to raise funds by issuing equity and debt instruments.

- Usually, these funds come with a lock-in period which ranges from 4 to 7 years.

- Debt Funds:

- This fund primarily invests in debt securities of unlisted companies.

- Usually, such companies follow good corporate governance models and have high growth potential.

- They have a low credit rating, which makes them a risky option for conservative investors.

- As per SEBI guidelines, money accumulated by debt funds cannot be used to give loans.

- Fund of Funds:

- Such funds invest in other Alternative Investment Funds.

- They do not have an investment portfolio but focus on investing in different AIFs.

- Private Equity Funds:

- Category-3:

- Private Investment in Public Equity Fund (PIPE):

- A PIPE invests in shares of publicly traded companies. They acquire shares at a discounted price.

- Investment through PIPE is more convenient than going for a secondary issue owing to less paperwork and administration.

- Hedge Funds:

- Hedge funds pool money from accredited investors and institutions.

- These funds invest in both domestic and international debt and equity markets.

- They adopt an aggressive investment strategy to generate returns for investors.

- However, hedge funds are expensive as fund managers can charge an asset management fee of 2% or more.

- They can also levy 20% of the returns generated as their fees.

- Private Investment in Public Equity Fund (PIPE):

Benefits of Investing in AIFs

- High Return Potential:

- AIFs generally have a higher return potential than other investment options.

- The massive pooled amount gives the fund managers enough room to prepare flexible strategies for maximising returns.

- Low Volatility:

- AIFs are not directly related to stock markets. Volatility in these funds is less, particularly when compared with traditional equity investments.

- So, it might be suitable for risk-averse investors looking for stability.

- Diversification:

- These funds allow much-needed diversification in an investment portfolio.

- They act as a cushion at the time of financial crisis or market volatility.

News Summary

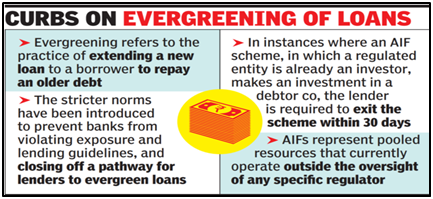

- In a move aimed at curbing evergreening of stressed loans, the RBI has directed banks, Non-Banking Financial Companies (NBFCs) and other lenders not to invest in any scheme of Alternative Investment Funds (AIFs).

Key highlights

- In order to address concerns relating to possible evergreening through this route, the RBI said the REs should not make ‘investments in any scheme of AIFs which has downstream investments either directly or indirectly in a debtor company of the RE’.

- Evergreening of loans is a process whereby a lender tries to revive a loan that is on the verge of default or in default by extending more loans to the same borrower.

- The process of evergreening of loans is typically a temporary fix for a bank.

- Downstream investments mean the actual investment by the AIF in a company using the funds they have raised from AIF investors.

- The debtor company of the Regulated entities (REs), for this purpose, means any company to which the RE currently has or had a loan or investment exposure anytime during the preceding 12 months.

- Evergreening of loans is a process whereby a lender tries to revive a loan that is on the verge of default or in default by extending more loans to the same borrower.

Rationale behind this step

- There have been a few instances where some of the regulated entities used the AIF route to evergreen loans that are under stress, thereby delaying classification of such loans as non-performing assets (NPA).

- In such a case, the RE creates an AIF structure to provide funding to its borrower which is likely to become an NPA.

- The AIF, created by the RE along with other investors, invests in the stressed company, which uses the same money to repay to the lender.

Q1) What is a hedge fund in simple terms?

A hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities and derivative products to generate returns at reduced risk.

Q2) What is the meaning of Monetary Policy?

Monetary policy is a set of actions available to a nation's central bank to achieve sustainable economic growth by adjusting the money supply.

Source: RBI tightens norms for lenders investing in AIFs | ET