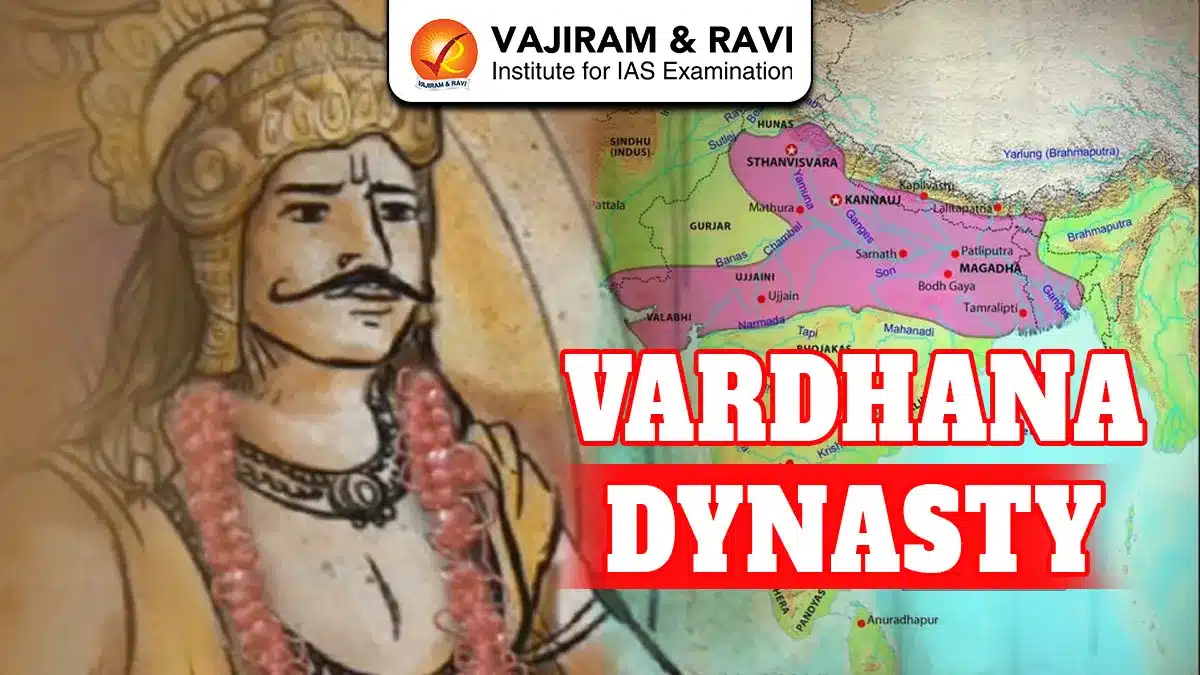

The Vardhana Dynasty emerged in North India after the decline of the Gupta Empire in the 6th century CE, a period marked by political fragmentation and the rise of regional powers. Former Gupta subordinates such as the Maukharis, Later Guptas, Gaudas, Maitrakas and Pushyabhutis asserted independence. Continuous warfare, weak central authority and the growing power of samantas defined this era. Amid this instability, the Pushyabhuti family of Thanesar gradually rose, laying the foundation for the Harshavardhana Dynasty that later unified much of northern India under a strong ruler.

Vardhana Dynasty

The Vardhana Dynasty is also known as the Pushyabhuti Dynasty and sometimes as Harshavardhana Dynasty. It ruled northern India from the period around 500 to 647 CE, with its capital initially at Thanesar and later at Kannauj. The dynasty reached its greatest extent under Emperor Harshavardhana, whose empire stretched from Punjab to Bengal and from the Himalayas to the Narmada River. The dynasty is known for its political consolidation, religious tolerance and cultural patronage which played a crucial role in shaping early medieval Indian history.

Vardhana Dynasty Timeline

The historical period of the Vardhana Dynasty during the 6th - 7th centuries CE with origin, expansion and decline of empire is listed here:

- c. 500 CE Foundation: Pushyabhuti established control over Thanesar, likely as a former Gupta subordinate asserting independence after imperial decline.

- 500-580 CE Early Rulers: Naravardhana, Rajyavardhana I and Adityavardhana ruled as Maharajas, probably feudatories under Guptas, Hunas, or Maukharis.

- 580-605 CE Prabhakaravardhana: Assumed title Maharajadhiraja, expanded territory, resisted Hunas and raised the dynasty to sovereign status.

