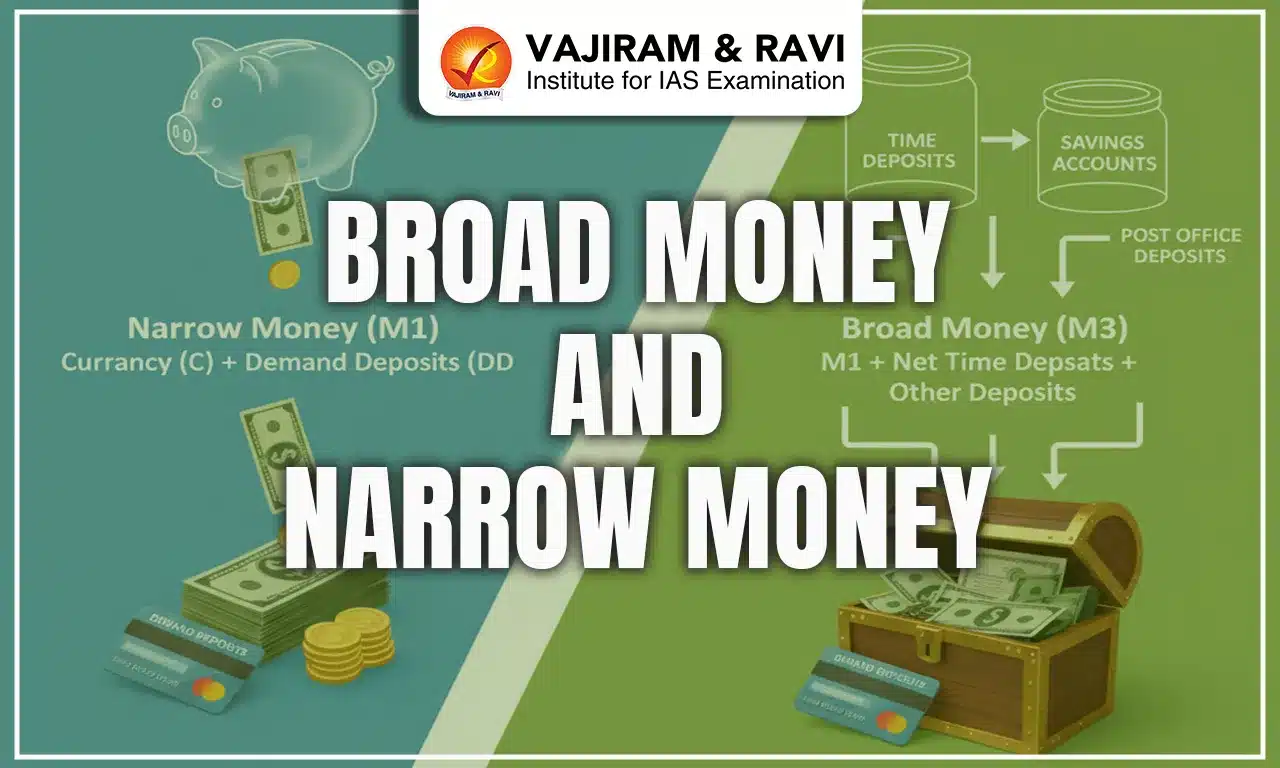

Broad Money and Narrow Money are two important measures used to understand the money supply in an economy. Narrow Money helps assess immediate liquidity and daily transactional capacity, board money provides a money comprehensive picture of the total financial resources circulating in the economy, influencing long-term monetary policy, economic growth and financial stability. In this article, we are going to cover Broad Money and Narrow Money and differences between them.

Broad Money and Narrow Money

Broad and narrow money are important concepts in economics, representing different layers of money supply within an economy. Narrow Money also known as M1 is the most liquid form of money that is easily available for immediate transaction, such as physical currency, coins and demand deposits held in banks. It shows the short-term spending power within the economy. On the other hand, Broad Money also known as M3 and M4 money is the one that has less liquid assets like the savings account, fixed deposits and other financial instruments that cannot be used immediately for transactions but contribute to the overall money available in the economy.

