Why in the news?

- It is the first time this innovative instrument (Insurance Surety Bond) is being utilized as a Bank Guarantee (BG) in the road infrastructure sector for monetization of bids.

- NHAI has been working closely with Highway Operators Association of India (HOAI), SBI General Insurance and AON India Insurance to implement this initiative.

About Insurance Surety Bond

- These bonds can be defined in their simplest form as a written agreement to guarantee compliance, payment, or performance of an act.

- These are instruments where insurance companies act as ‘Surety’ and provide the financial guarantee that the contractor will fulfil its obligation as per the agreed terms.

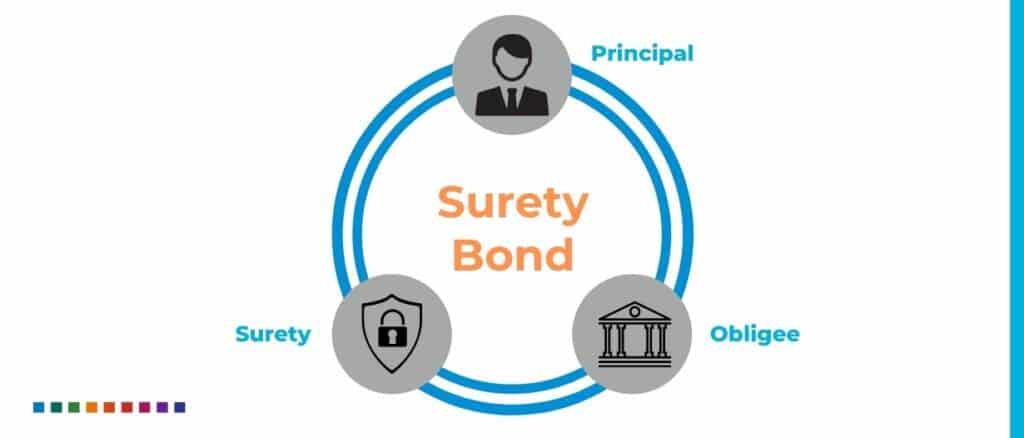

- Surety is a unique type of insurance because it involves a three-party agreement.

- The three parties in a surety agreement are:

- Principal: The party that purchases the bond and undertakes an obligation to perform an act as promised.

- Surety: The insurance company or surety company that guarantees the obligation will be performed. If the principal fails to perform the act as promised, the surety is contractually liable for losses sustained.

- Obligee: The party who requires and often receives the benefit of the surety bond. For most surety bonds, the obligee is a local, state or federal government organisation.

- Significance

- It will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal.

- The product gives the principal a contract of guarantee that contractual terms and other business deals will be concluded in accordance with the mutually agreed terms.

- In case the contractor doesn’t fulfil the contractual terms, the Principal can raise a claim on the surety bond and recover the losses they have incurred.

- Unlike a bank guarantee, the Surety Bond Insurance does not require large collateral from the contractor, thus freeing up significant funds for the contractor, which they can utilise for the growth of the business.

- The product will also help in reducing the contractors’ debts to a large extent, thus addressing their financial worries.

Q1) What are Green bonds?

These are a specific type of bond that is issued to raise capital for projects with environmental benefits. The proceeds from green bonds are earmarked for projects and activities that promote environmental sustainability and climate change mitigation. These projects can include renewable energy initiatives, energy efficiency projects, clean transportation, sustainable water management, and other environmentally friendly activities.

Last updated on February, 2026

→ UPSC Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC IFoS Notification 2026 is now out on the official website at upsconline.nic.in.

→ UPSC Calendar 2026 has been released.

→ UPSC Final Result 2025 is expected to be released in the second week of April 2026.

→ Check out the latest UPSC Syllabus 2026 here.

→ Join Vajiram & Ravi’s Interview Guidance Programme for expert help to crack your final UPSC stage.

→ UPSC Mains Result 2025 is now out.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ Prepare effectively with Vajiram & Ravi’s UPSC Prelims Test Series 2026 featuring full-length mock tests, detailed solutions, and performance analysis.

→ Enroll in Vajiram & Ravi’s UPSC Mains Test Series 2026 for structured answer writing practice, expert evaluation, and exam-oriented feedback.

→ Join Vajiram & Ravi’s Best UPSC Mentorship Program for personalized guidance, strategy planning, and one-to-one support from experienced mentors.

→ Check UPSC Marksheet 2024 Here.

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best UPSC Coaching in India