Supplementary demand for grants

26-08-2023

12:11 PM

1 min read

What’s in today’s article?

- Why in News?

- About the demand for grants

- News Summary

Why in News?

- The Government of India recently sought an additional ₹3 lakh-plus crore as supplementary demands for grants for 2022-23.

About the demand for grants:

Definition of demand of grants:

- Demand for grants are estimates of expenditure from the Consolidated Fund of India that are included in the annual financial statement (Budget) and must be voted on in the Lok Sabha.

- These grants are submitted in pursuance of Article 113 (Procedure in Parliament with respect to estimates) of the Indian Constitution.

Description of demand of grants:

- It includes provisions with respect to revenue expenditure, capital expenditure, grants to State and UT governments together with loans and advances.

- In general, one demand for grant is submitted for each ministry or department. However, multiple demands are provided for large ministries and departments.

Types of demand for grants:

- Article 115 of the Indian Constitution provides for Supplementary, additional or excess grants.

- Supplementary grants: The President shall cause to be laid before both Houses of Parliament a demand, if the amount authorized under Article 114 (Appropriation Bills) is found to be insufficient for the purposes.

- Additional grants: When a need has arisen for additional expenditure upon some new service not contemplated in the Budget, the President shall cause to be laid before both Houses of Parliament such demand.

- Excess grants: Similarly, if any money has been spent on any service in excess of the amount granted for that service, the President shall cause to be laid before both Houses of Parliament showing a demand for excess grants.

What is the difference between supplementary and excess grants?

- The Supplementary grants are presented to and passed by the House before the end of the financial year and no discussion can be raised on the original grants.

- While the demands for excess grants are made after the expenditure has actually been incurred and after the financial year to which it relates and members can point out how money has been spent unnecessarily.

- The Comptroller and Auditor General (CAG) of India bring such excesses to the notice of the Parliament.

- The Public Accounts Committee (PAC) examines these excesses and gives recommendations to the Parliament.

- Example: During the Covid-19 pandemic, the government has sought Parliamentary approval for a supplementary grant of ₹2.35 lakh crore for 2020-21, to meet additional expenditures on -

- Pradhan Mantri Garib Kalyan Yojana,

- Aatmanirbhar Bharat stimulus package,

- Grants-in-aid for the State Disaster Response Funds,

- Recapitalization of public sector banks etc.

News Summary:

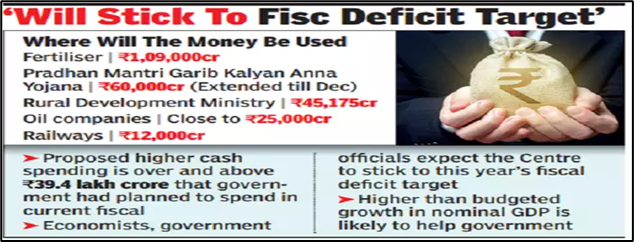

Image Caption: Plan to use supplementary grants

- The cost of the war in Ukraine is showing its impact on the Centre’s budget as the subsidy bill has shot up significantly.

- The government has sought additional grants primarily to fund a higher subsidy bill on items such as fertilizers, food and LPG, with about 10% of the sum to further ramp up capital expenditure in sectors like roads and railways.

- While the Finance Ministry has presented to Parliament an additional gross expenditure plan of about 4.36 lakh crore, the net cash outgo is estimated to be 3.26 lakh crore, with greater receipts and savings from existing outlays totaling 1.1 lakh crore.

- According to some experts, with tax revenues projected to be higher than the Budget figure and savings likely under other heads, the supplementary demands are not going to result in a major breach of the fiscal deficit target (6.4% of GDP).

- What is also expected to help the Centre is higher than budgeted growth in nominal GDP.

Q1) What does Comptroller and Auditor General (CAG) do?

Article 149 of the Constitution provides that the Comptroller and Auditor General of India who audits receipts and expenditure of the Union and each State and the Union Territory Governments.

Q2) What are the supplementary grants?

The additional grant required to meet the required expenditure of the government is called Supplementary Grants. When grants, authorised by the Parliament, fall short of the required expenditure, an estimate is presented before the Parliament for Supplementary or Additional grants.