Foreign Institutional Investors (FIIs) Latest News

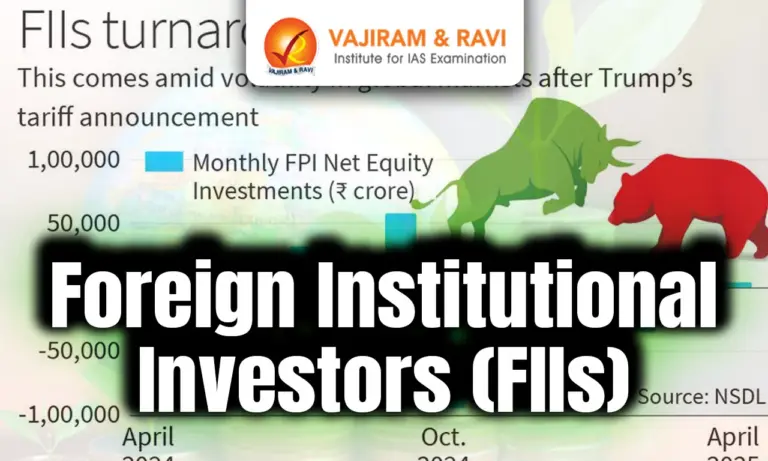

Foreign Institutional Investors (FIIs) became net buyers of Indian equities for the first time in four months in April 2025, registering an inflow of ₹4,223 crore.

About Foreign Institutional Investors (FIIs)

- FIIs are a subset of Foreign Portfolio Investors (FPIs), comprising large institutional investors like mutual funds, pension funds, insurance companies, and hedge funds.

- FIIs typically adopt a strategic and structured investment approach in foreign financial markets, offering long-term capital inflows to emerging economies like India.

- However, rapid FII outflows can destabilise domestic markets, making regulatory oversight crucial.

Regulatory Framework Governing FIIs in India

- FIIs are regulated by:

- The Foreign Exchange Management Act (FEMA), 1999

- SEBI (Foreign Portfolio Investors) Regulations

- The Reserve Bank of India (RBI) monitors sectoral investment ceilings daily.

Investment Ceilings and Eligibility

- FIIs can invest up to 10% in any single Indian company, subject to a cumulative FII/NRI/PIO limit of 24%.

- Eligible FII entities now include university funds, charitable endowments, and trusts with a minimum five-year operational track record.

- FIIs are permitted to invest in unlisted securities and use their proprietary funds.

Macroeconomic Drivers

- A major reason cited for the increased FII participation is the softening of the U.S. Dollar Index, which has declined from 104–105 to nearly 99–100, improving the relative strength of the Indian rupee.

- The Reserve Bank of India’s accommodative stance and macro-stability have encouraged investments, particularly in banking, financial services, and insurance (BFSI) sectors.

- Meanwhile, FIIs reduced their exposure to the IT sector due to concerns about a potential U.S. recession and its impact on tech earnings.

Source: TH

Last updated on February, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ UPSC Final Result 2025 is expected to be released in the first week of March 2026.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Check UPSC Marksheet 2024 Here.

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India

Foreign Institutional Investors (FIIs) FAQs

Q1. What is a Foreign Institutional Investor (FII)?+

Q2. How are FIIs different from Foreign Direct Investment (FDI)?+

Q3. Which regulatory body governs FIIs in India?+

Tags: foreign institutional investors prelims pointers upsc prelims current affairs