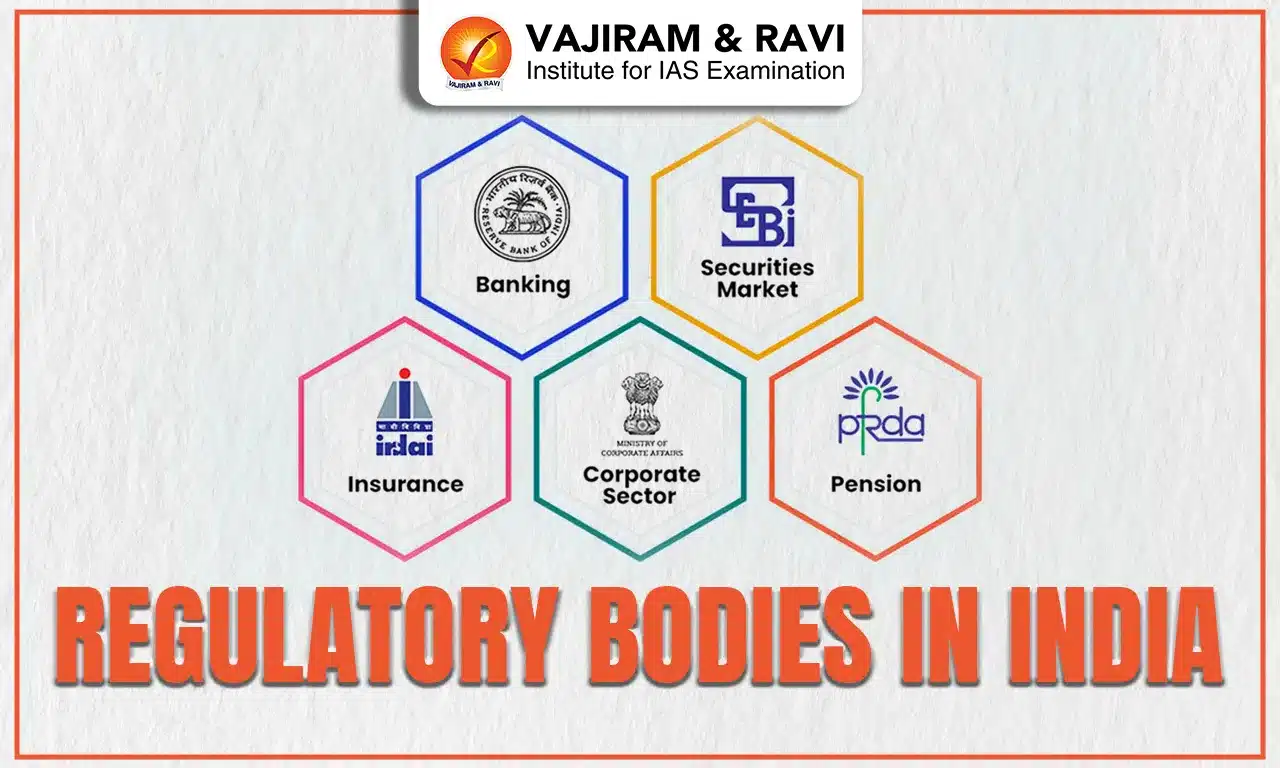

Regulatory Bodies in India are institutions established by the government to oversee, guide, and control different sectors, ensuring they operate within legal and ethical frameworks. They play a vital role in maintaining transparency, accountability, and fairness. By enforcing regulations and standards, these bodies help prevent misuse, protect public interest, and promote good governance. They also support sustainable growth by monitoring sectoral performance and resolving disputes. This article examines the types of regulatory bodies in India, the challenges they face, and the proposed reforms to enhance their effectiveness.

Regulatory Bodies in India

Regulatory Bodies in India are key institutions set up by the government to oversee, guide, and regulate various sectors, ensuring compliance with laws and ethical standards. In India, they operate across domains such as banking, insurance, healthcare, and education. These bodies maintain order, fairness, and efficiency within critical sectors, acting as safeguards against malpractice. Their functions complement the broader governance framework, promoting transparency, accountability, and public trust in the system.

Types of Regulation in India

- Economic Regulation: Aims to prevent market failures by controlling monopolistic practices and promoting healthy competition.

- Environmental Regulation: Seeks to protect the environment in line with constitutional provisions, including Fundamental Rights, Directive Principles of State Policy, and Fundamental Duties.

