About National Pension System (NPS)

- It is a retirement benefit scheme introduced by the Government of India to facilitate regular income post-retirement for all subscribers.

- NPS was launched on 1st January, 2004.

- Initially, NPS was introduced for the new government recruits (except the armed forces). With effect from 1st May, 2009, NPS has been provided for all citizens of the country, including the unorganised sector workers on voluntary basis.

- Voluntary: It is a voluntary scheme for all citizens of India. People can invest any amount in their NPS account at any time.

- Permanent Retirement Account Number (PRAN): It is based on a unique PRAN, which is allotted to every subscriber.

- Portability: NPS account or PRAN will remain the same irrespective of changes in employment, city, or state. It can be used from any location in India.

- PFRDA (Pension Fund Regulatory and Development Authority) is the governing body for NPS.

- There is no defined benefit that would be available at the time of exit from the system, and the accumulated wealth depends on the contributions made and the income generated from the investment of such wealth.

- Under NPS, individual savings are pooled into a pension fund, which is invested by PFRDA-regulated professional fund managers into diversified portfolios comprising Government Bonds, Bills, Corporate Debentures, and Shares.

- Contributions made by individual subscribers are accumulated until retirement, and corpus growth continues via market-linked returns. Subscribers also have the option to exit this plan before retirement or opt for superannuation.

- PRAN will provide access to two personal accounts:

- Tier I Account: This is a non-withdrawable account meant for savings for retirement.

- Tier II Account: This is simply a voluntary savings facility. The subscriber is free to withdraw savings from this account whenever he or she wishes. No tax benefit is available on this account.

Q1) What is the PFRDA (Pension Fund Regulatory and Development Authority)?

The Pension Fund Regulatory & Development Authority Act was passed on 19th September, 2013 and the same was notified on 1st February, 2014. PFRDA regulates NPS, subscribed by employees of Govt. of India, State Governments and by employees of private institutions/organizations & unorganized sectors. The objective of PFRDA is to promote old-age income security by establishing, developing and regulating pension funds to protect the interests of the subscribers of pension fund and for matters connected therewith or incidental thereto.

Source: Will deliberate on Old Pension Scheme after panel report: Amit Shah

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

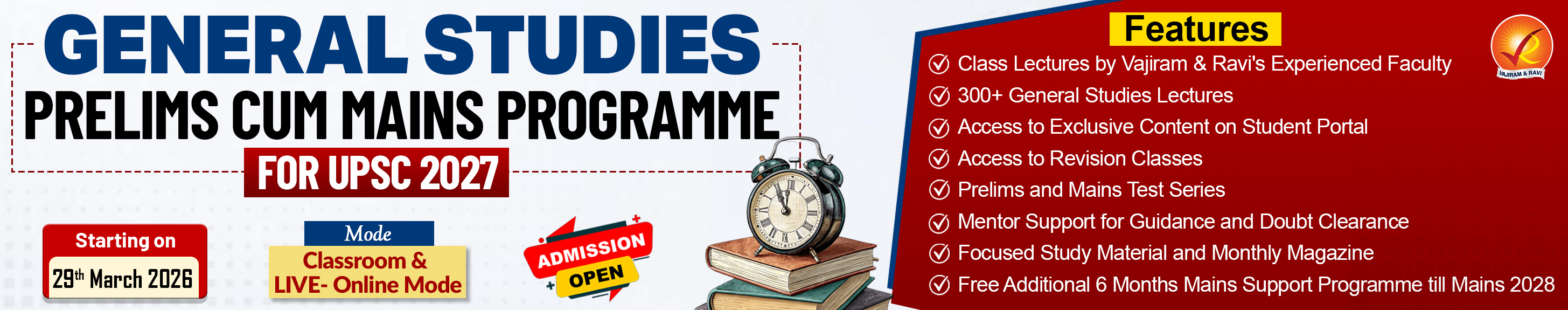

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India