Small Is Good: Mudra Loan Npas at Just 3.3% In 7 Years

26-08-2023

12:18 PM

1 min read

What’s in Today’s Article

- Pradhan Mantri MUDRA Yojana – About, Features, Performance so far

- News Summary

Why In News:

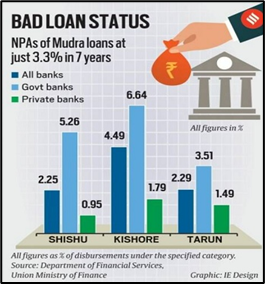

- An RTI enquiry revealed that bad loans under the Pradhan Mantri MUDRA Yojana for all banks since the launch of the scheme, added up to Rs 46,053.39 crore as on June 30, 2022.

- This is just 3.38 per cent of the total disbursements of Rs 13.64 lakh crore under the scheme during the period.

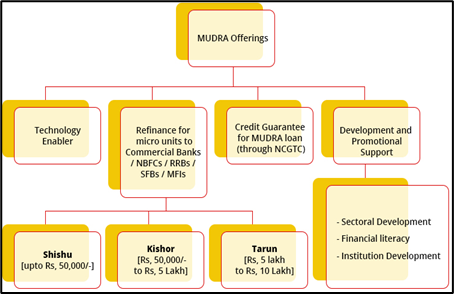

About:

- The Micro Units Development & Refinance Agency (MUDRA) was launched on April 8, 2015 to provide loans up to Rs 10 lakh to non-corporate, non-farm, small and micro enterprises.

- MUDRA loans are extended by banks, NBFCs, MFIs and other eligible financial intermediaries as notified by MUDRA Ltd.

- The overdraft amount of Rs 5000 sanctioned under PMJDY has been also classified as MUDRA loans under Prime Minister MUDRA Yojana (PMMY).

- The MUDRA loans are extended under following three categories:

- Loans upto ` 50,000/- (Shishu)

- Loans from ` 50,001 to ` 5 lakh (Kishore)

- Loans from ` 5,00,001/- to ` 10 lakh (Tarun)

- With an objective to promote entrepreneurship among the new generation aspiring youth, it is ensured that more focus is given to Sishu category loans followed by Kishore and Tarun categories.

Features:

- Eligible borrowers: Individuals/ Proprietary concern/ Partnership Firm/ Private Ltd. Company/ Public Company Any other legal forms.

- Purpose: Need based term loan/OD limit/composite loan to eligible borrowers for acquiring capital assets and/or working capital/marketing related requirements.

- Security: In terms of RBI guidelines, banks are mandated not to accept collateral security in the case of loans upto Rs 10 lakh extended to units in the Micro Small Enterprises (MSE) Sector.

- Financial Inclusion: Banking the Unbanked, Securing the Unsecuredand Funding the Unfunded are being achieved through leveraging technology and adopting multi-stakeholders’ collaborative approach.

- Tenor: MUDRA loan can be availed for 5 years or maximum 7 years.

Performance so far

- More than 34.42 crore loans for an amount of Rs 18.60 lakh crore have been sanctioned since launch of the scheme (as on 25.03.2022).

- Approximately 22% of the total loans have been sanctioned to New Entrepreneurs.

- Approximate 68% loans of the total number of loans have been sanctioned to Women Entrepreneurs

News summary

- The data obtained under the Right to Information Act revealed that non-performing assets (NPAs) of banks for Mudra loans – including those extended during the Covid-19 pandemic are lower than the average NPAs of the sector as a whole.

- The gross NPAs of the banking sector as a whole stood at 5.97 per cent for the year-ending March 31, 2022.

- A non-performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- The NPAs for Shishu loans were the lowest at 2.25 per cent of disbursements and the highest for Kishore loans at 4.49 per cent. For Tarun loans bad loans were 2.29 per cent of disbursements.