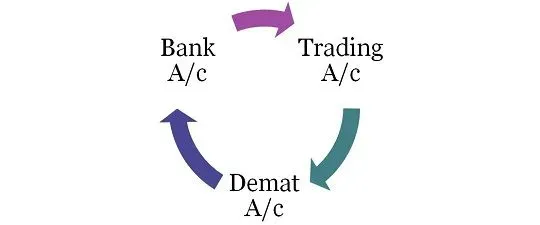

About Bank Account Vs Demat Account

- Bank account

- Purpose: It is a bank account used for storing and managing money. It facilitates various financial transactions such as deposits, withdrawals, transfers, bill payments, and online transactions.

- Types of Assets Held: It holds funds in the form of cash, which can be deposited, withdrawn, or transferred as required. Some bank accounts may also hold fixed deposits, savings certificates, or other financial products offered by the bank.

- Regulatory Authority: Bank accounts are regulated by banking regulators such as the Reserve Bank of India (RBI) in India.

- Transactions: It involves deposits, withdrawals, transfers, and payments. Customers can use various channels such as ATMs, online banking, mobile banking, and cheques to conduct banking transactions.

- Interest and Returns: Bank accounts may earn interest on the funds deposited, depending on the type of account and prevailing interest rates. Some bank accounts also offer rewards or cashback on transactions.

- Demat account: It serves as a secure digital vault for holding various securities. It stores securities in electronic format, a process known as dematerialisation, effectively converting physical shares into digital assets.

- Purpose: A demat account is primarily used for holding and trading securities such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) in electronic form. It allows investor to buy, sell, and transfer securities seamlessly.

- Types of Assets Held: Securities held in a demat account are in electronic or digital form. These include stocks, bonds, debentures, mutual fund units, government securities, and other financial instruments.

- Regulatory Authority: These are regulated by securities market regulators such as the Securities and Exchange Board of India (SEBI) in India. Depositories like the National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) oversee the functioning of demat accounts.

- Transactions: It involves buying, selling, and transferring securities. Investors can trade securities on stock exchanges through their demat accounts.

- Interest and Returns: Demat accounts do not generate interest or returns on the securities held in the account. Returns are generated based on the performance of the securities held.

Q1: What is a security in a financial context?

It is a certificate or other financial instrument that has monetary value and can be traded. Securities are generally classified as either equity securities, such as stocks and debt securities, such as bonds and debentures.

Source: How is a demat account different from a bank account? Here are the key distinctions

Last updated on March, 2026

→ UPSC Final Result 2025 is now out.

→ UPSC has released UPSC Toppers List 2025 with the Civil Services final result on its official website.

→ Anuj Agnihotri secured AIR 1 in the UPSC Civil Services Examination 2025.

→ UPSC Marksheet 2025 Will be out soon.

→ UPSC Notification 2026 & UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ Check out the latest UPSC Syllabus 2026 here.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Shakti Dubey secures AIR 1 in UPSC CSE Exam 2024.

→ Also check Best UPSC Coaching in India