The Union Budget 2026 is India’s annual financial statement presented by the Central Government that lays down plans for revenue and expenditure for the next financial year from 1 April 2026 to 31 March 2027. It is the most important financial instrument of the government, reflecting priority sectors, economic strategy, taxation policy, social welfare, and fiscal discipline.

The budget determines how India mobilises resources, spends on defence, health, education, infrastructure, and social sectors, and balances growth with fiscal prudence.

What is Union Budget of India?

The Union Budget of India is the annual financial statement of the Government of India, which presents a detailed account of the estimated revenues and expenditures of the Central Government for a particular financial year, running from 1st April to 31st March.

The Union Budget is presented every year by the Union Finance Minister in the Lok Sabha, on 1st February, and it requires approval from Parliament before implementation.

Also Read: New Income Tax Slab 2026-27

Union Budget 2026-27 PDF Download

Union Budget 2026-27 PDF presents the Government of India’s roadmap for sustained economic growth, fiscal discipline, and inclusive development under the vision of Viksit Bharat. It highlights key policy measures across manufacturing, infrastructure, agriculture, services, taxation, and social sectors with a strong focus on reform-led growth.

Union Budget 2026 Highlights

Union Budget 2026 has been presented by Finance Minister Nirmala Sitharaman on 1st Februaury, 2026 (Sunday). Aligned with the Viksit Bharat@2047 vision, the budget seeks to balance fiscal discipline with strategic investments that promise strong long-term economic returns. The key highlights of the Union Budget 2026-27 has been discussed below in detail.