Broad Money and Narrow Money Difference

Broad Money and Narrow Money are different in terms of liquidity. While Narrow Money is highly liquid and readily usable for daily transactions, broad money includes all forms of money, both liquid and semi-liquid reflecting the total value of money accessible to households and businesses.

| Aspect | Broad Money | Narrow Money |

|

Definition |

Encompasses all forms of money, including less liquid assets like savings and term deposits. |

Covers the most liquid money, instantly available for spending. |

|

Indicated as |

M3 and M4 |

M1 |

|

Liquidity |

Lower liquidity compared to narrow money. |

High liquidity, immediately usable. |

|

Economic Assessment |

Evaluates overall liquidity and stability of the financial system. |

Focuses on short-term liquidity and immediate spending ability. |

|

Sensitivity to Changes |

Less responsive to short-term shifts in consumer expenditure. |

Closely tied to fluctuations in consumer confidence and spending. |

|

Examples |

Deposits with maturity up to 2 years, redeemable deposits, repurchase agreements, money market funds, short-term debt securities. |

Physical cash, coins, demand deposits, traveler’s checks, and other highly liquid assets. |

Narrow Money

Narrow money, often referred to as M1, represents the segment of a nation’s money supply that is instantly available for transactions. It typically consists of physical currency in circulation and demand deposits with banks. Globally, narrow money is considered a vital benchmark for economic activity and is a central component of monetary policy management.

Central banks monitor M1 closely, influencing its supply through tools like interest rate adjustments, reserve requirements, and open market operations.

Narrow Money (M1) Characteristics

- Highly liquid and immediately usable for payments.

- Includes physical cash, coins, and demand deposits in checking accounts.

- Easily accessible and widely used in day-to-day transactions.

- Instantly convertible without any loss in value.

- Limited scope, covering only immediately spendable funds.

- Serves routine payments, purchases, and withdrawals.

- Examples: cash in hand, traveler’s checks, and bank demand deposits.

Role of Narrow Money in Economies

- Liquidity Indicator: Reflects the availability of money for immediate expenditure.

- Inflation Control: Rising M1 can push inflation; falling M1 can cause deflation.

- Growth Stimulus: An increase in M1 can fuel demand, encouraging production and growth.

- Interest Rate Management: Narrow money supply influences interest rates—less M1 raises rates, while more M1 lowers them.

Broad Money

Broad money represents the total supply of money in the economy, combining narrow money (M1) with less liquid forms such as savings deposits, time deposits, and financial instruments. Sometimes termed M2/M3, broad money is a critical measure of a nation’s overall liquidity and the long-term stance of its monetary policy.

Characteristics of Broad Money (M3):

- Includes both liquid and semi-liquid assets that require time to convert into cash.

- Covers savings accounts, fixed deposits, and market funds.

- Less liquid than narrow money; cannot be directly used for payments.

- Encompasses a much larger share of total money supply.

- Primarily used for investments, savings, and long-term economic stability.

- Strongly linked to long-term monetary policy, affecting inflation, interest rates, and credit flow.

- Examples: fixed deposits, savings accounts, and money market instruments.

Role of Broad Money in Economies:

- Broad money is vital for assessing the overall financial health of an economy.

- Central banks regulate its growth to control inflation, stabilize exchange rates, and influence GDP growth.

- Since it includes less-liquid assets, it impacts investment behavior and capital availability.

- Economists rely on M3 to study monetary expansion and formulate policies for medium- to long-term stability.

- For instance, the Reserve Bank of India adjusts interest rates to influence broad money supply, promoting growth when more liquidity is needed or slowing inflation when excess money is circulating.

- Higher availability of broad money accelerates credit access and boosts growth, while lower supply contracts spending and investment.

- Thus, monitoring broad money is crucial for balancing inflation control with sustainable economic growth, making it a cornerstone of global financial systems.

| Also Check Other Posts | |

| Care Economy | Mutual Funds |

| Alternative Investment Funds | GDP Deflator |

Last updated on February, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India

Broad Money and Narrow Money FAQs

Q1. Is broad money M3 or M4?+

Q2. What are examples of broad money?+

Q3. Which is narrow money, M1 or M2?+

Q4. What is Narrow Money?+

Q5. What is M1 and M2?+