RBI to withdraw Rs 2,000 notes from circulation

26-08-2023

12:31 PM

What’s in today’s article?

- Why in news?

- Demonetisation

- What is demonetisation?

- Why countries opt for demonetisation?

- What are the advantages and disadvantages of Demonetization?

- Demonetisation in India

- News Summary: RBI to withdraw Rs 2,000 notes from circulation

- Why are Rs 2000 denomination banknotes being withdrawn?

- Analysis

- Has such withdrawal of notes happened before?

Why in news?

- The Reserve Bank of India has decided to withdraw Rs 2,000 denomination banknotes from circulation.

- Banknotes of ₹2,000 denomination were introduced after ₹1000 and ₹500 banknotes were demonetised on November 8, 2016.

Demonetisation

What is demonetisation?

- Demonetization is the process through which a nation's economic unit of exchange loses its legally enforceable validity.

- It is a drastic intervention into the economy that involves removing the legal tender status of a currency.

Why countries opt for demonetisation?

- To address issues like hyperinflation and to stabilize the currency

- To eliminate negative situations or actions like counterfeit currency, terror, and tax fraud

- To introduce a new monetary system in some circumstances

- To facilitate trade and access to markets,

- To push informal economic activity into more transparency

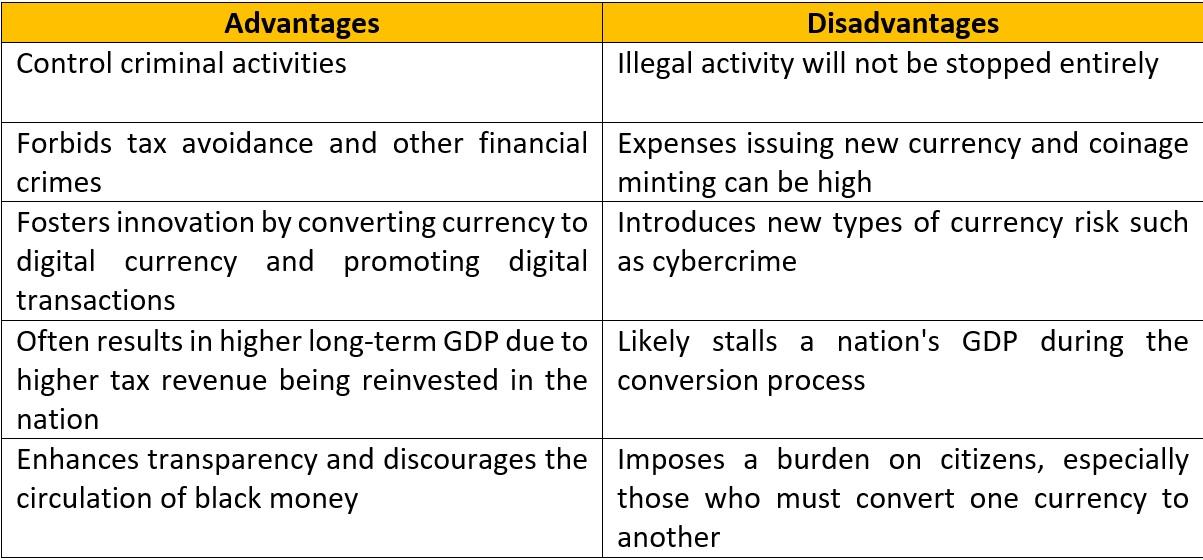

What are the advantages and disadvantages of Demonetization?

Image caption: advantages and disadvantages of Demonetization

Demonetisation in India

- Previous demonetisation - Demonetisation has been implemented twice:

- In 1946, RBI demonetized 1000- and 10000-rupee notes.

- In 1978, the government demonetized 1000-, 5000-, and 10000-rupee notes in order to curb the menace of black money.

- 2016 demonetisation

- On November 8, 2016, PM Modi announced the decision of the government to demonetise currency notes of Rs 500 and Rs 1,000 in a bid to tackle corruption.

News Summary: RBI to withdraw Rs 2,000 notes from circulation

- The Reserve Bank of India announced that it has decided to withdraw the Rs 2,000 currency notes from circulation.

