India-Middle East-Europe Economic Corridor Latest News

- India’s National Security Council Secretariat recently hosted officials from the U.S., UAE, Saudi Arabia, France, Italy, Germany, Israel, Jordan, and the EU to review progress on the India-Middle East-Europe Economic Corridor (IMEC).

- This article deals with the corridor’s ambitions, challenges, and future prospects.

About India-Middle East-Europe Economic Corridor (IMEC)

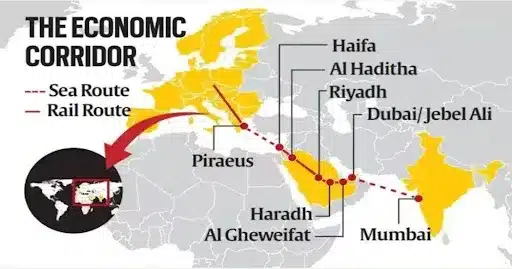

- Announced at the 2023 G20 Summit in New Delhi, the IMEC aims to boost economic development through enhanced connectivity between Asia, the Arabian Gulf, and Europe.

- It consists of two segments:

- the India-Gulf corridor, linking India’s western ports to the UAE and then via high-speed freight rail through Saudi Arabia and Jordan to Haifa, Israel; and

- the Gulf-Europe corridor, connecting Haifa to Greece and Italy by sea, followed by onward transport through Europe’s rail networks.

- Expected to reduce India-Europe shipping times by about 40% compared to the Red Sea route, the project has seen limited progress since its launch.

IMEC’s Promise and the Geopolitical Opening That Enabled It

- The IMEC was conceived during India’s G20 Presidency in September 2023, at a rare moment of Middle East stability following years of regional rivalries.

- Arab normalisation with Israel, which Saudi Arabia was poised to join, created conditions for India, Middle Eastern states, the U.S., and Europe to envision a corridor connecting India to Europe.

- The economic case was strong — the EU is India’s largest trading partner, with FY 2023-24 bilateral trade at $137.41 billion, and non-oil trade with the UAE and Saudi Arabia rising significantly.

- Planned as more than a trade route, IMEC aimed to integrate electricity and digital connectivity cables, clean hydrogen pipelines, and measures to boost efficiency, reduce costs, create jobs, and cut emissions.

- It sought to address persistent trade challenges, including lack of tariff standardisation, low financial integration, limited corridor-wide insurance, and varying port capacities, while building a cross-Saudi/UAE railway to link its sea legs.

- Although these were considered manageable through investment and cooperation, the project stalled when, less than a month later, the region was plunged into ongoing conflict, preventing the first stakeholder meeting from taking place.

Gaza War Turns IMEC’s Challenges into Fundamental Obstacles

- While the IMEC’s economic rationale remains strong, its hurdles have shifted from manageable to fundamental due to Israel’s ongoing war on Gaza, which has strained regional ties.

- The corridor’s key Middle East-Europe link depends on Jordan-Israel cooperation, now at a low point amid tensions over Palestinian displacement.

- Prospects for Saudi-Israel normalisation have also diminished, with Riyadh demanding Palestinian concessions that Israel is unwilling to make.

- The war’s expansion into Lebanon, Yemen, Syria, Iraq, and tensions with Iran heightens insurance costs for regional trade, further complicating implementation.

- Ironically, despite hindering progress, Israel sees the IMEC as crucial to deepening its economic integration with the Arab world, excluding Palestine.

- Prime Minister Netanyahu has termed framed of the project as a geopolitical blessing for participating states.

IMEC’s Future Hinges on Middle East Stability and Conflict Resolution

- While the IMEC’s western leg faces uncertainty, India’s strong strategic and economic ties with the UAE and Saudi Arabia keep prospects for its eastern leg alive.

- Initiatives like UPI integration enhance digital connectivity potential, but intra-Gulf economic rivalries, such as Saudi measures to counter Emirati dominance, hinder unified corridor planning.

- For the IMEC to match its 2023 vision, the regional stability that enabled its conception must be restored — a goal tied to resolving the Palestinian statehood issue.

- Growing global recognition of the need to end Israel’s Gaza war, reflected in actions like Germany halting certain arms shipments to Israel, underscores this reality.

- Until lasting peace is achieved, IMEC remains a “day-after” project, with current efforts limited to planning and trade facilitation.

Source: IE

India-Middle East-Europe Economic Corridor FAQs

Q1: What is the IMEC?

Ans: A trade and connectivity corridor linking India, the Gulf, and Europe through sea and rail routes.

Q2: When was IMEC announced?

Ans: During the G20 Summit in New Delhi in September 2023.

Q3: How much can IMEC reduce shipping time?

Ans: By about 40% compared to the Red Sea route.

Q4: What halted IMEC’s progress?

Ans: The outbreak of the Gaza war less than a month after its launch.

Q5: Which countries are key IMEC partners?

Ans: India, UAE, Saudi Arabia, Jordan, Israel, Greece, and Italy.