International Monetary Fund (IMF) is a global financial institution established in 1945 to promote international economic cooperation and financial stability. Founded after the Bretton Woods Conference, it comprises 191 nations that work together to address balance of payments issues, foster macroeconomic stability, and facilitate international trade.

International Monetary Fund (IMF) provides loans to countries experiencing economic crises in exchange for economic reforms and policy changes. As an institution with a unique role in the world economy, the IMF plays a crucial part in fostering global prosperity and maintaining peace through economic means.

International Monetary Fund About

International Monetary Fund (IMF) is a global financial institution that promotes international monetary cooperation and financial stability. Currently, the IMF has 191 member countries, with the Principality of Liechtenstein having become the 191st member on October 21, 2024.

International Monetary Fund Headquarters

International Monetary Fund (IMF) is headquartered at 700 19th Street NW, Washington, D.C., United States, with a second main building at 1900 Pennsylvania Avenue NW, Washington, D.C.

Full Form of IMF

Full Form of IMF is the International Monetary Fund, an organisation established in July 1944. The IMF is a global organisation dedicated to promoting global economic stability and growth.

International Monetary Fund Established

International Monetary Fund (IMF) was established during the Bretton Woods Conference held in New Hampshire, USA, in July 1944. Formally constituted on December 27, 1945, it was founded by 29 nations that signed the Articles of Agreement, which serve as its foundational document. The IMF commenced its financial activities on March 1, 1947.

International Monetary Fund History

International Monetary Fund's history dates back to the Bretton Woods agreement in 1944. During the Great Depression (during Inter War Period 1918-1939), countries increased trade barriers to recover their struggling economies, which resulted in the devaluation of national currencies and a decrease in global trade.

- Great Depression (1930s) and World War II: The Great Depression caused global unemployment and trade contraction. World War II further devastated economies, destabilised currencies, and disrupted international trade.

- Bretton Woods Conference (1944): Representatives from 44 nations met to create a new monetary system to prevent the currency issues that contributed to the Great Depression and WWII, leading to the establishment of the IMF and World Bank (Bretton Woods twins).

- IMF Establishment: Formally established on December 27, 1945, the IMF began financial operations in 1947.

International Monetary Fund Objectives

The primary objectives of the International Monetary Fund (IMF) include promoting global monetary cooperation, fostering trade and economic growth, and discouraging policies that could hinder prosperity. To achieve these objectives, member countries work together and engage with other international organisations.

Functions of International Monetary Fund

The International Monetary Fund (IMF) functions to promote global monetary cooperation, ensure exchange rate stability, facilitate balanced growth of international trade, provide financial assistance to members, and offer policy advice to foster economic stability.

- Financial Assistance: International Monetary Fund (IMF) provides financial support to countries hit by financial crises. Unlike development banks, the IMF does not lend to individual projects.

- IMF provides various lending instruments tailored to countries' needs and circumstances. These include:

- Stand-By Arrangement (SBA)

- Standby Credit Facility (SCF)

- Extended Fund Facility (EFF)

- Rapid Credit Facility (RCF)

- Rapid Financing Instrument (RFI)

- Flexible Credit Line (FCL)

- Precautionary and Liquidity Line (PLL)

- Extended Credit Facility (ECF)

- Policy Advice: The International Monetary Fund (IMF) provides policy advice by monitoring the economic and financial policies of member countries, identifying risks, and recommending adjustments to sustain growth and promote stability through surveillance activities.

- Capacity Development: The IMF provides technical assistance and training, known as capacity development, to member countries to strengthen their economic institutions, improve tax collection, modernise monetary and exchange rate policies, develop legal systems, and strengthen governance.

International Monetary Fund Governance Structure

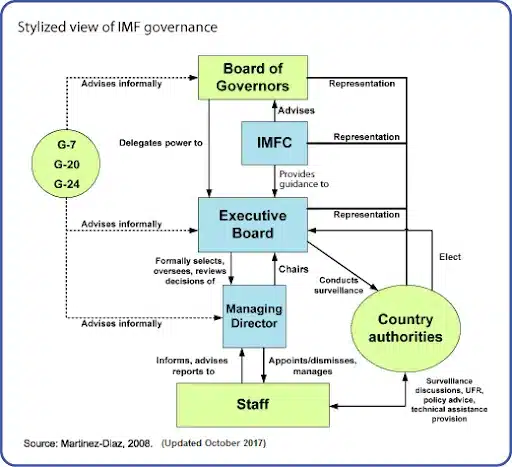

The International Monetary Fund (IMF) operates under a governance structure comprising the Board of Governors, the Executive Board, and the Managing Director. The Board of Governors, representing each of the 191 member countries, serves as the highest decision-making body, while the Executive Board conducts the institution's day-to-day operations under the leadership of the Managing Director.

- Board of Governors: The highest decision-making body of the IMF, meeting annually to approve quota increases and SDR allocations, admit new members, and compel member withdrawals. Each member country has one governor and one alternate governor.

- The Finance Minister of India is an ex-officio Governor, with the RBI Governor as the Alternate Governor.