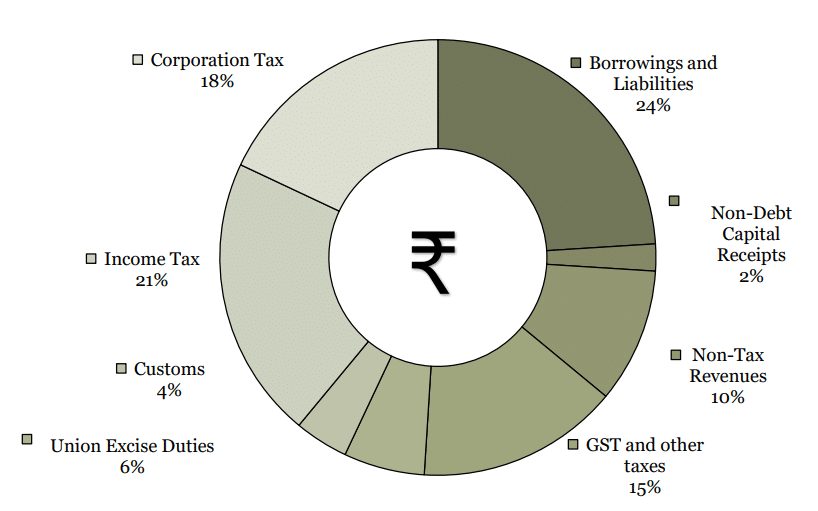

Rupee Comes From

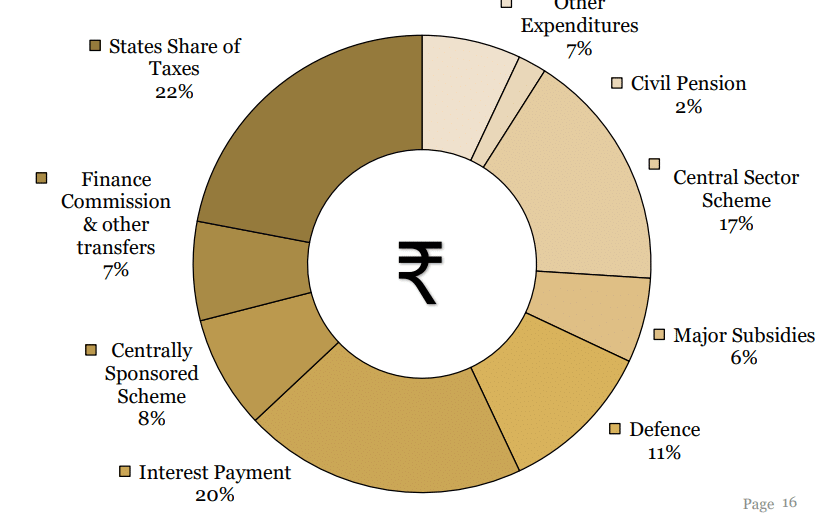

Rupee Goes to

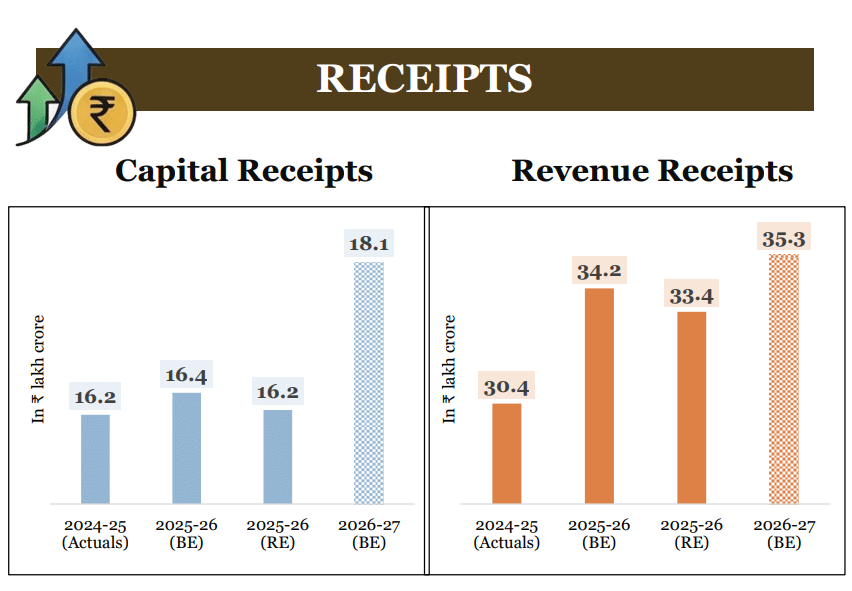

Receipts

Expenditures

1. Overall Vision and Economic Philosophy

- The Union Budget 2026–27 is guided by the theme “Action over Ambivalence, Reform over Rhetoric, People over Populism”, aligning with the long-term vision of Viksit Bharat

- The budget focuses on moderate inflation, sustained high growth (~7%), fiscal discipline, and macroeconomic stability, while balancing ambition with social inclusion.

- Strong emphasis is placed on reduced import dependence, energy security, domestic manufacturing capacity, and public investment-led growth.

2. Yuva Shakti & Inclusive Growth Focus

- The budget is Yuva Shakti-driven, targeting employment generation, skill development, and entrepreneurship for youth.

- Priority is given to poor, underprivileged, and disadvantaged sections, reinforcing the vision of Sabka Saath, Sabka Vikas.

- The government outlines three Kartavyas:

- First Kartavya: Accelerate and sustain economic growth

- Second Kartavya: Fulfil aspirations of our people

- Third Kartavya: Vision of Sabka Saath, Sabka Vikas

- First Kartavya: Accelerate and sustain economic growth

3. Sustaining Momentum of Structural Reforms

- Over 350 structural reforms have been implemented, including GST simplification, labour code notification, and quality control rationalisation.

- High Level Committees have been formed.

- Central Government is working with the State Governments on deregulation and reducing compliance requirements.

4. Manufacturing Push: Strategic & Frontier Sectors

-

Major schemes announced for strengthening high-value and technology-intensive manufacturing, including:

- Revival of 200 legacy industrial clusters

- India Semiconductor Mission (ISM) 2.0

- Electronics Components Manufacturing Scheme

- Biopharma SHAKTI

- Dedicated Chemical Parks, Container Manufacturing, and Rare Earth Permanent Magnets initiatives

- Hi-Tech Tool Rooms in CPSEs

- Scheme for Container Manufacturing

- Dedicated initiative for the manufacturing of affordable Sports Goods

5. Tax & Customs Reforms to Boost Manufacturing

- Five-year income tax exemption for non-residents supplying capital goods to toll manufacturers in bonded zones.

- Expansion of duty-free import limits for seafood, footwear, leather, and textile exporters.

- Deferred duty payment facilities for trusted manufacturers and recognition of regular importers with trusted supply chains.

- One-time concessional duty window for eligible SEZ manufacturing units to sell in Domestic Tariff Area

6. MSME Growth as ‘Champions’

- Introduction of a ₹10,000 crore SME Growth Fund and ₹2,000 crore top-up to the Self-Reliant India Fund.

- Mandatory use of TReDS by CPSEs for MSME procurement, with CGTMSE-backed credit guarantee for invoice discounting.

- Linking GeM with TReDS to ensure faster and cheaper MSME financing.

- Development of Corporate Mitras in Tier-II and Tier-III towns for affordable compliance support

7. Services Sector as a Growth Engine

- Establishment of a High-Powered Education-to-Employment Committee focusing on services.

- Five Medical Value Tourism Hubs to be developed in partnership with states and the private sector.

- Expansion of AYUSH infrastructure, allied health institutions, caregiver training, and AVGC creator labs.

- Strong push to sports, design, healthcare, and the orange economy through institutional strengthening

- Khelo India Mission – integrated talent development pathweay, systematic coaching development, intergration of science & technology and development of sports infrastructure.

