What’s in today’s article?

- Background (Context for the article)

- About Carbon Markets (Meaning, Types, Market in India, Legislative Measures, etc.)

- News Summary

Why in News?

- India is planning a stabilization fund to keep prices of credits in its planned carbon market above a certain threshold, ensuring that they remain attractive for investors and that the market succeeds in cutting emissions.

Background:

- In order to keep global warming within 2°C, ideally no more than 1.5°C, global greenhouse gas (GHG) emissions need to be reduced by 25 to 50% over this decade.

- Nearly 170 countries have submitted their nationally determined contributions (NDCs) so far as part of the 2015 Paris Agreement, which they have agreed to update every five years.

- NDCs are climate commitments by countries setting targets to achieve net-zero emissions.

- India, for instance, is working on a long-term roadmap to achieve its target of net zero emissions by 2070.

- In order to meet their NDCs, one mitigation strategy is becoming popular with several countries— carbon markets.

- Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfil their NDCs.

What are Carbon Markets?

- Carbon markets are essentially a tool for putting a price on carbon emissions— they establish trading systems where carbon credits or allowances can be bought and sold.

- A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

- Carbon allowances or caps, meanwhile, are determined by countries or governments according to their emission reduction targets.

- A United Nations Development Program release this year noted that interest in carbon markets is growing globally, i.e., 83% of NDCs submitted by countries mention their intent to make use of international market mechanisms to reduce greenhouse gas emissions.

What are different types of Carbon Markets?

- Compliance Market –

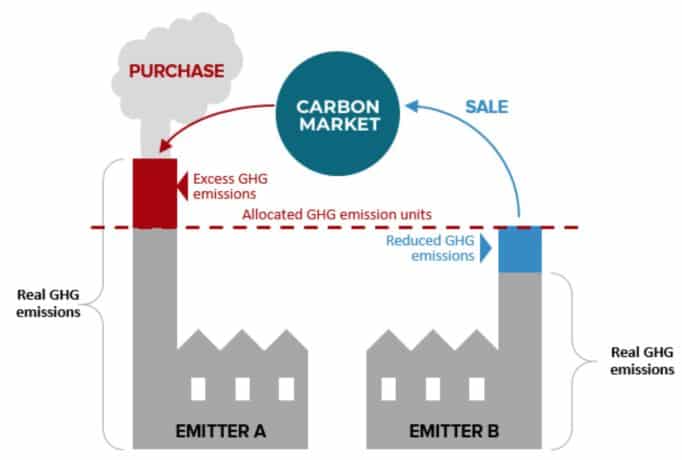

Image Caption: Working of Carbon Market

- These are set up by policies at the national, regional, and/or international level— are officially regulated.

- Entities in this sector are issued annual allowances or permits by governments equal to the emissions they can generate.

- If companies produce emissions beyond the capped amount, they have to purchase additional permit, either through official auctions or from companies which kept their emissions below the limit, leaving them with surplus allowances.

- The market price of carbon gets determined by market forces when purchasers and sellers trade in emissions allowances.

- Voluntary Market –

- These are markets in which emitters— corporations, private individuals, and others— buy carbon credits to offset the emission of one tonne of CO2 or equivalent greenhouse gases.

- Such carbon credits are created by activities which reduce CO2 from the air, such as afforestation.

- In a voluntary market, a corporation looking to compensate for its unavoidable GHG emissions purchases carbon credits from an entity engaged in projects that reduce, remove, capture, or avoid emissions.

What is the status of Carbon Market in India?

- In the past, India has made investments in producing carbon credits and exporting them to international enterprises.

- Between 2010 and June 2022, India issued 35.94 million carbon credits or nearly 17% of all voluntary carbon market credits issued globally.

- However, the government now intends to forbid its exports, guarantee the expansion of a local domestic market for carbon credits, and increase its internal trade.

- Currently, India’s carbon market is a voluntary carbon market where private parties voluntarily exchange certified reductions of GHGs from the atmosphere for carbon credits.

Legislative Push:

- The Lok Sabha, in August 2022, passed the Energy Conservation (Amendment) Bill, 2022 aimed at putting in place provisions to make the use of clean energy mandatory and paving the way for the setting of carbon markets in the country.

- Through the amendment of the Energy Conservation Act, the Central government aims to develop India’s Carbon market and boost the adoption of clean technology.

- The Bill empowers the central government to specify a carbon credit trading scheme.

- The central government or any authorized agency may issue carbon credit certificates to entities registered under and compliant with the scheme.

- The entities will be entitled to purchase or sell the certificate.

News Summary:

- India is planning a stabilization fund to keep prices of credits in its planned carbon market above a certain threshold.

- This is intended to ensure that the prices for carbon credits remain attractive for investors and that the market succeeds in cutting emissions.

- Beginning in 2008, prices of carbon credits in other countries slumped heavily, because of that year’s economic crisis and because governments had issued too many of them.

- Money in the stabilization fund would be used by a market regulator to buy carbon credits if prices fell too low.

- Exactly how it would work and where the money would come from is still under discussion.

- The World Bank has already said it will provide $8 million to help India prepare carbon-pricing instruments.

- India’s carbon market is being set up in two phases, according to the government’s presentation slides.

- In the first phase, between 2023 and 2025, the existing energy-savings certificates will be converted to carbon credits.

- The Central government is expected to publish the carbon market’s rules soon.

Q1) What is a carbon credit?

A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

Q2) What is a stabilization fund?

A stabilization fund is a mechanism set up by a government or central bank to insulate the domestic economy from large influxes of revenue. A primary motivation is maintaining steady government revenue in the face of major commodity price fluctuations as well as the avoidance of inflation.

Source: Explained | What are carbon markets and how do they operate?

Last updated on January, 2026

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Notification 2026 Postponed for CSE & IFS which was scheduled to be released on 14 January 2026.

→ UPSC Calendar 2026 has been released.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India