What’s in today’s article?

- Why in News?

- What is PM-ABHIM?

- What is PHSPP and EHSDP?

- News Summary Regarding WB Lending

Why in News?

- The World Bank (WB) is lending up to $1 billion (divided into two complementary loans of $500 million under PHSPP and EHSDP each) to help India with preparedness for future pandemics as well as to strengthen its health infrastructure.

- Through this combined financing, the bank will support India’s flagship Pradhan Mantri-Ayushman Bharat Health Infrastructure Mission (PM-ABHIM).

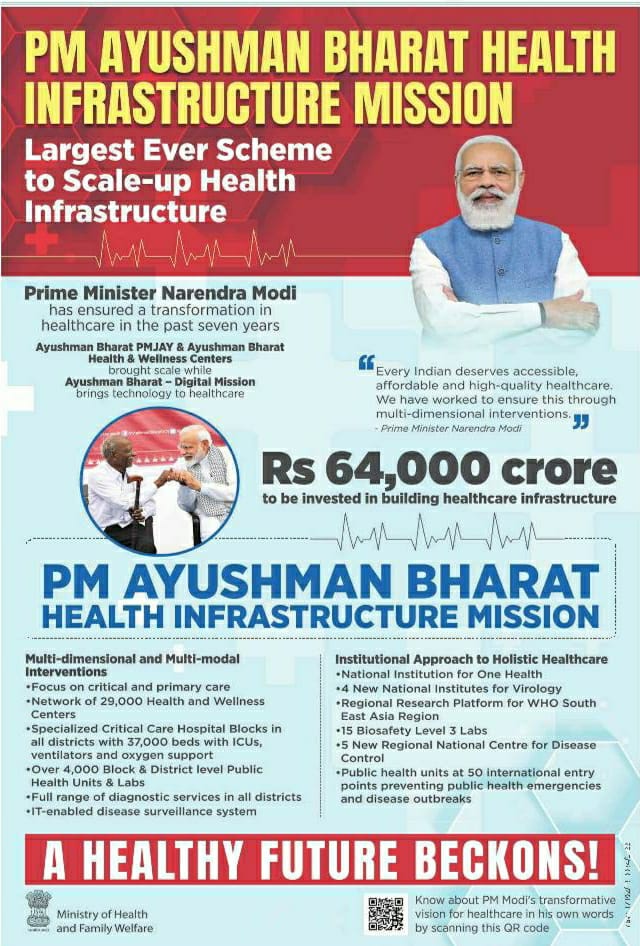

What is PM-ABHIM?

- The PM Atmanirbhar Swasth Bharat Yojana (PMASBY), which has now been renamed as PM-ABHIM, was announced in the Union Budget 2021-22 with an outlay of ₹64,180 crore.

- The PM-ABHIM scheme was launched in October 2021 by the Union Ministry of Health and Family Welfare, and will run in addition to the National Health Mission (NHM).

- It is one of the largest Pan-India health schemes for strengthening healthcare infrastructure to accomplish the vision of comprehensive healthcare across the country.

- Objectives:

- To strengthen grass root public health institutions.

- To expand and build an IT enabled disease surveillance system.

- To expand research on COVID-19 and other infectious diseases and to develop the core capacity to deliver the One Health Approach.

- Components: It consists of Centrally Sponsored Scheme Components [like Ayushman Bharat – Health & Wellness Centres (AB-HWCs) in rural and urban areas] and some Central Sector Components (like Critical Care Hospital Blocks).

What is PHSPP and EHSDP?

- The $500-million Public Health Systems for Pandemic Preparedness Program (PHSPP) will support the government’s efforts to prepare India’s surveillance system to detect and report epidemics of potential international concern.

- Another $500 million Enhanced Health Service Delivery Program (EHSDP) will support government’s efforts to strengthen service delivery through a redesigned primary healthcare model, which includes –

- Improved household access to primary healthcare facilities,

- Stronger links between each household and its primary care facility through regular household visits and

- Risk assessment of noncommunicable diseases.

- Both the PHSPP and the EHSDP utilise the Program-for-Results financing instrument that focuses on achievement of results rather than inputs.

- Both the PHSPP and EHSDP loans from the International Bank for Reconstruction and Development (IBRD) of WB have a final maturity of 18.5 years including a grace period of five years.

- The PHSPP and EHSDP will leverage the unique strengths of both the Center and the States to support the development of more accessible, high-quality, and affordable health services.

- This strengthening of health systems, combined with attention to strong disease response, will improve preparedness and response to future disease outbreaks.

News Summary Regarding WB Lending

- India’s performance in health has improved over time.

- According to WB, India’s life expectancy has increased from 58 in 1990 to 69.8 in 2020.

- The under-five mortality rate (36 per 1,000 live births), infant mortality rate (30 per 1,000 live births), and maternal mortality ratio (103 per 100,000 live births) are all close to the average for India’s income level.

- This reflects significant achievements in access to skilled birth attendance, immunisations, and other priority services.

- Despite these advances in the health of the Indian population, COVID-19 brought to the fore the urgent need for pandemic preparedness (a global public good) and health system strengthening around the world.

- The current WB loans loans will prioritise health service delivery in seven States including Andhra Pradesh, Kerala, Meghalaya, Odisha, Punjab, TN and UP.

Q1) What are the components of PM-ABHIM?

The Pradhan Mantri-Ayushman Bharat Health Infrastructure Mission (PM-ABHIM) was launched in 2021 for strengthening healthcare infrastructure. It consists of Centrally Sponsored Scheme Components [like AB-HWCs in rural and urban areas] and some Central Sector Components (like Critical Care Hospital Blocks).

Q2) How will PHSPP and EHSDP loans help India?

Both the loans from the IBRD of WB have a final maturity of 18.5 years including a grace period of five years. These will leverage the unique strengths of both the Center and the States to support the development of more accessible, high-quality, and affordable health services.

Source: World Bank to lend $1 billion to support India’s health sector | NHP.gov.in | Worldbank.org

Last updated on June, 2025

→ UPSC Notification 2025 was released on 22nd January 2025.

→ UPSC Prelims Result 2025 is out now for the CSE held on 25 May 2025.

→ UPSC Prelims Question Paper 2025 and Unofficial Prelims Answer Key 2025 are available now.

→ UPSC Calendar 2026 is released on 15th May, 2025.

→ The UPSC Vacancy 2025 were released 1129, out of which 979 were for UPSC CSE and remaining 150 are for UPSC IFoS.

→ UPSC Mains 2025 will be conducted on 22nd August 2025.

→ UPSC Prelims 2026 will be conducted on 24th May, 2026 & UPSC Mains 2026 will be conducted on 21st August 2026.

→ The UPSC Selection Process is of 3 stages-Prelims, Mains and Interview.

→ UPSC Result 2024 is released with latest UPSC Marksheet 2024. Check Now!

→ UPSC Toppers List 2024 is released now. Shakti Dubey is UPSC AIR 1 2024 Topper.

→ Also check Best IAS Coaching in Delhi