What’s in Today’s Article?

- Understanding Exchange Rate Regimes

- India’s Exchange Rate Policy

- Implications of Rupee Devaluation

- Structural Constraints in the Indian Economy

- Policy Questions and Challenges

- Conclusion

Why in News?

- The Indian rupee recently witnessed a sharp devaluation against the dollar after a period of relative stability post-COVID.

- This article examines India’s exchange rate policies, structural constraints in the economy, and the broader implications of rupee depreciation.

Understanding Exchange Rate Regimes:

- Nominal and Real Exchange Rates: The nominal exchange rate is the official exchange rate that doesn’t account for inflation, while the real exchange rate is the nominal exchange rate adjusted for inflation.

- Determinants of Exchange Rates:

- Current Account: Influenced by net exports.

- Capital Account: Driven by foreign investment flows.

- Impact: Demand for foreign currency increases with a higher current account deficit and capital outflow.

- Types of Exchange Rate regimes:

- Fixed Exchange Rate: Central bank maintains a constant exchange rate by managing reserves.

- Floating Exchange Rate: Market-driven exchange rate with no central bank intervention.

- Managed-Floating Exchange Rate: A mix of market forces and central bank intervention.

India’s Exchange Rate Policy:

- Past trends:

- India has primarily followed a managed-float regime for three decades.

- From 2010, the Reserve Bank of India (RBI) managed the rupee asymmetrically:

- Under excess demand: Depreciated the rupee and sold foreign reserves.

- Under excess supply: Accumulated reserves to avoid appreciation.

- Post-COVID shifts:

- Between 2022 and late 2024, the RBI temporarily adopted a fixed exchange rate-like regime to stabilize the rupee.

- Recent sharp devaluation suggests a return to the managed-float approach, driven by:

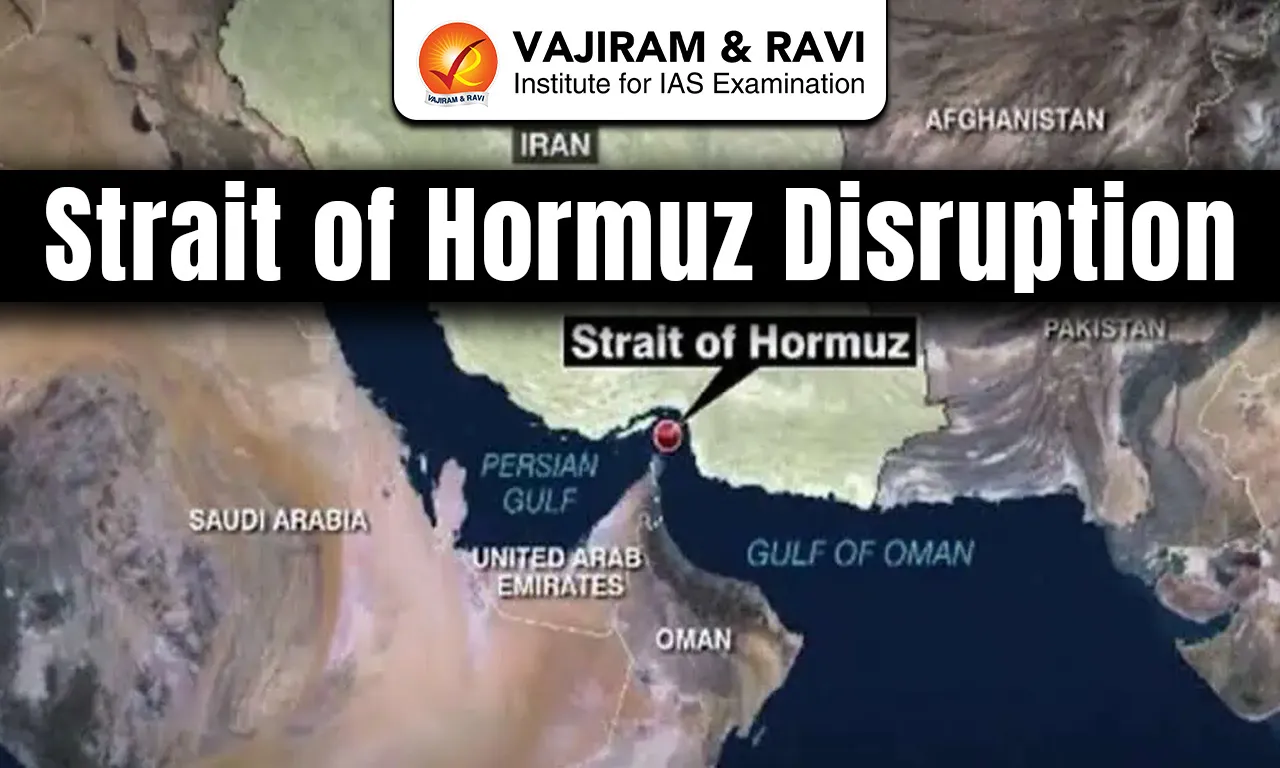

- Capital outflows.

- Rising import costs amid high crude oil prices.

Implications of Rupee Devaluation:

- Positive effects:

- Boosting exports: Depreciation can make domestic goods cheaper, enhancing export competitiveness if:

- Net exports respond positively to a weaker real exchange rate.

- Nominal depreciation leads to real depreciation.

- Boosting exports: Depreciation can make domestic goods cheaper, enhancing export competitiveness if:

- Adverse effects:

- Inflationary pressures: Increased import costs raise domestic prices.

- Reduced purchasing power: Firms pass on higher costs to consumers, squeezing real incomes.

Structural Constraints in the Indian Economy:

- Divergence between NEER and REER:

- These indices reflect the weighted average exchange rate of India with respect to its multiple trade partners.

- According to the definitions of these indices, any increase or positive change indicates appreciation, whereas any drop or negative change indicates depreciation.

- Since the mid-2010s, the nominal effective exchange rate (NEER) has depreciated, while the real effective exchange rate (REER) has appreciated.

- This divergence undermines export competitiveness, as higher domestic prices offset the benefits of nominal depreciation.

- Rising markups:

- Non-financial firms have increased markups (ratio of output price to variable costs), contributing to domestic price inflation.

- Key cost drivers include raw materials, labor, fuel, and indirect taxes.

Policy Questions and Challenges:

- Policy dilemmas:

- Should India revert to the managed-float regime of the 2010s or adopt a new framework?

- How can policy address inflationary pressures while maintaining export competitiveness?

- RBI’s role:

- The RBI’s recent ad hoc policy shifts highlight the need for a systematic exchange rate strategy.

- Clearer objectives and consistent communication are essential for addressing current challenges.

Conclusion:

- The devaluation of the rupee underscores structural vulnerabilities in the Indian economy and raises critical questions about the future of exchange rate policy.

- A nuanced approach that balances inflation control with export growth is vital for sustainable economic recovery.

Q.1. What do you mean by currency depreciation?

Currency depreciation is when a currency’s value decreases in relation to another currency. This happens in a floating exchange rate system, where the value of a currency is determined by supply and demand in the forex market.

Q.2. What is the difference between currency depreciation and currency devaluation?

Currency depreciation is a natural decrease in a currency’s value, while devaluation is a deliberate government action to reduce the value of a currency.

Source: TH

Last updated on March, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ UPSC Final Result 2025 is expected to be released soon.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Check UPSC Marksheet 2024 Here.

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India