Bioremediation Latest News

- India is witnessing an urgent environmental crisis triggered by decades of unchecked waste generation, industrial pollution, pesticide accumulation, oil spills, and heavy-metal contamination.

Understanding Bioremediation

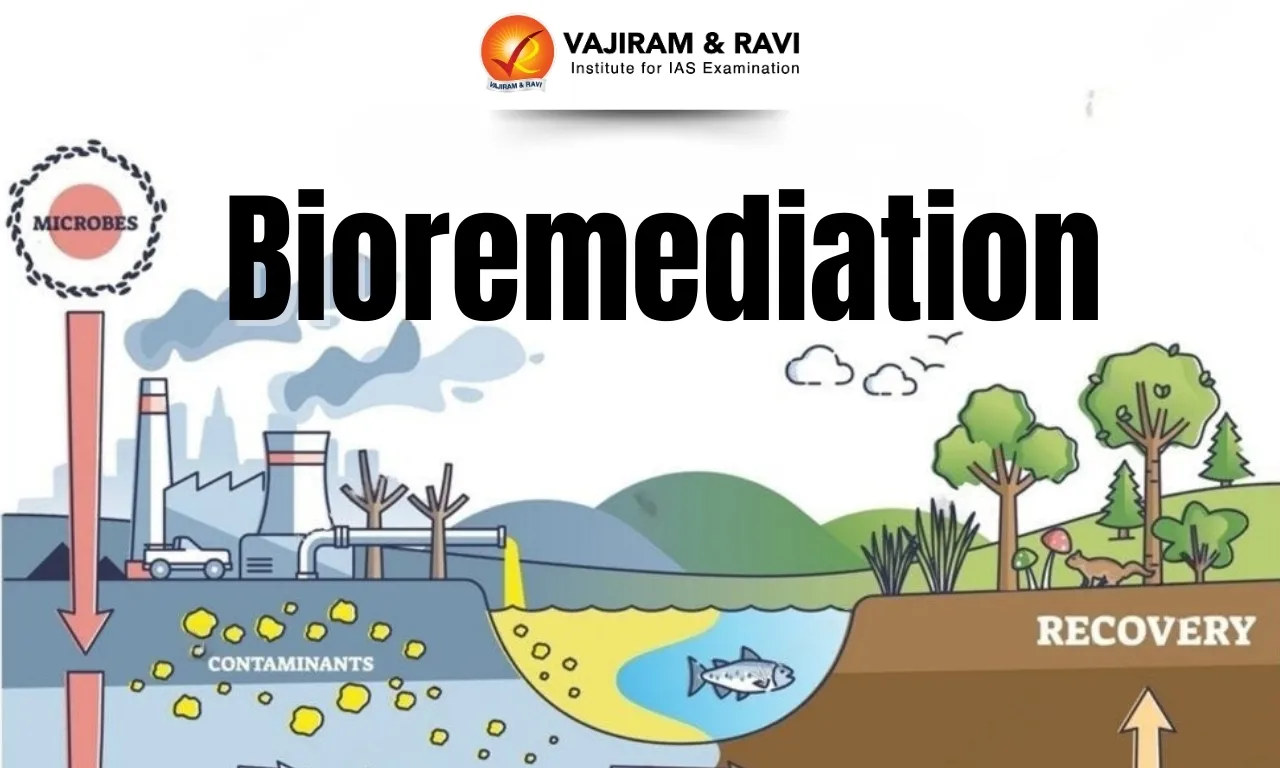

- Bioremediation literally means “restoring life through biology.” It relies on naturally occurring or engineered microorganisms, bacteria, fungi, algae, or plants to break down dangerous pollutants into harmless by-products.

- These pollutants range from oil and pesticides to plastics and toxic heavy metals.

- Microbes metabolise pollutants as food, converting them into water, carbon dioxide, or organic acids, while certain organisms transform metals into safer, non-leaching forms.

Types of Bioremediation Techniques

- In Situ Bioremediation

- Treatment occurs directly at the contaminated site.

- Examples include oil-eating bacteria deployed over ocean spills.

