What’s in today’s article?

- Why in news?

- What is Monetary Policy Committee (MPC)?

- News Summary: RBI monetary policy update

- What are the Key rates after the recent announcements made by MPC?

- Other highlights of the MPC announcements

- Why is the RBI in pause mode on raising interest rates?

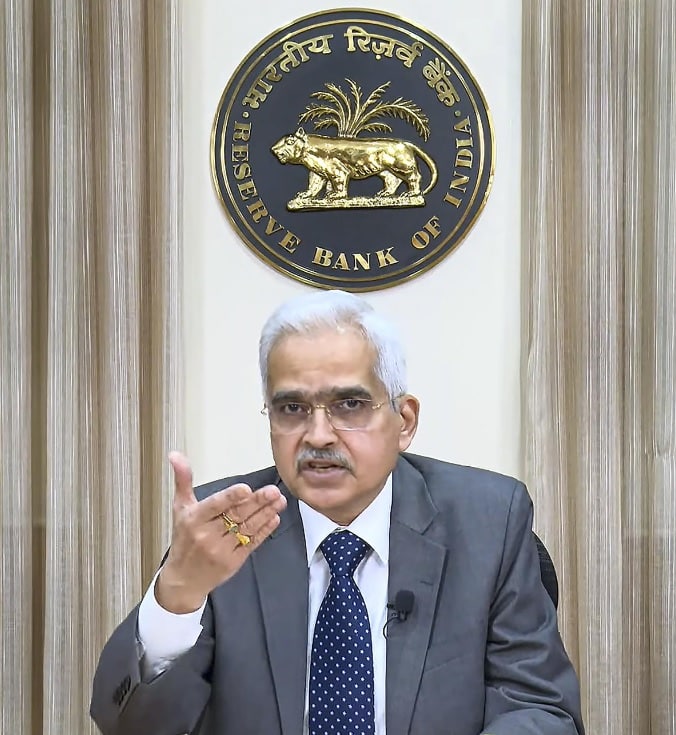

Why in news?

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged.

- This is for the second time since the RBI started hiking Repo rate in May 2022 to check inflation.

What is Monetary Policy Committee (MPC)?

- The Committee

- Under Section 45ZB of the amended RBI Act, 1934, the central government is empowered to constitute a six-member Monetary Policy Committee (MPC).

- MPC will determine the policy interest rate required to achieve the inflation target. The first such MPC was constituted in September 2016.

- Members of MPC

- As per the amended RBI act, the MPC shall consist of

- the RBI Governor as its ex officio chairperson,

- the Deputy Governor in charge of monetary policy,

- an officer of the Bank to be nominated by the Central Board, and

- three persons to be appointed by the central government.

- Functions of MPC

- Setting Policy Interest Rates: The primary function of the MPC is to determine the policy interest rates, specifically the repo rate.

- Inflation Targeting: The current inflation target set by the government is a Consumer Price Index (CPI) inflation target of 4% with a tolerance band of +/- 2%.

- Economic Analysis and Forecasting: The MPC conducts thorough analysis and forecasting of various economic indicators, including inflation, GDP growth, employment, fiscal conditions, and global economic developments.

- Decision-Making: The MPC meets at least four times a year to review the monetary policy stance.

News Summary: RBI monetary policy update

What are the Key rates after the recent announcements made by MPC?

- Repo Rate – The repo rate now stands at 6.50 per cent.

- Repo rate is the rate at which the Reserve Bank of India lends money to commercial banks in the event of any shortfall of funds.

- The standing deposit facility (SDF) – This rate stands at 6.25%.

- The SDF is a liquidity window through which the RBI will give banks an option to park excess liquidity with it.

- It is different from the reverse repo facility in that it does not require banks to provide collateral while parking funds.

- The idea of an SDF was first mooted in the Urjit Patel Monetary Policy Committee report in 2014.

- It later received the government’s nod following an amendment to the RBI Act in 2018, vide the Finance Bill.