- It asked all to exchange these notes by September 30,2023.

- The Rs 2,000 notes, however, will continue to be legal tender.

- Legal tender refers to the recognized currency or monetary instrument that is considered valid for transactions within a specific jurisdiction.

- Deposit into bank accounts can be made in the usual manner, without any restriction.

- The exchange facility for Rs 2,000 currency notes will start from May 23, 2023.

Why are Rs 2000 denomination banknotes being withdrawn?

- Rationale behind introduction of ₹2000 denomination banknote

- The ₹2000 denomination banknote was introduced in November 2016 under Section 24(1) of RBI Act, 1934.

- It was introduced primarily with the objective to meet the currency requirement of the economy in an expeditious manner after withdrawal of the legal tender status of all ₹500 and ₹1000 banknotes in circulation at that time.

- Objective fulfilled and printing of ₹2000 banknotes was stopped

- With fulfilment of that objective, printing of ₹2000 banknotes was stopped in 2018-19.

- A majority of the ₹2000 denomination notes were issued prior to March 2017 and are at the end of their estimated life-span of 4-5 years.

- With fulfilment of that objective, printing of ₹2000 banknotes was stopped in 2018-19.

- ₹2000 banknotes lost its sheen

- It has also been observed that this denomination is not commonly used for transactions.

- The total value of these banknotes in circulation has declined from ₹6.73 lakh crore at its peak of March 31, 2018 (37.3 per cent of Notes in Circulation) to ₹3.62 lakh crore, constituting only 10.8 per cent of Notes in Circulation on March 31, 2023.

- Availability of banknotes in other denominations in adequate quantities

- The stock of banknotes in other denominations continue to be adequate to meet the currency requirement of the public.

- Clean Note Policy of RBI

- In view of the above factors, and in pursuance of the Clean Note Policy of the Reserve Bank of India, it has been decided to withdraw the ₹2000 denomination banknotes from circulation.

- Clean Note Policy is a policy adopted by RBI to ensure availability of good quality banknotes to the members of public.

- In view of the above factors, and in pursuance of the Clean Note Policy of the Reserve Bank of India, it has been decided to withdraw the ₹2000 denomination banknotes from circulation.

Analysis

- Segments most affected

- The three segments which will be affected by this move will be gold & jewellery, real estate and political parties.

- In the run up to elections, there is always a tendency to stack up cash.

- Deposit accretion of banks

- Experts believe that, due to recent decision, deposit accretion of banks could improve marginally in the near term.

- Deposit accretion refers to the increase in deposits held by a bank over a certain period of time.

- It represents the growth or accumulation of funds in a bank's deposit accounts, which can come from various source.

- This will ease the pressure on deposit rate hikes and could also moderate short-term interest rates.

- Experts believe that, due to recent decision, deposit accretion of banks could improve marginally in the near term.

- Crowd management at branches

- At a time only 10 notes of ₹2,000 can be exchanged. Anyone can come back again as the restriction is at a time.

- Hence, crowd management at branches may become difficult.

- Demonetisation with a human face

- Many analysts feel this is demonetisation with a human face.

- The latest RBI decision impacts just about 11% of currency in circulation and therefore will probably trigger little chaos.

- People have time until September-end 2023, to deposit and/or exchange ₹2000 banknotes.

- Many analysts feel this is demonetisation with a human face.

Has such withdrawal of notes happened before?

- In 2014, the RBI completely withdrew from circulation all banknotes issued prior to 2005.

- The January 22, 2014 notification urged public to approach banks for exchanging these notes after April 1.

Q1) What are the benefits of Demonetisation?

Demonetization is important for fighting various evils like corruption, counterfeit currency racket, tax evasion, etc. It helps in tracing and restricting illegal economic activities.

Q2) What is Clean Note Policy of RBI?

The Reserve Bank of India (RBI) has a "Clean Note Policy" in place to ensure the circulation of clean and good quality banknotes in the country. The policy aims to maintain the integrity and usability of Indian currency by withdrawing unfit or soiled banknotes from circulation.

Source: RBI to withdraw Rs 2,000 notes from circulation, will continue to be legal tender till Sept 30 | Economic Times | Business Line | The Hindu | Indian Express