Ethanol Revolution Latest News

- India’s ethanol blending programme has undergone a major shift, with grain-based ethanol, especially from maize, surpassing sugarcane-based production for the first time, marking a structural change in the country’s biofuel strategy.

Evolution of India’s Ethanol Blending Programme

- India’s ethanol blending programme (EBP), launched to reduce crude oil imports and support sugarcane farmers, has undergone a remarkable transformation.

- Initially conceived to enable sugar mills to generate additional revenue and make timely payments to cane growers, the programme has evolved into a multi-feedstock ethanol industry powered largely by grains, especially maize and rice.

- This shift marks a major structural change in India’s biofuel policy. What began as a sugarcane-linked project is now driven by grain-based distilleries, which have received over Rs. 40,000 crore in investments, reshaping the dynamics of rural industry, fuel policy, and agricultural markets.

Sugarcane as the Foundation

- Ethanol production in India began through the fermentation of sucrose from molasses, a by-product of sugarcane processing.

- Until 2017-18, sugar mills mainly used C-heavy molasses, the final by-product of sugar extraction.

- However, the introduction of higher procurement prices for ethanol made from B-heavy molasses and direct cane juice or syrup encouraged mills to divert cane from sugar production to ethanol.

- Between 2013-14 and 2018-19, ethanol supplies to oil marketing companies (OMCs) surged from 38 crore litres to nearly 189 crore litres, raising the average blending rate from 1.6% to 4.9%.

- The policy was hailed as a success in stabilising the sugar sector, especially during periods of price volatility and excess production.

The Shift from Sugar to Grain

- Starting from the 2018-19 fiscal year, the government allowed ethanol production from grains such as maize, rice, and damaged foodgrains, setting differential ex-distillery prices for each.

- Initially, this was meant to help sugar mills operate their distilleries year-round by using grains during the off-season (May-October).

- However, with attractive pricing and flexible feedstock regulations, standalone grain-based ethanol plants began proliferating across India, particularly in Punjab, Haryana, Bihar, Andhra Pradesh, Madhya Pradesh, Maharashtra, Karnataka, Rajasthan, and Chhattisgarh.

- By 2023-24, this transition became strikingly visible. Out of the 672.49 crore litres of ethanol supplied to OMCs, only 270.27 crore litres (40.2%) came from sugarcane-based sources, while 402.22 crore litres (59.8%) were grain-based, mostly maize and broken rice.

Maize Becomes the Mainstay

- The current 2024-25 ethanol supply year reflects the dominance of grains. Out of the 920 crore litres likely to be procured, about 620 crore litres are expected to come from grain-based sources, with maize contributing nearly 420 crore litres.

- Two main factors explain this shift:

- Reduced Sugarcane Availability: Droughts in 2023-24 and 2024-25 hit sugarcane production, prompting the government to restrict ethanol derived from cane juice and B-heavy molasses to safeguard sugar supplies for domestic consumption.

- Sugar diverted for ethanol fell from 45 lakh tonnes in 2022-23 to 24-35 lakh tonnes in the subsequent two years.

- Sugar production declined from 359 lakh tonnes (2021-22) to an estimated 261 lakh tonnes (2024-25).

- Pricing Advantage: Ethanol from maize fetches Rs. 71.86 per litre, compared to Rs. 57.97 from C-heavy molasses, Rs. 60.73 from B-heavy, and Rs. 65.61 from cane juice/syrup. This made maize ethanol more lucrative for distillers.

Growth, Capacity and Policy Implications

- For 2025–26, OMCs invited tenders for 1,050 crore litres of ethanol to achieve the 20% blending target, but received offers totalling 1,776 crore litres, far exceeding requirements. Of this, 1,304 crore litres were from grain-based sources, mainly maize and FCI rice.

- Currently, India has 499 operational distilleries with a combined production capacity of 1,822 crore litres annually.

- The massive expansion, driven by private and cooperative investment, shows the sector’s potential but also raises policy challenges.

Challenges and Sustainability Concerns

- Excess Production Capacity

- With ethanol demand capped by blending limits (20% being the technical ceiling for current vehicles), the sector faces a looming oversupply risk. Balancing production capacity and consumption will require strategic planning to avoid price distortions.

- The Food vs. Fuel Debate

- India’s ethanol policy now faces the global dilemma of diverting food grains for fuel. Producing 420 crore litres of ethanol from maize consumes about 11 million tonnes of grain, roughly 26% of India’s total maize output (42 mt).

- Since maize is a critical input for poultry, dairy, and livestock feed, rising ethanol demand could pressure feed costs and food inflation.

- Similarly, ethanol from rice depends on surplus stocks held by the Food Corporation of India (FCI), which may not persist every year.

- Environmental Considerations

- While ethanol is a cleaner-burning fuel that reduces greenhouse gas emissions, large-scale grain diversion raises sustainability concerns related to water use, land allocation, and fertiliser intensity, particularly in maize cultivation.

Government’s Future Strategy

- To ensure balance, the government is likely to adopt a dual-feedstock policy, encouraging both sugarcane and grain-based ethanol while closely monitoring the food security implications.

- Efforts are also underway to develop second-generation (2G) biofuels using agricultural residues like paddy straw, which could help achieve the 20% blending target by 2025-26 sustainably.

- The government’s continued focus on ethanol reflects its commitment to energy transition, rural income diversification, and reducing crude oil imports, which cost over $160 billion annually.

Source: IE

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

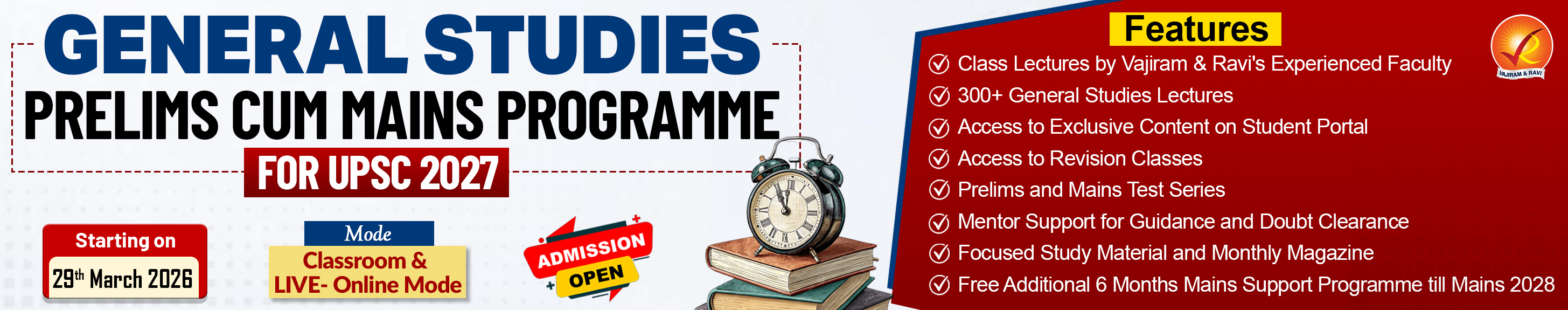

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India

Ethanol Revolution FAQs

Q1. What was the original purpose of India’s ethanol blending programme?+

Q2. Which feedstock currently dominates India’s ethanol production?+

Q3. What percentage of ethanol in 2023–24 came from sugarcane?+

Q4. Why has sugarcane-based ethanol declined recently?+

Q5. What are the main challenges of grain-based ethanol?+

Tags: ethanol revolution mains articles upsc current affairs upsc mains current affairs