Why India’s Farm Exports May Face Headwinds?

26-08-2023

12:28 PM

1 min read

What’s in today’s article?

- Why in News?

- India’s Latest Farm Exports

- India’s Latest Farm Imports

- What Are the Likely Risk Factors to India’s Farm Exports?

- Government Initiatives to Promote Agricultural Exports

Why in News?

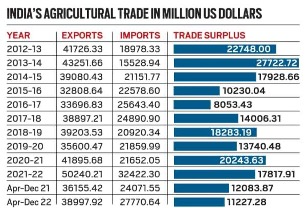

- Both agricultural exports from and imports into India have scaled new highs in the fiscal year that ended March 31, 2023.

India’s Latest Farm Exports

- Government data show the value of farm exports in April-December (9 months) 2022, at USD 39 billion.

- This is 7.9% higher than the USD 36.2 billion for the corresponding period of the previous year.

- At this rate, the record USD 50.2 billion exports achieved in 2021-22 look set to be surpassed.

- Key Factors behind the increase in Exports –

- The two big contributors to India’s agri-export growth have been rice and sugar.

- India in 2021-22 shipped out an all-time-high 21.21 million tonnes (mt) of rice valued at USD 9.66 billion.

- Sugar exports hit a record value of USD 4.60 billion in 2021-22, as against USD 2.79 billion, USD 1.97 billion, USD 1.36 billion, and USD 810.90 million in the preceding four fiscals.

- This fiscal has seen a further surge of 43.6%, from USD 2.78 billion in April-December 2021 to USD 3.99 billion in April-December 2022.

- The exports of rice and sugar are well on course to touch, if not top, $11 billion and $6 billion respectively in 2022-23.

India’s Latest Farm Imports

- Similar to exports, the imports are also growing.

- The imports of agri produce stood at USD 27.8 bn in Apr-Dec 2022.

- This is a growth of 15.4% over the USD 24.1 bn for Apr-Dec 2021.

- As a result, there has been a further shrinking of the surplus on the farm trade account.

Image Caption: India’s Agricultural Trade

- The growth in imports has come mainly from three commodities –

- The first is vegetable oils, whose imports shot up from USD 11.09 bn in 2020-21 to USD 18.99 bn in 2021-22. Imports meet roughly 60% of India’s vegetable oil requirements.

- The other three commodities are cotton, cashew and spices.

- Key Factors behind the increase in Imports –

- India’s cotton production has declined from 398 lakh bales in 2013-14 to a 12-year low of 307.05 lakh bales in 2021-22.

- The effects of not allowing new genetic modification (GM) technologies after the first-generation Bt cotton are showing, and impacting exports as well.

- A proactive approach is required in edible oils as well, where planting of GM hybrid mustard has been permitted with great reluctance.

- India’s cotton production has declined from 398 lakh bales in 2013-14 to a 12-year low of 307.05 lakh bales in 2021-22.

What Are the Likely Risk Factors to India’s Farm Exports?

- Agri-exports in the current fiscal could face headwinds from two sources –

- International Prices –

- With two of the world’s largest exporters (Russia and Ukraine) of wheat and other crucial crops entering a second year of war, the food prices are likely to remain elevated.

- Domestic Prices –

- The second source is domestic, more specifically food inflation fears ahead of the 2024 national elections.

- The Union government banned wheat exports last May.

- This was followed by a ban on broken rice exports and the slapping of a 20% duty on all non-parboiled non-basmati shipments in September.

- Exports of sugar have also stopped since this month’s start.

- International Prices –

·

Government Initiatives to Promote Agricultural Exports

- Promotion of exports of agricultural products is a continuous process.

- To promote agricultural exports, the Government has taken several steps at State/District levels.

- Agriculture Export Policy 2018 –

- In order to boost farm exports, the Government introduced a comprehensive Agriculture Export Policy in 2018, with the following objectives –

- To diversify our export basket, destinations and boost high-value and value-added agricultural exports including focus on perishables.

- To promote novel, indigenous, organic, ethnic, traditional and non-traditional agri products exports.

- To provide an institutional mechanism for pursuing market access, tackling barriers and deal with sanitary and phytosanitary issues.

- To strive to double India's share in world agri exports by integrating with global value chain at the earliest.

- To enable farmers to get benefit of export opportunities in overseas market.

- In order to boost farm exports, the Government introduced a comprehensive Agriculture Export Policy in 2018, with the following objectives –

- District as Export Hub Initiative –

- Under the DEH initiative, products including agricultural products with export potential have been identified in all 733 districts across the country.

- Transport and Marketing Assistance for Specified Agriculture Products –

- It is a Central Sector Scheme.

- It aims at providing assistance for the international component of freight to mitigate the freight disadvantage for the export of agriculture products.

- Besides, Product specific Export Promotion Forums (EPF) for eight high potential agri products i.e., Grapes, Mango, Banana, Onion, Rice, Nutri-Cereals, Pomegranate, Floriculture & Plant material have been created.

Q1) What are the top 3 wheat producing states in India?

Uttar Pradesh contributed 32.42% of the total wheat production in India. Madhya Pradesh contributed 16.08% of the total wheat produced in India. Punjab produced 15.65% of the total wheat in India. Around 64% of India's total wheat production is from these 3 states.

Q2) What are the top 3 cotton producing states in India?

Gujarat, Maharashtra and Telangana are the major cotton producing states which produce about 65% of cotton production in the country.