- Ex Situ Bioremediation

- Contaminated soil or water is removed, treated in a facility, and then returned.

- This approach allows controlled treatment for complex pollutant mixtures.

- Modern bioremediation blends traditional microbiology with advanced biotechnology, enabling precise identification of biomolecules and replication of microbes tailored for specific environments like sewage systems or agricultural fields.

- Synthetic biology has introduced:

- GM microbes for tough pollutants such as plastics and oil residues,

- Biosensing organisms that change colour or fluoresce when detecting toxins, aiding early warnings and monitoring.

Urgent Need for Bioremediation in India

- India’s rapid industrialisation and urbanisation have come with steep environmental costs.

- Heavily polluted rivers like the Ganga and Yamuna, untreated sewage, toxic effluents, oil leaks, pesticide residues, and heavy metals have created widespread ecological degradation.

- Traditional clean-up systems, thermal treatments, chemical neutralisation, and mechanical extraction are expensive, energy-intensive, and often produce secondary pollution.

- Bioremediation stands out as a cost-effective, scalable, and environmentally sustainable alternative, especially critical for a country dealing with:

- Large polluted land areas,

- Limited resources for remediation,

- Dense urban centres are overwhelmed by waste.

- India’s natural biodiversity gives it an additional advantage. Indigenous microbes adapted to extreme environments (heat, salinity, acidity) can outperform imported strains in cleaning local contamination.

India’s Current Progress in Bioremediation

- India’s bioremediation ecosystem is growing but remains mostly at the pilot-project stage. Key developments include:

- Government-Led Initiatives

- The Department of Biotechnology (DBT) supports bioremediation projects through its Clean Technology Programme, encouraging partnerships between universities, research institutes, and industries.

- The CSIR–NEERI has a mandate to develop and implement bioremediation programmes nationwide.

- Research Innovations

- IIT researchers created a nanocomposite material from cotton to clean oil spills.

- Scientists have identified bacteria capable of degrading soil pollutants.

- Start-up Participation

- Companies now offer microbial formulations for cleaning wastewater and soil, indicating growing commercial adoption.

Global Trends in Bioremediation

- Japan uses plant- and microbe-based systems in urban waste strategies.

- The European Union funds multinational collaborations for oil spill clean-up and mining land restoration.

- China applies engineered bacteria to restore industrial wastelands under its soil pollution control programme.

- These global examples underline how bioremediation can be mainstreamed in national environmental management.

Opportunities for India

- India has immense opportunities to integrate bioremediation into:

- River rejuvenation (e.g., Namami Gange), Sewage treatment infrastructure, Land reclamation, Industrial clean-up missions.

- Beyond environmental benefits, bioremediation can create jobs in:

- Biotechnology research, Waste management, Environmental consulting, Local start-up ecosystems.

Risks and Regulatory Challenges

- Bioremediation also carries risks, especially when using genetically modified organisms (GMOs).

- Poor containment or inadequate testing can harm ecosystems. India currently faces:

- A lack of unified national standards for bioremediation, Insufficient site-specific data, Weak biosafety guidelines, and Limited trained personnel.

Way Forward

- Creating national bioremediation standards and certification systems,

- Building regional bioremediation hubs linking universities, industries, and local governments,

- Supporting start-ups under the DBT-BIRAC ecosystem,

- Engaging communities to dispel myths and build acceptance of microbial clean-up technologies.

Source: TH

Bioremediation FAQs

Q1: What is bioremediation?

Ans: It is the use of microbes, algae, or plants to break down or neutralise toxic pollutants.

Q2: Why is bioremediation important for India?

Ans: It offers a low-cost, sustainable solution to widespread pollution in land and water bodies.

Q3: Which organisations are leading bioremediation research in India?

Ans: DBT, CSIR–NEERI, and institutions like IITs.

Q4: What are the major types of bioremediation?

Ans: In situ (on-site) and ex situ (off-site) remediation methods.

Q5: What risks does bioremediation pose?

Ans: GM microbes can cause ecological harm if not rigorously tested and regulated.