- 605-606 CE Rajyavardhana II: Avenged Maukhari alliance by defeating Malwa ruler but was treacherously killed by Gauda king Shashanka.

- 606-647 CE Harshavardhana: Crowned emperor, unified northern India, ruled for 41 years from Kannauj, marking dynastic zenith.

- 647 CE Decline: Harsha died without an heir, leading to fragmentation and the end of Pushyabhuti rule.

Vardhana Dynasty Sources

The sources of information for the Vardhana Dynasty include the following Literature, Inscriptions, etc. mentioned here:

- Harshacharita: Sanskrit biography written by Banabhatta, Harshavardhana’s court poet, providing detailed information on his life, administration and military campaigns.

- Si-Yu-Ki (Great Tang Records): Travel account of Chinese pilgrim Xuanzang describing political conditions, society, religion and economy during Harsha’s reign.

- Aihole Inscription: Composed by Pulakesin II’s court poet Ravikirti, it mentions Harsha’s defeat on the Narmada, confirming historical events.

- Banskhera Inscription: Land grant issued by Harshavardhana containing his genealogy, administrative titles and governance practices.

- Madhuban Copper Plate Inscription: Provides details about land grants, officials and revenue system under Harsha’s rule.

- Nalanda Seal: Archaeological source mentioning Harsha’s support to Nalanda University and Buddhist institutions.

- Coins: Gold coins of Harshavardhana supply limited but useful information about economy and royal symbolism.

- Literary Works by Harsha: Plays like Ratnavali, Nagananda and Priyadarshika reflect contemporary culture and religious ideas.

- Other Contemporary Texts: References in Buddhist and Brahmanical literature help corroborate political and religious history.

Vardhana Dynasty Rulers

The Vardhana Dynasty included several rulers, but its true greatness emerged under Harshavardhana. The various Kings of this Dynasty are:

- Pushyabhuti: He was the founder of the dynasty as mentioned in Harshacharita, credited with establishing the dynasty at Thanesar and initiating regional authority. The dynasty is often named after him as Pushyabhuti Dynasty.

- Naravardhana: Early ruler who likely governed as a feudatory, maintaining dynastic continuity during post Gupta political uncertainty.

- Rajyavardhana I: Continued consolidation of Thanesar region while remaining subordinate to stronger contemporaneous powers.

- Adityavardhana: Strengthened alliances, married into Later Gupta family and expanded influence in north western regions.

- Prabhakaravardhana: First independent monarch, defeated Hunas, allied with Maukharis and assumed imperial title Maharajadhiraja.

- Rajyavardhana II: Defeated Malwa ruler Devagupta but was assassinated by Gauda king Shashanka through deceit.

- Harshavardhana: United Thanesar and Kannauj, expanded empire, patronised Buddhism, literature and ruled as Sakalottarapathanatha. The Dynasty is often named after him as Harshavardhana Dynasty.

Vardhana Dynasty Administration

The administration under Vardhana Dynasty followed Gupta traditions but showed increasing feudal and decentralised features as highlighted below:

- Central Authority: King held supreme legislative, executive and judicial powers, supported by Mantri Parishad of ministers and advisors.

- Provincial Structure: Empire divided into Bhuktis, Visayas, Pathakas and Gramas, ensuring governance from provincial to village levels.

- Officials: Kumaramatyas, Uparikas, Visayapatis and Gramikas handled civil administration at different levels.

- Feudal Elements: Mahasamantas and Maharajas were hereditary local chiefs, indicating growing decentralisation.

- Land Grants: Land granted to Brahmins and officials, reducing coin circulation and strengthening feudal relationships.

- Law and Order: Weak enforcement noted by Hiuen Tsang; crimes punished harshly, though Buddhist influence softened penalties.

Vardhana Dynasty Economy

The economy under Vardhana Dynasty showed clear decline compared to the Gupta period:

- Agriculture: Villages became self sufficient as reduced trade lowered market demand for surplus agricultural produce.

- Trade and Commerce: Decline evident from fewer coins, weakening merchant guilds and shrinking trade centres.

- Taxation System: Revenue derived from Bhaga land tax equal to one-sixth produce, Bali, Hiranya, customs and ferry taxes.

- Coinage: Limited minting reflected land based revenue and grants replacing cash payments.