- International Monetary and Financial Committee (IMFC): IMFC advises the Board of Governors on matters related to the management of the international monetary and financial system. It has 24 members drawn from the governors.

- Executive Board: They are responsible for conducting the day-to-day business and work closely with the Managing Director.

Managing Director International Monetary Fund

The Managing Director is the head of the IMF staff and Chairman of the Executive Board. The MD is appointed by the Executive Board for a 5-year term. Kristalina Georgieva, a Bulgarian economist, has served as the Managing Director of the IMF since October 1, 2019, and was reappointed for a second term in April 2024.

International Monetary Fund President

The International Monetary Fund President is officially known as the Managing Director. As of 2025, Kristalina Georgieva serves in this role, overseeing the organisation’s operations, guiding its policy decisions, and representing it globally.

International Monetary Fund Quota System

International Monetary Fund quota system refers to the financial contribution that each member country makes to the International Monetary Fund (IMF). It determines a country’s financial commitment, voting power, and access to IMF resources. The quota is based on the size of a country's economy relative to the global economy and reflects its financial capacity to contribute to the IMF.

- In addition to quotas, the IMF has established borrowing arrangements to supplement its resources. These include the New Arrangements to Borrow (NAB), a multilateral borrowing agreement among 38 countries and institutions, which serves as a backstop to quotas.

- Furthermore, the IMF manages Special Drawing Rights (SDRs), an international reserve asset allocated to member countries. While SDRs are not a direct source of financing, they can be exchanged among members to bolster liquidity during financial crises.

How IMF Quota is Determined?

The International Monetary Fund (IMF) determines each member country's quota based on a formula that reflects its relative position in the global economy. This formula considers four key variables:

- Gross Domestic Product (GDP): Weighted at 50%, with 60% based on market exchange rates and 40% on purchasing power parity (PPP).

- Openness to Trade: Weighted at 30%, measured by the sum of current payments and receipts over five years.

- Economic Variability: Weighted at 15%, assessed by the standard deviation of current receipts and net capital flows over five years.

- International Reserves: Weighted at 5%, based on the country's holdings of international reserves.

IMF Special Drawing Rights (SDRs)

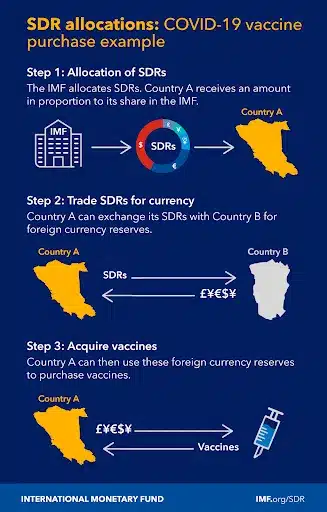

IMF Special Drawing Rights (SDRs) are an international reserve asset created by the International Monetary Fund (IMF) to supplement the foreign exchange reserves of its member countries.

- Introduced in 1969, SDRs are not a currency but a potential claim on the freely usable currencies of IMF members.

- The value of SDRs is determined by a basket of major global currencies, including the US Dollar, Euro, Chinese Yuan, Japanese Yen, and British Pound.

- SDRs can be exchanged among member countries, providing liquidity during economic crises.

- The IMF allocates SDRs to members based on their quotas, allowing them to bolster reserves without incurring debt.

- The most recent major allocation of SDRs was in 2021, aimed at supporting global economic recovery amid the COVID-19 pandemic.

Reports Published by IMF

The International Monetary Fund (IMF) publishes a variety of reports to provide insights into global economic trends and policy analyses. These reports serve as essential resources for policymakers, economists, and researchers worldwide.

- World Economic Outlook Report: It is published twice a year. It analyses global economic developments.

- Global Financial Stability Report: It assesses the global financial system and markets.

- Fiscal Monitor Report: It is prepared twice a year by the IMF’s Fiscal Affairs Department. It provides an overview of the latest public finance developments.

- External Sector Report: It evaluates global external developments.

India and IMF

India is a founding member of the IMF. India has closely engaged with the institution over the decades, benefiting from its financial assistance during the balance of payments crises in the 1980s and early 1990s.

- Since 1993, India has not taken any financial assistance from the IMF.

- By the mid-2000s, India had become a net creditor to the IMF, allowing it to exert greater influence in IMF decision-making processes.

- As of February 2014, India holds a quota of 13,114.4 million SDRs (equivalent to around USD 18.2 billion), which is 2.75% of the total.

- India's voting share amounts to 2.63%, placing it among the top 10 nations in terms of voting rights.

IMF and Wolrd Bank

The International Monetary Fund (IMF) and the World Bank are two key global financial institutions established to promote economic stability and development, with the IMF focusing on monetary cooperation and the World Bank on poverty reduction.

- The IMF focuses on ensuring international monetary stability, offering short-term financial assistance, and providing policy advice to countries facing economic challenges.

- In contrast, the World Bank's primary mission is long-term development, offering loans and grants to support infrastructure projects, poverty and developmental issues in developing countries.

- While the IMF addresses macroeconomic issues, the World Bank works on reducing poverty and fostering sustainable development. Both organizations collaborate to promote global economic stability and growth.

