Why In News?

- From December 1, all complaints related to GST profiteering will be dealt with by India’s antitrust watchdog Competition Commission of India (CCI), in place of National Anti-Profiteering Authority.

What’s in Today’s Article?

- National Anti-Profiteering Authority (NAA) – About, rationale, working

- Competition Commission of India (CCI)

- News Summary

ABOUT NAA:

- The NAA was set up in November 2017 as a statutory body under the GST law to check unfair profiteering activities by registered suppliers

- Its core function is to ensure that benefits of reduction in GST rates on goods and services and of the input tax credit are passed on to consumers by way of reduction in prices

- It was set up for two years till 2019, but was later extended till November 2021.

Rationale behind establishing NAA

- Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit should be passed on to the recipient by way of commensurate reduction in prices.

- However, it has been the experience of many countries that when GST was introduced there has been a marked increase in inflation and the prices of the commodities.

- This was happening because the suppliers were not passing on the commensurate benefits to the consumer and thereby indulging in illegal profiteering.

- Therefore, NAA was constituted by the Central Government to examine whether the reduction in the tax rate have actually resulted in a commensurate reduction in prices to the recipients.

Working

- As per the GST law, a 3-tier structure was set up for investigation and adjudication of the profiteering complaints.

- The complaints are required to be first sent to state-level screening and standing committees, which are then forwarded to DGAP for investigation.

- The investigation report is then submitted to NAA. The authority thereafter passes an order after hearing both the parties.

- If NAA finds that a supplier has indulged in profiteering, it has to return the profiteered amount, along with 18 per cent interest, to the consumer.

- If all the consumers cannot be identified, then the amount is transferred to the consumer welfare fund.

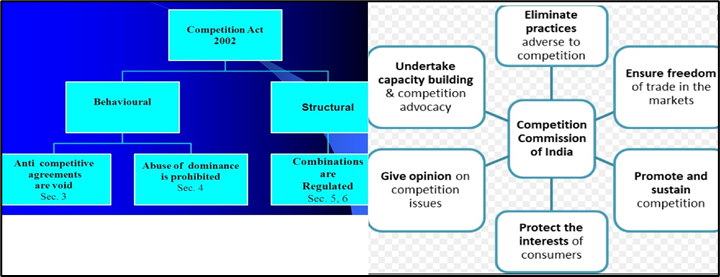

Competition Commission of India (CCI):

- The Competition Commission of India (CCI) is a statutory body established in March 2009 under the Competition Act, 2002.

- Objectives:

- Eliminate practices having adverse effect on competition

- Promote and sustain competition

- Protect the interests of consumers

- Ensure freedom of trade in the markets of India

- The Commission consists of one Chairperson and six members who shall be appointed by the Central Government.

Background:

- The GST Council, in its 45th meeting in September last year, gave one-year extension post November 2021 till November 30, 2022, to NAA and also decided to shift the work to CCI after that.

- i.e., NAA’s investigation arm will continue to function in some form under CCI.

- The move is aimed at reducing the multiplicity of regulators as CCI can handle cases independently.

News’s Summary:

- Currently, all consumer complaints of companies not passing on GST rate cut benefits are investigated by the Directorate General of Anti-profiteering (DGAP), which then submits its report to the NAA.

- The tenure of NAA ends this month and its functions will be taken over by the CCI from December 1.

- The central government, on the recommendations of the Goods and Services Tax Council, has transferred the functions of NAA to the CCI.

- i.e., now CCI will examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

Challenges of Transfer:

- Transfer of all pending cases from NAA to CCI and forming a special bench for adjudication may take some time before things ease out.

- Jurisdictional high courts will consider remanding all the writ petitions filed in profiteering cases to CCI.

Last updated on February, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ UPSC Final Result 2025 is expected to be released in the second week of April 2026.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Check UPSC Marksheet 2024 Here.

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India