About Equity funds

- An equity fund is a mutual fund that invests principally in stocks.

- It can be actively or passively (index fund) managed. Equity funds are also known as stock funds.

- Stock mutual funds are principally categorized according to company size, the investment style of the holdings in the portfolio and geography.

What are Active equity funds?

- In this fund the fund manager is ‘Active’ in deciding whether to buy, hold, or sell the underlying securities and in stock selection.

- This fund relies on professional fund managers who manage investments.

- Active funds adopt different strategies and styles to create and manage the portfolio.

- They are expected to generate better returns (alpha) than the benchmark index.

- The risk and return in the fund will depend upon the strategy adopted.

What are Passive equity funds?

- These funds hold a portfolio that replicates a stated index or benchmark.

- In a passive fund, the fund manager has a passive role in the stock selection.

- Buy, hold or sell decisions are driven by the benchmark index and the fund manager/dealer merely needs to replicate the same with minimal tracking error.

Q1) What are Mutual funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They’re managed by professional fund managers or management teams who make investment decisions based on the fund’s objectives.

Last updated on July, 2025

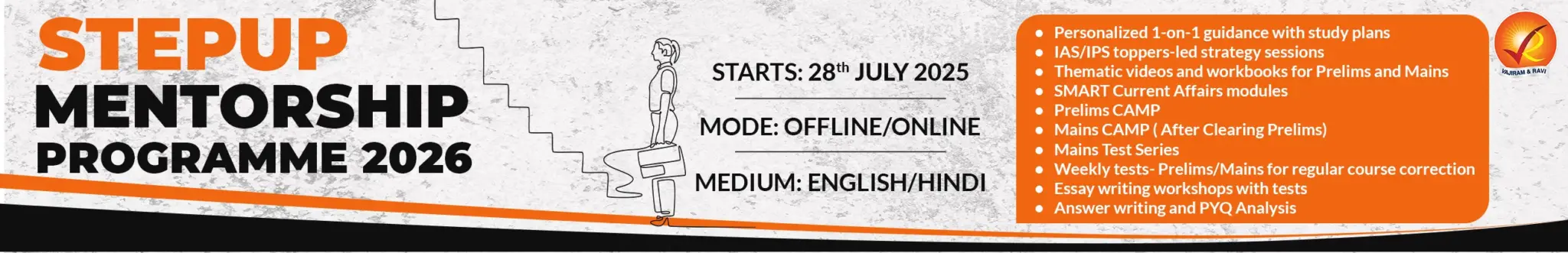

→ UPSC Notification 2025 was released on 22nd January 2025.

→ UPSC Prelims Result 2025 is out now for the CSE held on 25 May 2025.

→ UPSC Prelims Question Paper 2025 and Unofficial Prelims Answer Key 2025 are available now.

→ UPSC Calendar 2026 is released on 15th May, 2025.

→ The UPSC Vacancy 2025 were released 1129, out of which 979 were for UPSC CSE and remaining 150 are for UPSC IFoS.

→ UPSC Mains 2025 will be conducted on 22nd August 2025.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best IAS Coaching in Delhi