International Monetary Fund Significance

The International Monetary Fund (IMF) plays a crucial role in maintaining global economic stability by providing financial assistance to countries in crisis, offering policy advice, and fostering international cooperation to promote sustainable economic growth.

- Crisis Lender of Last Resort: It provides emergency financing to countries facing balance of payments crises, allowing them to rebuild reserves and stabilise currencies.

- Promote Stability and Sustainable Growth: The IMF monitors national economies and provides advice on policy adjustments.

- Capacity Development: It provides policy advice and capacity-building assistance for sound economic management.

- Research & Standards Setting: It sets global standards and best practices in financial sector oversight, fiscal transparency, etc.

- Concessional Lending: The IMF provides concessional finance and debt relief for low-income developing countries to support poverty reduction and growth strategies.

International Monetary Fund Criticisms

The International Monetary Fund (IMF) faces criticism for imposing stringent conditions on loans, which some argue exacerbate economic hardships. Critics also highlight its perceived dominance by developed nations, undermining the interests of poorer countries.

- Conditionality of Loans: IMF loans often come with conditions requiring recipient countries to adopt economic policies like austerity, privatisation, and financial liberalisation. Many critics argue that these exacerbate economic crises.

- One-Size-Fits-All Approach: Critics argue that IMF policy prescriptions are often rigid and fail to account for individual country contexts and development needs.

- Lack of Transparency and Accountability: The IMF is seen as lacking transparency in its operations. Critics argue it is not accountable enough to borrower countries or stakeholders impacted by its policies.

- Alignment with Wealthy Countries: Critics allege that IMF policies typically align with the economic ideologies and commercial interests of its largest shareholders, like the US and Western European nations.

- Impacts on Poor and Marginalised: Civil society groups argue that IMF-prescribed budget cuts and austerity in recipient countries hurt access to food, healthcare, and essential services for the poor.

IMF Loan to Pakistan

The International Monetary Fund (IMF) has recently approved a $1 billion loan disbursement to Pakistan as part of its $7 billion Extended Fund Facility program, bringing total disbursements to $2 billion so far.

- The International Monetary Fund's (IMF) approval of financial assistance to Pakistan came just days after the devastating Pahalgam terror attack in Kashmir, which claimed the lives of 26 Hindu tourists.

- The incident triggered the most intense conflict in decades in India-Pakistan relations, marked by Indian airstrikes as part of Operation Sindoor, on suspected militant hideouts in Pakistan, followed by retaliatory drone attacks from Islamabad.

- Amid this escalating hostility, India formally protested the IMF’s decision, expressing concerns that the funds could be diverted to support cross-border terrorism or military operations against India.

- Despite India's objections and abstention from the IMF board vote, the loan was granted, providing much-needed economic relief to Pakistan.

- Additionally, the IMF approved a separate $1.4 billion climate resilience loan for Pakistan, raising concerns about potential misuse given the country’s track record.

International Monetary Fund Way Forward

The way forward for the International Monetary Fund (IMF) involves enhancing global economic stability by addressing emerging challenges like climate change, digital currencies, and inequality, while continuing to support member nations through financial assistance and policy guidance.

- Greater Loan Conditionality Flexibility: Introduce policies to assess country-specific contexts and development needs before imposing rigid austerity/financial liberalisation conditions.

- Enhancing Transparency: Streamline disclosure, stakeholder engagement, and public consultations to allow greater input in program design and more independent evaluations.

- Democratising Governance and Leadership: Reform quota formulas, representation, and diversity in leadership beyond Western advanced economies to make the IMF more inclusive and accountable to its member base.

- Reorienting Capacity Building Priorities: Shift the capacity building focus appropriately towards domestic revenue mobilisation and sustainable financing for developmental spending instead of harsh cuts in social sectors.

International Monetary Fund UPSC PYQs

Question 1: "Rapid Financing Instrument" and "Rapid Credit Facility" are related to the provisions of lending by which one of the following? (UPSC Prelims 2022)

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

Answer: (b)

Question 2: “Gold Tranche” (Reserve Tranche) refers to (UPSC Prelims 2020)

(a) a loan system of the World Bank

(b) one of the operations of a Central Bank

(c) a credit system granted by WTO to its members

(d) a credit system granted by the IMF to its members

Answer: (d)

Question 3: ‘Global Financial Stability Report’ is prepared by the (UPSC Prelims 2016)

(a) European Central Bank

(b) International Monetary Fund

(c) International Bank for Reconstruction and Development

(d) Organization for Economic Cooperation and Development

Answer: (b)

Last updated on January, 2026

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Notification 2026 Postponed for CSE & IFS which was scheduled to be released on 14 January 2026.

→ UPSC Calendar 2026 has been released.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India

International Monetary Fund FAQs

Q1. What is the international monetary fund?+

Q2. What is IMF and its functions?+

Q3. What is the role of the IMF in India?+

Q4. What does the IMF give money for?+

Q5. Is India a member of the IMF?+

Tags: International Monetary Fund quest UPSC International Relations and Institutions Notes