- Revenue Division: Income divided into royal expenses, scholars, officials and religious endowments.

- Craft Decline: Reduced trade weakened handicrafts, metalwork and urban manufacturing.

- Charity System: Harsha donated wealth every five years, reinforcing the religious economy.

- Agrarian Focus: Economy relied primarily on land revenue rather than commercial taxation.

Vardhana Dynasty Military

The military strength under Vardhana Dynasty supported territorial expansion but faced southern resistance. The key features of Military and Army during Vardhana are:

- Army Composition: Included infantry, cavalry, elephants and camels, each with separate commanders.

- Command Structure: Cavalry led by Brihadasvavaru; king personally supervised campaigns.

- Northern Campaigns: Defeated Malwa ruler, subdued Gauda hostility and established dominance across North India.

- Southern Limitation: Defeated by Chalukya ruler Pulakesin II at Narmada, fixing southern boundary permanently.

- Diplomacy: Alliances with Bhaskaravarman of Kamarupa and Maitrakas of Valabhi strengthened imperial control.

Vardhana Dynasty Art and Culture

The art and culture of the Vardhana Dynasty continued the zenith of Gupta Empire. The major features of art are discussed here:

- Architecture: No distinct style; followed Gupta patterns with religious stupas, monasteries and temples.

- Sultanganj Buddha: Largest known copper Buddha statue, cast using lost wax technique, dating 500-700 CE.

- Art Centres: Kannauj, Varanasi, Ujjain emerged as major cultural hubs.

- Literature by Harsha: Authored Priyadarshika, Ratnavali and Nagananda, showcasing Sanskrit drama excellence.

- Court Scholars: Banabhatta wrote Harshacharita and Kadambari; Mayurabhatta composed Suryashataka.

- Education: Nalanda flourished under royal patronage, attracting scholars like Hiuen Tsang.

Vardhana Dynasty Society

The society under the rule of Vardhana Dynasty reflected rigid caste hierarchy with religious tolerance. The major characteristics of the society is highlighted here:

- Varna System: Brahmins privileged through land grants; Kshatriyas ruled; Vaishyas traded; Shudras practiced agriculture.

- Sub Castes: Numerous jatis existed, indicating social stratification intensifying during this period.

- Women’s Status: Education existed among elites, but sati, dowry and ban on widow remarriage prevailed.

- Untouchability: Practiced against executioners and scavengers, who lived outside villages.

- Religion: Harsha followed tolerant policy, patronised Shaivism, Buddhism, Surya worship equally.

- Buddhist Assemblies: Kannauj and Prayag assemblies promoted Mahayana Buddhism and royal charity.

- Foreign Travellers: Xuanzang (Hiuen Tsang), a Chinese Buddhist monk who visited India during Harshavardhana’s reign and spent several years at his court. He came to study Buddhism, collect sacred texts and visit important Buddhist pilgrimage centres across India. His travel account Si-Yu-Ki (Great Tang Records on the Western Regions) is a major source for Harshavardhana’s period.

Vardhana Dynasty Decline

After the death of Harshavardhan, the Vardhana Dynasty declined rapidly. The major reason behind the fall of dynasty are considered as following:

- No Heir: Harsha died in 647 CE without a successor, creating power vacuum.

- Fragmentation: Feudatories like Bhaskaravarman annexed territories.

- Kannauj’s Fate: Remained politically important, later ruled by Yashovarman.

- End of Vardhana Rule: Ministerial takeover failed to maintain empire, ending Pushyabhuti dominance in 647 CE.

Vardhana Dynasty FAQs

Q1: Who founded the Vardhana Dynasty?

Ans: The Vardhana Dynasty was founded by Pushyabhuti in 500 CE as mentioned in the Harshacharita.

Q2: Who was the most powerful ruler of the Vardhana Dynasty?

Ans: Harshavardhana was the most powerful ruler who expanded the empire across northern India.

Q3: What was the capital of the Vardhana Dynasty?

Ans: Initially Thanesar was the Capital and later Kannauj served as the capital of the Pushyabhuti Dynasty.

Q4: Which sources provide information about the Vardhana Dynasty?

Ans: Harshacharita, Xuanzang’s Si-Yu-Ki, inscriptions, seals and coins are main sources.

Q5: What was the religion of Harshavardhana?

Ans: Harshavardhana followed Shaivism initially but later supported Mahayana Buddhism.