8. Tourism, Education & Culture

- Development of 15 archaeological sites into experiential destinations and a National Destination Digital Knowledge Grid.

- Pilot upskilling of 10,000 tourist guides and setting up a National Institute of Hospitality.

- Establishment of 5 University Townships, girls’ hostels in STEM institutions, and telescope infrastructure facilities

- India to host the first-ever Global Big Cat Summit.

- Development of Buddhist Circuits in the North East Region.

9. Financial Sector Reforms

- Setting up the High Level Committee on Banking for Viksit Bharat to align with India’s next growth phase.

- Incentive of ₹100 crore for the single issuance of municipal bonds of more than ₹1000 crore and continuation of AMRUT-linked support.

- Introduction of market-making framework and total return swaps in corporate bonds.

- Restructuring Power Finance Corporation (PFC) and Rural Electrification Corporation (REC).

- Review of FEMA (Non-debt Instruments) Rules and restructuring of PFC and REC.

- Increase in Securities Transaction Tax (STT) on futures and options

10. Agriculture & Allied Sectors

- Integrated development of 500 reservoirs and Amrit Sarovars.

- Targeted programmes for fisheries, horticulture, cashew, cocoa, coconut, sandalwood, and animal husbandry.

- Launch of Bharat-VISTAAR integrating AgriStack and ICAR practices with AI system.

11. Infrastructure & Public Capital Expenditure

- Continued sharp rise in public capex, supported through REITs, InVITs, NIIF, and NABFID.

- New Dedicated Freight Corridors, 20 New National Waterways, and coastal cargo promotion.

- ₹2 lakh crore support to states under SASCI Scheme.

- Focus on Tier-II and Tier-III city infrastructure and logistics corridors

12. Energy Security & Climate Action

- ₹20,000 crore for the Carbon Capture Utilization and Storage (CCUS) Scheme.

- BCD exemptions for lithium-ion batteries, solar glass, nuclear projects (extended till 2035), and critical minerals.

- Excise duty relief on biogas-blended CNG to promote clean energy

13. People-Centric Development

- Creation of a Care Ecosystem with training of 1.5 lakh caregivers.

- Launch of SHE Marts, Divyangjan Kaushal Yojana, and Divyang Sahara Yojana.

- Expansion of mental health institutions and trauma care centres at district hospitals

- Supporting Artificial Limbs Manufacturing Corporation of India (ALIMCO) to scale up production of assistive devices, invest in R&D and AI integration.

14. Ease of Doing Business & Trust-Based Governance

- Automated customs, single digital cargo clearance window, and extended validity of advance rulings.

- Simplification of TDS/TCS, extended return filing timelines, and decriminalisation of minor tax offences.

- MAT rationalisation and immunity schemes to encourage voluntary compliance

15. Fiscal Discipline & Deficit Targets

- Fiscal deficit targeted at 4.3% of GDP in BE 2026–27, continuing the consolidation path.

- Debt-to-GDP ratio projected at 55.6%, with a medium-term target of 50±1% by 2030.

- 16th Finance Commission Recommendation: ₹1.4 lakh crore Finance Commission grants to states; vertical devolution share retained at 41%.

Union Budget History

India’s budgetary tradition began during the colonial era and has grown into a vital instrument guiding the country’s economic and social policies. From the first budget in 1860 to modern times, it reflects India’s evolving fiscal priorities and development goals.

- Colonial Era Beginnings: The first budget in India was presented on 7th April 1860 by James Wilson, the first Finance Member of the Viceroy’s Council.

- Purpose in Early Times: Initially, the budget mainly focused on revenue collection and expenditure for administration under British rule.

- First Post-Independence Budget: After India gained independence, the first budget was presented on 26th November 1947 by R. K. Shanmukham Chetty, setting the foundation for India’s sovereign fiscal policy.

- Evolution Over Time: The Union Budget transformed from a simple statement of revenue and expenditure to a comprehensive economic policy instrument.

- Policy and Social Impact: Today, the budget influences economic growth, social welfare, taxation, infrastructure development, and national priorities.

- Annual Significance: The budget is presented every year, on 1st February, marking the beginning of discussions on economic strategies for the upcoming fiscal year.

- Modern Innovations: Over decades, the budget has incorporated reforms like digital reporting, gender budgeting, environmental considerations, and sector-specific allocations.

- Public Engagement: With growing transparency, the budget now engages citizens, experts, and industries through detailed presentations, press releases, and live sessions.

Union Budget Constitutional Provisions

The Union Budget of India is prepared, presented, and implemented strictly according to the constitutional framework laid down in the Indian Constitution. These provisions ensure financial accountability, legislative control, and transparency in the use of public money.

