About Rebate of State and Central Taxes and Levies (RoSCTL) Scheme

- It aims to reimburse all embedded State and Central Taxes/Levies for exports of manufactured goods and garments.

- It has been established as a successor for the old “Rebate of State Levies (RoSL) Scheme.

- The difference between RoSL & RoSCTL Scheme is that under the RoSL Scheme, there was no benefit on the central tax and Levies. But in the RoSCTL scheme, the exporter will get rebate of both State and Central tax and Levies.

- Objective: To compensate for the State and Central Taxes and Levies in addition to the Duty Drawback Scheme on export of apparel/ garments and Made-ups by way of rebate.

- The rebate under the Scheme shall be in the form of duty credit scrips.

- The scrips shall be issued electronically on the Customs system.

- The duty credit scrips shall be used for payment of Basic Customs Duty on import of goods. These scrips shall be freely transferable.

- The duty credit available in an e-scrip shall be transferred at a time for the entire amount in the said e-scrip to another person and transfer of the duty credit in part shall not be permitted.

- Validity of e-scrip: The period of validity of the e-scrip, of one year from its creation, shall not change on account of transfer of the e-scrip.

- Eligibility: All exporters of garments/Apparel and made-ups manufactured in India are eligible to take benefit under this scheme, except entities/ IECs under the Denied Entity List of the Directorate General of Foreign Trade (DGFT).

- Implementing agency: It has been notified by the Ministry of Textiles. However, the scheme shall be implemented by the Department of Revenue.

Q1) What is the role of the Directorate General of Foreign Trade?

It is the agency of the Ministry of Commerce and Industry of the Government of India responsible for administering laws regarding foreign trade.

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

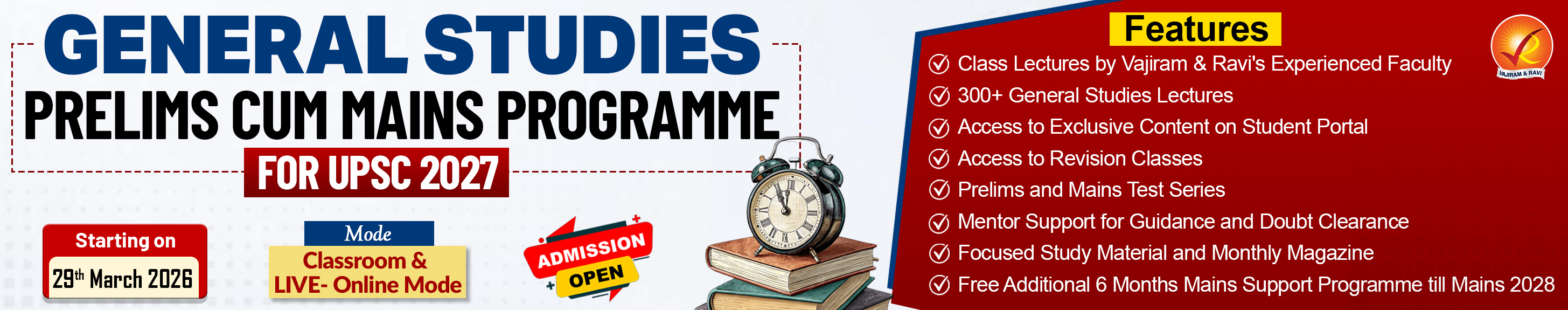

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India