Reforming the Process of Sovereign Credit Rating

22-12-2023

09:56 PM

1 min read

What’s in Today’s Article?

- Why in News?

- What is a Sovereign Credit Rating?

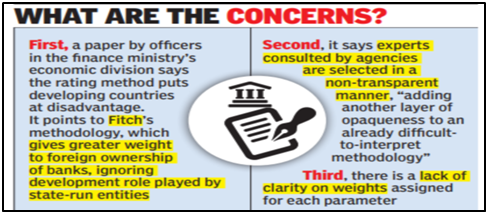

- Issues with the Methodology of Credit Rating

- Recommendations Given by the CEA to Reform Credit Rating

Why in News?

- In an essay ‘Understanding a Sovereign’s Willingness to Pay Back: A Review of Credit Rating Methodologies’, the office of the CEA in the Finance Ministry has called for urgent reforms and transparency in the process of sovereign credit rating.

- According to the Chief Economic Advisor (CEA), methodologies used by agencies (CRAs) are heavily loaded against developing countries like India due to an “over-reliance” on non-transparent and subjective qualitative factors.

What is a Sovereign Credit Rating?

- A sovereign credit rating is a measurement of a government’s ability to repay its debt, with a low rating indicating high credit risk.

- Typically, rating agencies use various parameters to rate a sovereign. These include growth rate, inflation, government debt, short-term external debt as a percentage of GDP and political stability.

- A favourable credit card rating enhances credibility and signifies a positive track record of timely loan repayment in the past.

- It assists banks and investors in evaluating loan applications and determining the interest rates to be offered.

- The global credit rating industry is highly concentrated, with three leading agencies: Moody's, Standard & Poor's, and Fitch.

- While S&P and Fitch rate India at BBB, Moody’s rates the South Asian country at Baa3, which indicates the lowest possible investment grade.

- This is despite India climbing the ladders from the 12th largest economy in the world in 2008 to the 5th largest in 2023, with the 2nd-highest growth rate recorded during the period among all the comparator economies.

Issues with the Methodology of Credit Rating

- A quantitative analysis showed that over half the credit ratings are determined by the qualitative component.

- Institutional Quality, proxied mostly by the World Bank’s Worldwide Governance Indicators (WGIs), emerges as the foremost determinant of a developing economy’s credit rating.

- This presents a problem since these metrics tend to be non-transparent, perception-based, and derived from a small group of experts, and cannot represent the willingness to pay the sovereign.

- Their effect on the ratings is non-trivial since it implies that to earn a credit rating upgrade, developing economies must demonstrate progress along arbitrary indicators.

Recommendations given by the CEA to Reform Credit Rating

- The CEA recommended relying mainly on a country’s debt repayment history to determine its ‘willingness to pay’, instead of “less-than-optimal” qualitative information.

- Such a model will do enormous good to the credibility of the CRAs.

- Qualitative information and judgement can be the last resort when all other options for applying authentic, verifiable information are precluded.

- Even if governance indicators are to be relied upon, they must be based on clear, well-defined, measurable principles rather than subjective judgements by CRAs.

- CRAs tend to have a detailed database of best practices from around the world, which they apparently rely upon to form their judgements.

- This knowledge must be shared with the countries they rate so that appropriate action can be taken on a sovereign’s part to improve its creditworthiness.

Q1) What role does credit rating play in the Indian economy?

The Indian credit rating system is critical in the financial market since it informs investors about the creditworthiness of debt securities. It aids in estimating the risk of investing in a specific security and in making informed investment decisions.

Q2) What are the functions of chief economic advisor (CEA) to the Government of India (GoI)?

The CEA to the GoI advises the government on economic matters and is responsible for the preparation of the Economic survey of India tabled in Parliament before the Union budget of India is presented. The CEA holds the rank of a Secretary to the GoI.

Source: Rating agencies too subjective, loaded against India, need reform: CEA