- The marginal standing facility (MSF) rate – It stands at 6.75%.

- MSF is a window for banks to borrow from the central bank in an emergency situation when inter-bank liquidity dries up completely.

- The Bank Rate – It is now 6.75%.

- Bank rate is the rate charged by the central bank for lending funds to commercial banks.

- There is a slight difference between Bank Rate and Repo Rate. In Repo Rate, RBI lends money to the banks against securities for the short term only.

Other highlights of the MPC announcements

- Retained the policy stance as withdrawal of accommodation

- The MPC decided to remain focused on withdrawal of accommodation.

- An accommodative stance means the central bank is prepared to expand the money supply to boost economic growth.

- Withdrawal of accommodation means reducing the money supply in the system which will rein in inflation further.

- This is to ensure that inflation progressively aligns with the target, while supporting growth.

- The MPC decided to remain focused on withdrawal of accommodation.

- Inflation outlook

- The headline inflation trajectory was likely to be shaped by food price dynamics.

- Milk prices, on the other hand, are likely to remain under pressure due to supply shortfalls and high fodder costs.

- Crude oil prices have eased but the outlook remains uncertain.

- Taking into account these factors and assuming a normal monsoon, CPI inflation has been projected at 5.1% for 2023-24.

- Growth forecast

- Higher rabi crop production in 2022-23, the expected normal monsoon, and the sustained buoyancy in services should support private consumption and overall economic activity in the current year.

- The government’s thrust on capital expenditure, moderation in commodity prices and robust credit growth are expected to nurture investment activity.

- Weak external demand, geoeconomic fragmentation, and protracted geopolitical tensions, however, pose risks to the outlook.

- Taking all these factors into consideration, real GDP growth for 2023-24 has been projected at 6.5%.

Why is the RBI in pause mode on raising interest rates?

- Retail inflation within comfort zone of RBI

- Retail inflation declined to an 18-month low of 4.7 per cent in April, remaining under the RBI’s comfort zone of 2-6 per cent for two consecutive months.

- Expansion of GDP

- India’s gross domestic product (GDP) expanded at 6.1 per cent January-March 2023 quarter, in turn pushing up the growth estimate for the full year (2022-23) to 7.2 per cent.

Q1) What is the marginal standing facility (MSF)?

The Marginal Standing Facility (MSF) is a monetary policy tool used by central banks, particularly in countries that follow a corridor system of interest rates. It is a facility that allows banks to borrow funds from the central bank on an overnight basis against eligible securities at a rate slightly higher than the prevailing policy rate. The MSF serves as a secondary window for banks to borrow money from the central bank when they are unable to obtain funds from other sources or facing a liquidity shortage. The interest rate charged on MSF loans is usually higher than the repo rate or the main policy rate set by the central bank.

Q2) What is inflation?

Inflation refers to the general increase in prices of goods and services in an economy over a period of time, leading to a decrease in the purchasing power of money. In other words, it means that the value of money declines, and as a result, individuals need more money to buy the same quantity of goods and services. Inflation is typically measured using an inflation rate, which indicates the percentage change in the average price level of a basket of goods and services over a specific period, often on an annual basis. It is usually calculated using various price indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Source: RBI monetary policy update: keeps repo rate unchanged, retains FY24 GDP growth forecast at 6.5% | RBI | Indian Express

Last updated on June, 2025

→ UPSC Notification 2025 was released on 22nd January 2025.

→ UPSC Prelims Result 2025 is out now for the CSE held on 25 May 2025.

→ UPSC Prelims Question Paper 2025 and Unofficial Prelims Answer Key 2025 are available now.

→ UPSC Calendar 2026 is released on 15th May, 2025.

→ The UPSC Vacancy 2025 were released 1129, out of which 979 were for UPSC CSE and remaining 150 are for UPSC IFoS.

→ UPSC Mains 2025 will be conducted on 22nd August 2025.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best IAS Coaching in Delhi