Why in the news?

- It is the first time this innovative instrument (Insurance Surety Bond) is being utilized as a Bank Guarantee (BG) in the road infrastructure sector for monetization of bids.

- NHAI has been working closely with Highway Operators Association of India (HOAI), SBI General Insurance and AON India Insurance to implement this initiative.

About Insurance Surety Bond

- These bonds can be defined in their simplest form as a written agreement to guarantee compliance, payment, or performance of an act.

- These are instruments where insurance companies act as ‘Surety’ and provide the financial guarantee that the contractor will fulfil its obligation as per the agreed terms.

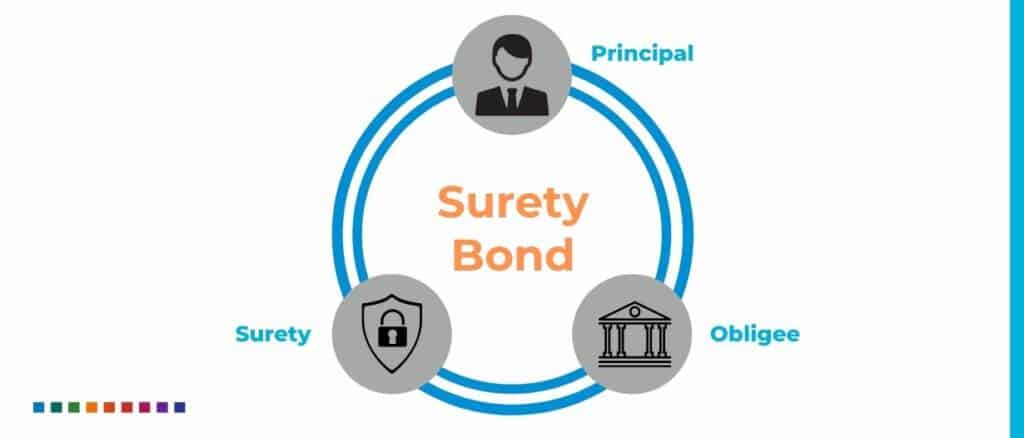

- Surety is a unique type of insurance because it involves a three-party agreement.

- The three parties in a surety agreement are:

- Principal: The party that purchases the bond and undertakes an obligation to perform an act as promised.

- Surety: The insurance company or surety company that guarantees the obligation will be performed. If the principal fails to perform the act as promised, the surety is contractually liable for losses sustained.

- Obligee: The party who requires and often receives the benefit of the surety bond. For most surety bonds, the obligee is a local, state or federal government organisation.

- Significance

- It will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal.

- The product gives the principal a contract of guarantee that contractual terms and other business deals will be concluded in accordance with the mutually agreed terms.

- In case the contractor doesn’t fulfil the contractual terms, the Principal can raise a claim on the surety bond and recover the losses they have incurred.

- Unlike a bank guarantee, the Surety Bond Insurance does not require large collateral from the contractor, thus freeing up significant funds for the contractor, which they can utilise for the growth of the business.

- The product will also help in reducing the contractors’ debts to a large extent, thus addressing their financial worries.

Q1) What are Green bonds?

These are a specific type of bond that is issued to raise capital for projects with environmental benefits. The proceeds from green bonds are earmarked for projects and activities that promote environmental sustainability and climate change mitigation. These projects can include renewable energy initiatives, energy efficiency projects, clean transportation, sustainable water management, and other environmentally friendly activities.

Last updated on June, 2025

→ UPSC Notification 2025 was released on 22nd January 2025.

→ UPSC Prelims Result 2025 is out now for the CSE held on 25 May 2025.

→ UPSC Prelims Question Paper 2025 and Unofficial Prelims Answer Key 2025 are available now.

→ UPSC Calendar 2026 is released on 15th May, 2025.

→ The UPSC Vacancy 2025 were released 1129, out of which 979 were for UPSC CSE and remaining 150 are for UPSC IFoS.

→ UPSC Mains 2025 will be conducted on 22nd August 2025.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best IAS Coaching in Delhi