Four Labour Codes Latest News

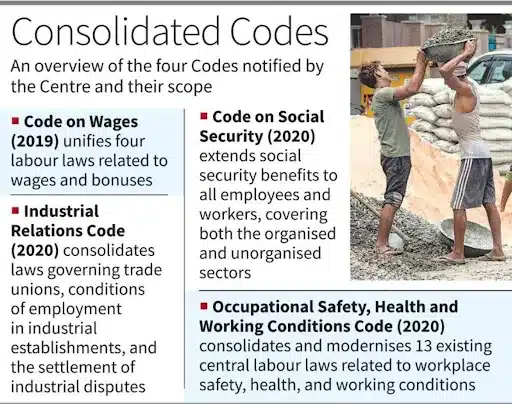

- The Government of India notified all Four Labour Codes, consolidating 29 Central labour laws into a simplified, modern regulatory framework.

- This marks one of the most significant labour reforms since Independence, aimed at improving labour welfare, social security, workplace safety, and ease of doing business.

Background

- Four labour codes: Code on Wages, 2019; Industrial Relations (IR) Code, 2020; Code on Social Security, 2020; and the Occupational Safety, Health and Working Conditions (OSHWC) Code, 2020.

- Pending implementation: These codes were pending implementation due to protests by Central Trade Unions (CTUs). Despite resistance, the Centre has now operationalised them.

- Systemic reforms introduced:

- Gender-neutral work policies

- Uniform safety standards

- Streamlined contract labour regulation

- India-wide ESIC and EPFO coverage

- National floor wages

- Move towards formalisation of labour market

Key Features of the Four Labour Codes

- Universal social security and expanded coverage:

- First-time statutory recognition of gig workers, platform workers, and aggregators.

- ESIC expanded to all districts, including hazardous units.

- Aadhaar-linked Universal Account Number (UAN) - fully portable benefits for migrant workers.

- Accident compensation extended to commuting accidents.

- Social security contributions - aggregators to contribute 1–2% of annual turnover (capped at 5%).

- Wages, minimum pay and timely payment:

- National Floor Wage introduced.

- Mandatory timely wage payments across establishments.

- Wage structure redefined to increase basic pay component, enhancing provident fund and gratuity provisioning.

- Women workers’ rights and safety:

- Women allowed to work night shifts, underground mines, heavy machinery operations—with consent and safety conditions.

- Equal pay for equal work mandated.

- Free annual health check-up for workers aged over 40.

- Fixed term employment (FTE):

- Workers can be hired for a fixed duration without compromising benefits.

- FTE employees get - same wages as permanent workers; medical, leave, and social security benefits; and gratuity eligibility after one year (earlier 5 years).

- Simplifying compliance and improving Ease of Doing Business:

- Single registration, licence and return system.

- Inspector-cum-facilitator model for supportive compliance.

- Two-member tribunals for faster dispute resolution.

- National OSH Board to harmonise safety standards.

Stakeholder Responses

- Government:

- Most comprehensive labour-oriented reform since Independence.

- Codes will formalise employment, ensure global alignment, and improve worker protections.

- Industry: CII welcomed the Codes as a “historic milestone," aiding a predictable labour regime and boosting economic growth.

- Trade unions (CTUs):

- Termed the Codes: “Anti-worker, pro-employer”, “Declaration of war on working masses”

- Concern areas - FTE misuse, restrictions on the right to strike, retrenchment norms.

- Nationwide protests planned for 26 November.

- Bharatiya Mazdoor Sangh (BMS): Partially supportive - backs Codes on Wages & Social Security but wants changes in OSHWC and IR Codes.

Challenges and Concerns

- CTUs: Oppose curtailment of strike rights, retrenchment rules, and fear dilution of worker protections.

- Implementation capacity: Labour is a Concurrent Subject—requires State cooperation. Many States are still finalising rules; implementation asymmetry is likely.

- Risk of FTE misuse: Fear that employers may replace permanent jobs with fixed-term contracts.

- Gig worker social security: Turning provisions into effective schemes remains a challenge. Past initiatives like e-Shram saw poor follow-through.

- Clarity on wage floor: National Floor Wage requires new methodology and agreements across States.

Way Forward

- Strengthening consultation mechanisms: Revive the Indian Labour Conference (ILC) for consensus-building. Continuous dialogue with unions, employers and States.

- Capacity building for States: Technical and financial support to implement new digital compliance systems.

- Clear scheme design for gig workers: Transparent rules for aggregator contribution. Seamless portability using UAN.

- Monitoring and preventing misuse of FTE: Strong checks to avoid replacing permanent jobs with FTE roles.

- Awareness campaigns: Workers, especially in informal sectors, need awareness of new rights.

Conclusion

- The implementation of the Four Labour Codes represents a historic restructuring of India’s labour governance framework.

- By consolidating 29 outdated laws, the Codes aim to create a future-ready labour ecosystem that promotes worker welfare, social security, gender equality, and ease of doing business.

- However, implementation challenges, trade union resistance, and risks of misapplication remain significant.

- Effective stakeholder engagement and transparent rule-making will be crucial for the Codes to fulfil their objective of creating an inclusive, formalised, and equitable labour market in India.

Four Labour Codes FAQs

Q1: What is the significance of the Four Labour Codes?

Ans: It consolidated 29 archaic laws into a unified framework to enhance social security, formalisation, worker safety, and ease of doing business.

Q2: How the Labour Codes aim to extend social security to gig and platform workers?

Ans: The Social Security Code provides first-time statutory recognition to gig/platform workers and mandates aggregator contributions.

Q3: What are the concerns raised by trade unions regarding the Labour Codes?

Ans: Trade unions argue that the Codes dilute worker rights through restrictive strike provisions, flexible retrenchment norms, etc.

Q4: How does the introduction of Fixed Term Employment (FTE) impact labour market flexibility and worker welfare?

Ans: FTE offers employers flexibility while ensuring workers receive benefits equal to permanent staff, including gratuity after one year.

Q5: What is the role of the National Floor Wage under the Code on Wages?

Ans: The National Floor Wage sets a nationwide minimum benchmark, reducing inter-state wage disparities and ensuring timely, uniform wage payments.