- Regulation in Public Interest: Ensures the welfare of citizens by maintaining the quality, safety, and reliability of goods and services.

Regulatory Bodies in India Types

- Statutory Independent Regulatory Agencies: These are autonomous bodies created by law to operate independently of government departments. They originated in the USA and have been adopted globally to ensure fairness and protect public interest in liberalized economies. Examples in India include SEBI, TRAI, and RBI.

- Self-Regulatory Authorities: These institutions regulate themselves through their own rules, within the framework of existing laws. An example is the Press Council of India.

Regulatory Bodies in India Duties

- Supervise regulated practices and preserve reserved titles or practices.

- Establish conditions for registration and ensure compliance with laws.

- Promote professional ethics and address professional misconduct or incompetence.

- Implement transparent, objective, and impartial disciplinary procedures.

- Monitor continuing competency programs to enhance practice standards.

Elements of High-Performance Regulator

- Clarity of Purpose: Clear, conflict-free objectives prevent inefficiency and overlapping mandates.

- Regulatory Board Composition: Predominantly non-executive members for independent oversight; oversee organizational structure, processes, and budget.

- Legislative Process: Regulations drafted through structured procedures with public consultations, cost-benefit analyses, and transparent finalization.

- Executive Process: Licensing and investigations must be fair, equitable, and ensure due process for applicants.

- Judicial Process: Administrative law departments ensure separation of powers, transparent hearings, reasoned orders, and avenues for appeal.

- Reporting and Accountability: Publish comprehensive reports focusing on regulatory performance, not external economic conditions.

- Role of Parent Department: Clearly defined role; support the regulator while maintaining its autonomy.

Regulatory Bodies in India Importance

- Regulatory Bodies in India serve as the backbone of governance by balancing public interest with sectoral growth.

- The Reserve Bank of India (RBI) manages monetary policy and ensures financial stability.

- The Food Safety and Standards Authority of India (FSSAI) is responsible for regulating food quality and safety.

- The Securities and Exchange Board of India (SEBI) oversees and regulates the securities market.

- The Insurance Regulatory and Development Authority of India (IRDAI) supervises and develops the insurance sector.

- The National Green Tribunal (NGT) addresses issues related to environmental governance and protection.

- Together, these Regulatory Bodies in India enforce compliance, promote fair competition, and encourage innovation across sectors.

Regulatory Governance in India Challenges

- Regulatory Bodies in India often adopt a reactionary approach, which delays timely and effective decision-making.

- Many of them lack true independence, functioning as extensions of ministries and facing government interference.

- Overlapping mandates and poor coordination between regulatory bodies create inefficiencies and conflicts.

- The absence of specialized expertise weakens their ability to make sound decisions and enforce regulations effectively.

- Financial dependence on government allocations makes them vulnerable to political influence and pressure.

- In some cases, corruption and nepotism arise due to opaque appointment processes and inadequate auditing.

- Chronic vacancies and understaffing, along with the posting of non-specialist officers, further reduce their efficiency.

Proposed Reforms for Effective Regulatory Governance

- Regulatory Bodies in India should conduct regular self-evaluations and publish their findings to promote transparency and informed public debate.

- Functional and financial autonomy can be strengthened by charging their budgets to the Consolidated Fund of India, reducing reliance on government allocations.

- A transparent appointment process for regulatory heads is essential to eliminate favoritism and build credibility.

- Using Regulatory Impact Assessments (RIA) can help weigh the costs and benefits of regulations, improving policy quality.

- Parliament should periodically review the performance of regulatory bodies and implement reforms through legislative amendments.

- Providing specialized technical assistance will enhance decision-making and enforcement capacity.

- Granting quasi-judicial powers to regulatory bodies can streamline dispute resolution and ease the judiciary’s burden.

- Establishing a “Regulator of Regulators,” as suggested by the Punchhi Commission, can ensure accountability and uniformity.

- Better interdepartmental coordination will reduce overlapping functions and improve overall efficiency.

Last updated on February, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ UPSC Final Result 2025 is expected to be released in the second week of April 2026.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Check UPSC Marksheet 2024 Here.

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India

Regulatory Bodies in India FAQs

Q1. How many regulatory bodies are there in India?+

Q2. What are regulatory bodies?+

Q3. What are the regulatory bodies in India financial?+

Q4. What are the statutory regulatory bodies in India?+

Q5. How many types of regulatory are there?+