Fertiliser Industry Latest News

- The Uttar Pradesh government has banned the sale of non-subsidised fertilisers by urea manufacturers and suppliers, raising concerns over excessive controls in the Indian fertiliser industry.

Structure of the Fertiliser Industry in India

- The fertiliser sector in India is one of the most regulated industries in the country.

- It plays a crucial role in ensuring food security, given India’s large agricultural base and dependence on chemical fertilisers such as urea, DAP, MOP and NPK complexes.

- The maximum retail price (MRP) of urea is fixed at Rs. 266.5 per 45-kg bag, and this rate has remained largely unchanged since November 2012.

- Although some fertilisers such as Di-Ammonium Phosphate (DAP) are officially “decontrolled”, companies receive a fixed subsidy per bag, subject to maintaining a capped MRP.

- For instance, the Centre provides a flat subsidy for DAP, but companies must sell it at a notified price to receive that subsidy.

- Similarly, for other fertilisers such as Muriate of Potash (MOP) and NPK complexes, MRPs are indirectly regulated. Companies must align prices with subsidy rates notified by the government, and “unreasonable” profits can be recovered from subsidy claims.

- Thus, while partial decontrol exists on paper, effective price control continues in practice.

Control Over Distribution and Movement

- Government control is not limited to pricing. The Centre also regulates the movement and allocation of subsidised fertilisers across states.

- The Department of Fertilisers (DoF) prepares an “agreed supply plan” based on the requirement assessed by the Union Agriculture Ministry and state governments.

- This plan is broken down state-wise, season-wise and month-wise.

- At the state level, district-wise allocation is decided by the agriculture authorities.

- Companies must dispatch fertilisers according to official railway rake and road movement plans.

- Once a rake reaches a designated railhead, the district agriculture officer allocates stock dealer-wise.

- In essence, even private fertiliser companies operate under a framework where price, quantity, location and timing of sale are largely determined by the government.

Non-Subsidised and Speciality Fertilisers

- Apart from subsidised fertilisers, companies also sell non-subsidised speciality nutrients. These include:

- Water-soluble fertilisers, Calcium nitrate, Zinc sulphate, Bentonite sulphur, Micronutrients and bio-stimulants

- These products are used in high-value crops such as fruits, vegetables and sugarcane. They are typically applied in smaller quantities but offer higher nutrient efficiency.

- Unlike subsidised fertilisers such as urea (around Rs. 5.9 per kg), speciality products can cost Rs. 60-90 per kg.

- However, their market size is small, about 0.4 million tonnes annually, compared to 67 million tonnes of subsidised fertilisers.

- These products are officially notified under the Fertiliser Control Order (FCO), 1985.

The Uttar Pradesh Ban

- In January 2026, the Uttar Pradesh agriculture directorate issued an order prohibiting urea manufacturers and suppliers from selling any “gair-anudaanit” (non-subsidised) fertilisers in the state.

- The ban applies to several major fertiliser companies, including cooperative, public and private entities.

- Reason Behind the Ban

- The state government acted on allegations of “tagging”, forcing farmers to buy non-subsidised products along with subsidised fertilisers. However, industry representatives argue that:

- Both product categories are sold through the same dealer networks.

- Cross-selling is a normal business practice.

- The market for speciality fertilisers in UP is relatively small compared to subsidised fertilisers.

Implications of the Ban

- Impact on Nutrient Use Efficiency

- Speciality fertilisers are often more nutrient-efficient and environmentally sustainable. Restricting their sale may discourage balanced fertiliser use and worsen overdependence on cheap urea.

- India already faces the problem of excessive nitrogen application due to the highly subsidised price of urea.

- Investor Sentiment

- The fertiliser industry operates in a capital-intensive environment. Frequent regulatory interventions can: Reduce private sector investment, Discourage innovation, Create policy uncertainty

- Market Distortions

- Ministry sources argue that banning established players could open space for unorganised operators selling low-quality products.

- This may undermine quality control and farmer education.

Structural Challenges in the Fertiliser Sector

- Overdependence on Subsidies: The fertiliser subsidy bill remains a major fiscal burden.

- Imbalanced Nutrient Use: Artificially cheap urea leads to overuse of nitrogen relative to phosphorus and potassium.

- Supply Constraints: Reports of urea selling above MRP have been linked to rising consumption and production constraints.

- Policy Overreach: Layered controls on price, movement and sales restrict market flexibility.

Way Forward

- Gradual rationalisation of fertiliser subsidies.

- Promotion of balanced nutrient application under schemes like Soil Health Cards.

- Encouragement of speciality and efficiency-enhancing fertilisers.

- Clear and predictable regulatory framework to attract investment.

- The fertiliser sector is central to India’s food security. However, excessive controls may hinder innovation, efficiency and long-term sustainability.

Source: IE

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

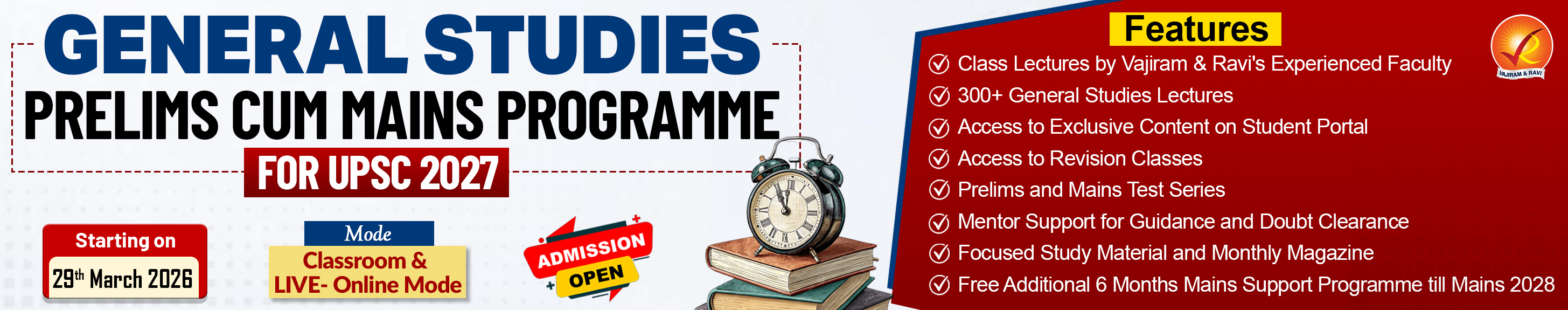

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India

Fertiliser Industry FAQs

Q1. What is the MRP of urea in India?+

Q2. Are DAP and other fertilisers fully decontrolled?+

Q3. What are non-subsidised fertilisers?+

Q4. Why did Uttar Pradesh ban non-subsidised fertilisers?+

Q5. What is a key concern regarding excessive controls in the fertiliser sector?+

Tags: fertiliser industry mains articles upsc current affairs upsc mains current affairs