Note: The term ‘budget’ is nowhere mentioned in the Constitution of India.

| Union Budget Constitutional Provisions | ||

| Article | Provision | Explanation |

|

Article 112 |

Annual Financial Statement |

Mandates the presentation of the Union Budget showing estimated receipts and expenditures of the Government of India for the financial year. |

|

Article 113 |

Voting on Demands for Grants |

Requires Lok Sabha approval for all expenditure demands of ministries; Rajya Sabha has no voting power. |

|

Article 114 |

Appropriation Bill |

Authorizes withdrawal of money from the Consolidated Fund of India after demands are passed. |

|

Article 110 |

Finance Bill (Money Bill) |

Contains tax proposals; can be introduced only in Lok Sabha and cannot be rejected by Rajya Sabha. |

|

Article 117 |

Financial Bills |

Deals with bills involving expenditure from the Consolidated Fund other than Money Bills. |

|

Article 266 |

All revenues, loans, and repayments go into this fund; money can be withdrawn only with parliamentary approval. |

|

|

Article 267 |

Used to meet unforeseen expenditure, placed at the disposal of the President. |

|

|

Article 109 |

Role of Rajya Sabha |

Rajya Sabha can only discuss the Budget and must return Money Bills within 14 days. |

|

Article 111 |

Presidential Assent |

Budget becomes law only after President gives assent to Appropriation and Finance Bills. |

|

Article 116 |

Vote on Account |

Allows government to meet expenses temporarily if Budget is not passed in time. |

Stages of Budget Session in Indian Parliament

The Budget Session of the Indian Parliament is a special session conducted to discuss, scrutinize, and approve the Union Budget for the upcoming financial year. The stages of Budget Session 2026-27 have been discussed below.

- Presentation of the Budget: The Union Budget is presented in the Lok Sabha on 1st February every year by the Finance Minister of India. During the presentation, the Finance Minister delivers the budget speech. After the speech, the budget is formally laid before both Houses of Parliament.

- General Discussion: Members of the Lok Sabha discuss the budget as a whole or on any principle involved in it. However, no cut motions can be moved, and the budget is not submitted to a vote at this stage. The Finance Minister has the right to reply at the end of the discussion, clarifying policies and addressing members’ concerns.

- Scrutiny by Departmental Committees: Each departmental standing committee conducts an in-depth examination of the Demands for Grants of its respective ministry. This process lasts three to four weeks, during which the House remains in recess. At the end of this period, the committees submit their reports to Parliament, suggesting reductions, modifications, or reallocations if necessary.

- Voting on Demands for Grants: The Lok Sabha votes on the individual demands for grants of each ministry. Only Lok Sabha members can vote on these demands. Expenditure charged on the Consolidated Fund of India is excluded and does not require voting.

- Passing of Appropriation Bill: No money can be withdrawn from the Consolidated Fund of India except through an Appropriation Bill. This bill authorises the government to withdraw funds and meet its approved expenditures for the financial year.

- Passing of Finance Bill: The Finance Bill is introduced to give legal effect to the financial proposals of the government, including taxation and revenue measures, for the upcoming year. It is presented as a Money Bill under Article 110 and requires Lok Sabha approval followed by Presidential assent to become the Finance Act.

Documents Presented in Parliament Along with the Union Budget

When the Union Budget is presented in Parliament, it is accompanied by several mandatory documents that provide detailed information on government finances, allocations, and fiscal policies. These documents ensure transparency, accountability, and detailed scrutiny of government expenditure and revenue.

Budget Documents:

- Annual Financial Statement (AFS): The primary budget document detailing the estimated receipts and expenditures of the Government of India, prepared under Article 112 of the Constitution.

- Demands for Grants (DGs): Ministry-wise requests for funds for specific services and schemes, which must be voted upon by the Lok Sabha.

- Finance Bill: Introduces new taxes or amendments to existing tax laws to implement the government’s revenue proposals.

- Appropriation Bill: Authorizes the withdrawal of funds from the Consolidated Fund of India to meet expenditure approved through the budget.

FRBM Act Mandated Statements (Fiscal Responsibility and Budget Management)

- Macro-Economic Framework Statement (MEFS): Evaluates economic growth prospects, fiscal balance, and external sector position for the upcoming year.

- Fiscal Policy Strategy Statement (FPSS): Outlines the government’s fiscal policies and priorities for the financial year.

- Medium-Term Fiscal Policy Statement (MTFPS): Presents medium-term fiscal targets and strategies to ensure sustainable public finances over the next 3 years.

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India

Union Budget 2026 FAQs

Q1. What is the Union Budget 2026-27?+

Q2. Who presents the Union Budget 2026-27?+

Q3. When is the Union Budget 2026-27 presented?+

Q4. Under which Article of the Constitution is the Union Budget presented?+

Q5. What are Demands for Grants?+