Rare Earths Latest News

- The ongoing China–US trade conflict has intensified over rare earth minerals, a critical component for high-tech industries.

- China recently tightened restrictions on rare earth exports, prompting US President Donald Trump to threaten 100% tariffs in retaliation.

Rare Earths: Abundant in Nature, Critical in Technology, and Dominated by China

- Rare earths refer to 17 metallic elements — from lanthanum (57) to lutetium (71), plus scandium (21) and yttrium (39) — known for their high density, conductivity, and thermal resistance.

- They are divided into light and heavy rare earths, based on atomic weight, and form an essential subset of critical minerals vital to modern industries.

Why They Matter

- These elements are indispensable, even in trace quantities, for a wide array of technologies — from smartphones, wind turbines, and electric vehicles to weapons systems, robotics, MRI scanners, and cancer treatment equipment.

- Their unique properties make them irreplaceable components in both civilian and defence applications, underpinning the global clean energy and digital revolutions.

- Rare earths typically occur in low concentrations, making extraction and refining expensive and environmentally complex.

- This high cost limits the number of countries that can profitably mine and process them.

China’s Global Dominance

- According to the International Energy Agency (IEA):

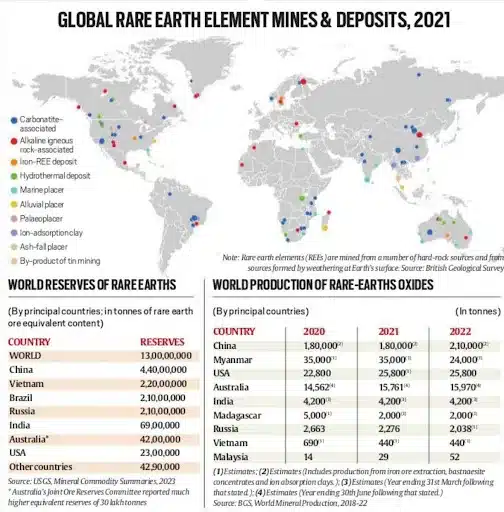

- Over 60% of rare earth mining occurs in China.

- More than 90% of global processing and refining capacity is also controlled by Beijing.

- This near-monopoly gives China strategic leverage in global supply chains, making rare earths a central weapon in trade and geopolitical rivalries, especially with the United States.

Global Reserves, Limited Production

- While Brazil, Australia, and India hold substantial rare earth reserves, their production remains minimal.

- The reasons include:

- Low economic viability due to high extraction costs, and

- Environmental concerns, as rare earth mining is highly polluting and requires complex waste management systems.

China’s Rare Earth Dominance: Weaponising Trade Through Rare Earths

- Beijing has pursued a deliberate industrial strategy to achieve near-total control over the mining and processing of these critical minerals, integrating them into its long-term economic and geopolitical planning.

- China’s export restrictions, particularly on heavy rare earths like terbium (65) and dysprosium (66) — essential for defence and high-tech manufacturing — are part of a policy to use rare earths as a strategic trade weapon.

- In response to US tariffs under President Donald Trump, Beijing has used its dominance in rare earths to gain leverage and escalation control in the ongoing US-China trade war.

- China’s decades-long investment in rare earth mining, refining, and technology has created a complete supply chain monopoly.

New Restrictions on Rare Earth Exports and Impact on India

- China has expanded its export control list to include five additional rare earth elements — holmium, erbium, thulium, europium, and ytterbium — along with related magnets and materials, bringing the total number of restricted elements to 12.

- The Ministry of Commerce also added refining technologies to the control list and announced that foreign producers using Chinese rare earths must now comply with its new export rules.

Limited Impact on India—for Now

- India’s exposure to rare earth supply disruptions is relatively limited, owing to low domestic consumption.

- According to the Ministry of Mines, India imported 2,270 tonnes of rare earth elements in 2023–24, up 23% from 2019–20, with 65% sourced from China and 10% from Hong Kong.

- The auto sector (particularly EVs) and the electronics industry have felt the sharpest impact from earlier Chinese restrictions in April.

India’s Domestic Initiatives and Future Plans

- India’s rare earth production remains modest, led by state-owned IREL Ltd, which operates a processing unit with a capacity of over 10,000 tonnes per annum, compared to China’s 200,000 tonnes in 2023.

- However, India is actively expanding its footprint:

- Seven seabed blocks in the Andaman Sea have been auctioned for exploration and mining of polymetallic nodules and crusts that may contain heavy rare earths.

- The Department of Atomic Energy has cleared plans for a Rare Earths Theme Park to establish pilot plants across the value chain.

- Two major projects — the Rare Earth Permanent Magnet Park in Visakhapatnam and the Rare Earth and Titanium Theme Park in Bhopal — are being developed with central funding to strengthen India’s presence in this strategic sector.

Global Shifts Beyond China

- Globally, efforts to diversify the rare earth supply chain are gaining traction:

- The US is preparing an executive order to stockpile deep-sea metals from the Pacific seabed, reducing reliance on China for battery minerals and rare earths.

- Japan, which faced Chinese curbs in the early 2010s, has since rebuilt its rare earth supply chains, offering a potential model for India and Western economies seeking independence from Beijing’s control.

Rare Earths FAQs

Q1: Why are rare earths central to the US-China trade conflict?

Ans: China dominates global rare earth production and refining, giving it leverage over the US, which relies on these minerals for defence and high-tech industries.

Q2: What new export restrictions has China imposed?

Ans: Beijing added five new rare earths and key refining technologies to its export control list, tightening global supply ahead of upcoming trade talks with Washington.

Q3: How does this impact India?

Ans: India’s impact is limited due to low consumption, but auto and electronics sectors face pressure. India imports 65% of rare earths from China.

Q4: What steps is India taking to reduce reliance on China?

Ans: India has auctioned seabed blocks in the Andaman Sea and is developing rare earth theme parks in Vizag and Bhopal to expand domestic refining.

Q5: How are other countries responding to China’s dominance?

Ans: The US plans to stockpile seabed metals, while Japan has rebuilt its rare earth supply chain to diversify away from Beijing’s near-monopoly.